Kodak 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

45

Eastman Kodak Company

Notes to Financial Statements

NOTE 1: SIGNIFICANT ACCOUNTING

POLICIES

Company Operations Eastman Kodak Company (the Company or Kodak)

is engaged primarily in developing, manufacturing, and marketing tradi-

tional and digital imaging products, services and solutions to consumers,

the entertainment industry, professionals, healthcare providers and other

customers. The Company’s products are manufactured in a number of

countries in North and South America, Europe, Australia and Asia. The

Company’s products are marketed and sold in many countries throughout

the world.

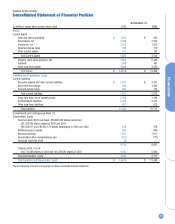

Basis of Consolidation The consolidated financial statements include the

accounts of Kodak and its majority owned subsidiary companies.

Intercompany transactions are eliminated and net earnings are reduced by

the portion of the net earnings of subsidiaries applicable to minority inter-

ests. The equity method of accounting is used for joint ventures and

investments in associated companies over which Kodak has significant

influence, but does not have effective control. Significant influence is gen-

erally deemed to exist when the Company has an ownership interest in

the voting stock of the investee of between 20% and 50%, although other

factors, such as representation on the investee’s Board of Directors, voting

rights and the impact of commercial arrangements, are considered in

determining whether the equity method of accounting is appropriate. The

cost method of accounting is used for investments in which Kodak has

less than a 20% ownership interest, and the Company does not have the

ability to exercise significant influence. These investments are carried at

cost and are adjusted only for other-than-temporary declines in fair value.

The carrying value of these investments is reported in other long-term

assets in the accompanying Consolidated Statement of Financial Position.

The Company’s equity in the net income and losses of these investments

is reported in other charges, net, in the accompanying Consolidated

Statement of Earnings. See Note 7, “Investments,” and Note 14, “Other

Charges, Net.”

Use of Estimates The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of con-

tingent assets and liabilities at year end, and the reported amounts of rev-

enues and expenses during the reporting period. Actual results could differ

from those estimates.

Foreign Currency For most subsidiaries and branches outside the U.S.,

the local currency is the functional currency. In accordance with the

Statement of Financial Accounting Standards (SFAS) No. 52, “Foreign

Currency Translation,” the financial statements of these subsidiaries and

branches are translated into U.S. dollars as follows: assets and liabilities

at year-end exchange rates; income, expenses and cash flows at average

exchange rates; and shareholders’ equity at historical exchange rates. For

those subsidiaries for which the local currency is the functional currency,

the resulting translation adjustment is recorded as a component of accu-

mulated other comprehensive income in the accompanying Consolidated

Statement of Financial Position. Translation adjustments are not tax-effect-

ed since they relate to investments, which are permanent in nature.

For certain other subsidiaries and branches, operations are conduct-

ed primarily in U.S. dollars, which is therefore the functional currency.

Monetary assets and liabilities, and the related revenue, expense, gain and

loss accounts, of these foreign subsidiaries and branches are remeasured

at year-end exchange rates. Non-monetary assets and liabilities, and the

related revenue, expense, gain and loss accounts, are remeasured at his-

torical rates. Adjustments which result from the remeasurement of the

assets and liabilities of these subsidiaries are included in net income.

Foreign exchange gains and losses arising from transactions denom-

inated in a currency other than the functional currency of the entity

involved are included in net income. The effects of foreign currency trans-

actions, including related hedging activities, were losses of $11 million,

$19 million, and $9 million in the years 2003, 2002, and 2001, respective-

ly, and are included in other charges, net, in the accompanying

Consolidated Statement of Earnings. Refer to the “Derivative Financial

Instruments” section of Note 1, “Significant Accounting Policies,” for a

description of how hedging activities are reflected in the Company’s

Consolidated Statement of Earnings.

Concentration of Credit Risk Financial instruments that potentially sub-

ject the Company to significant concentrations of credit risk consist princi-

pally of cash and cash equivalents, receivables, foreign currency forward

contracts, commodity forward contracts and interest rate swap arrange-

ments. The Company places its cash and cash equivalents with high-qual-

ity financial institutions and limits the amount of credit exposure to any

one institution. With respect to receivables, such receivables arise from

sales to numerous customers in a variety of industries, markets and geog-

raphies around the world. Receivables arising from these sales are gener-

ally not collateralized. The Company performs ongoing credit evaluations

of its customers’ financial conditions and no single customer accounts for

greater than 10% of the sales of the Company. The Company maintains

reserves for potential credit losses and such losses, in the aggregate, have

not exceeded management’s expectations. With respect to the foreign cur-

rency forward contracts, commodity forward contracts and interest rate

swap arrangements, the counterparties to these contracts are major finan-

cial institutions. The Company has never experienced non-performance by

any of its counterparties.

Additionally, the Company guarantees debt and other obligations with

certain unconsolidated affiliates and customers, which could potentially

subject the Company to significant concentrations of credit risk. However,

with the exception of the Company’s total debt guarantees for which there

is a concentration with one of Kodak’s unconsolidated affiliate companies,

these guarantees relate to numerous customers in a variety of industries,

markets and geographies around the world. The Company does not

believe that material payments will be required under any of its guarantee

arrangements. See Note 12, “Guarantees.”

Cash Equivalents All highly liquid investments with a remaining maturity

of three months or less at date of purchase are considered to be cash

equivalents.