Kodak 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

66

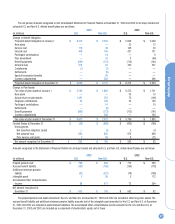

Consolidated Statement of Earnings for the year ended December 31,

2003. The completion of the 2001 Restructuring Programs resulted in the

elimination of the remaining 200 positions included in the original plans.

A total of 6,425 positions were eliminated under the 2001 Restructuring

Programs.

The remaining severance reserve of $6 million as of December 31,

2003 has not been paid since, in many instances, the employees whose

positions were eliminated could elect or were required to receive their

severance payments over an extended period of time. However, these pay-

ments will be made by the end of 2004. Most of the remaining exit costs

reserves of $13 million as of December 31, 2003 represent long-term

lease payments, which will be paid over periods after 2004.

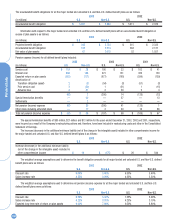

NOTE 17: RETIREMENT PLANS

Substantially all U.S. employees are covered by a noncontributory defined

benefit plan, the Kodak Retirement Income Plan (KRIP), which is funded by

Company contributions to an irrevocable trust fund. The funding policy for

KRIP is to contribute amounts sufficient to meet minimum funding require-

ments as determined by employee benefit and tax laws plus additional

amounts the Company determines to be appropriate. Generally, benefits

are based on a formula recognizing length of service and final average

earnings. Assets in the fund are held for the sole benefit of participating

employees and retirees. The assets of the trust fund are comprised of cor-

porate equity and debt securities, U.S. government securities, partnership

and joint venture investments, interests in pooled funds, and various types

of interest rate, foreign currency and equity market financial instruments.

At December 31, 2001, Kodak common stock represented approximately

3.4% of trust assets. In December 2002, in connection with Wilshire

Associates’ recommendation that KRIP eliminate its investments in spe-

cialty sector U.S. equities, the Company purchased the 7.4 million shares

of Kodak common stock held by KRIP for $260 million.

On March 25, 1999, the Company amended this plan to include a

separate cash balance formula for all U.S. employees hired after February

1999. All U.S. employees hired prior to that date were granted the option

to choose the KRIP plan or the Cash Balance Plus plan. Written elections

were made by employees in 1999, and were effective January 1, 2000.

The Cash Balance Plus plan credits employees’ accounts with an amount

equal to 4% of their pay, plus interest based on the 30-year treasury bond

rate. In addition, for employees participating in this plan and the

Company’s defined contribution plan, the Savings and Investment Plan

(SIP), the Company will match SIP contributions for an amount up to 3% of

pay, for employee contributions of up to 5% of pay. Company contributions

to SIP were $15 million, $14 million and $15 million for 2003, 2002 and

2001, respectively. As a result of employee elections to the Cash Balance

Plus plan, the reductions in future pension expense will be almost entirely

offset by the cost of matching employee contributions to SIP. The impact

of the Cash Balance Plus plan is shown as a plan amendment.

The Company also sponsors unfunded defined benefit plans for cer-

tain U.S. employees, primarily executives. The benefits of these plans are

obtained by applying KRIP provisions to all compensation, including

amounts being deferred, and without regard to the legislated qualified

plan maximums, reduced by benefits under KRIP.

Most subsidiaries and branches operating outside the U.S. have

defined benefit retirement plans covering substantially all employees.

Contributions by the Company for these plans are typically deposited

under government or other fiduciary-type arrangements. Retirement bene-

fits are generally based on contractual agreements that provide for benefit

formulas using years of service and/or compensation prior to retirement.

The actuarial assumptions used for these plans reflect the diverse eco-

nomic environments within the various countries in which the Company

operates.

The measurement date used to determine the pension obligation for

all major funded and unfunded U.S. and Non-U.S. defined benefit plans

comprising a majority of the plan assets and benefit obligations is

December 31.