Kodak 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

77

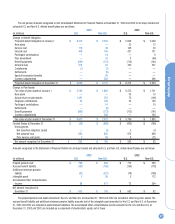

NOTE 24: QUARTERLY SALES AND

EARNINGS DATA — UNAUDITED

4th 3rd 2nd 1st

(in millions, except per share data) Quarter Quarter Quarter Quarter

2003

Net sales from continuing operations $3,778 $3,447 $3,352 $2,740

Gross profit from continuing operations 1,217 1,127 1,116 824

Earnings (loss) from continuing operations 7(5) 122(4) 112(3) (3)(1)

Earnings from discontinued operations(10) 12(6) ——15

(2)

Net earnings 19 122 112 12

Basic and diluted net earnings

(loss) per share(11)

Continuing operations .03 .42 .39 (.01)

Discontinued operations .04 .00 .00 .05

Total .07 .42 .39 .04

2002

Net sales from continuing operations $3,441 $3,352 $3,336 $2,706

Gross profit from continuing operations 1,206 1,290 1,254 860

Earnings from continuing operations 130(9) 336(8) 286(7) 41

Loss from discontinued operations(10) (17) (2) (2) (2)

Net earnings 113 334 284 39

Basic and diluted net earnings (loss)

per share(11)

Continuing operations .45 1.16 .98 .14

Discontinued operations (.06) (.01) (.01) (.01)

Total .39 1.15 .97 .13

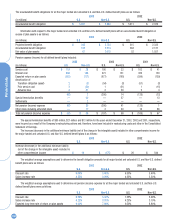

(1) Includes $46 million ($14 million included in cost of goods sold and $32 million

included in restructuring costs and other) of restructuring charges, which

reduced net earnings by $30 million; $21 million of purchased R&D, which

reduced net earnings by $13 million; $12 million (included in SG&A) for a

charge related to an intellectual property settlement, which reduced net earn-

ings by $7 million; and an $8 million (included in benefit for income taxes) tax

benefit related to the donation of certain patents.

(2) Represents the reversal of a tax reserve resulting from the Company’s repur-

chase of certain properties that were initially sold in connection with the 1994

divestiture of Sterling Winthrop Inc.

(3) Includes $54 million ($10 million included in cost of goods sold and $44 million

included in restructuring costs and other) of restructuring charges, which

reduced net earnings by $36 million; $14 million (included in SG&A) for a

charge connected with the settlement of a patent infringement claim, which

reduced net earnings by $9 million; $14 million (included in SG&A) for a charge

connected with a prior-year acquisition, which reduced net earnings by $9 mil-

lion; and $9 million (included in SG&A) for a charge to write down certain

assets held for sale following the acquisition of the Burrell Companies, which

reduced net earnings by $6 million.

(4) Includes $185 million ($33 million included in cost of goods sold and $152 mil-

lion included in restructuring costs and other) of restructuring charges, which

reduced net earnings by $125 million; and $8 million (included in SG&A) for a

donation to a technology enterprise, which reduced net earnings by $5 million.

(5) Includes $272 million ($16 million included in cost of goods sold and $256 mil-

lion included in restructuring costs and other) of restructuring charges, which

reduced net earnings by $187 million; $8 million (included in SG&A) for legal

settlements, which reduced net earnings by $5 million; $3 million (included in

SG&A) for strategic asset impairments, which reduced net earnings by $2 mil-

lion; $4 million (included in other charges) for non-strategic asset write-downs,

which reduced net earnings by $2 million; $10 million of purchased R&D

(included in R&D), which reduced net earnings by $6 million; a $9 million rever-

sal (included in SG&A) for an environmental reserve, which increased net earn-

ings by $6 million; and a $5 million (included in benefit for income taxes) tax

benefit related to the donation of certain patents.

(6) Includes $12 million for the reversal of environmental reserves at a formerly

owned manufacturing site, which increased net earnings by $7 million; and a

$3 million increase to net earnings in relation to the reversal of state income

tax reserves.

(7) Includes $13 million ($10 million included in SG&A and $3 million included in

other charges) for a charge related to asset impairments, which reduced net

earnings by $9 million; and a $45 million (included in provision for income

taxes) tax benefit related to the closure of the Company’s PictureVision sub-

sidiary.

(8) Includes $29 million (included in restructuring costs and other) reversal of

restructuring charges related to costs originally recorded as part of the

Company’s 2001 restructuring programs, which increased net earnings by $18

million; $20 million (included in restructuring costs and other) of restructuring

costs, which reduced net earnings by $20 million; $21 million ($13 million

included in SG&A and $8 million included in other charges) for a charge related

to asset impairments, which reduced net earnings by $13 million; and a $46

million (included in provision for income taxes) tax benefit related to the consol-

idation of its photofinishing operations in Japan.

(9) Includes $123 million ($16 million included in cost of goods sold and $107 mil-

lion included in restructuring costs and other) of restructuring charges, which

reduced net earnings by $78 million; $16 million ($9 million included in SG&A

and $7 million included in other charges) for a charge related to asset impair-

ments and other asset write-offs, which reduced net earnings by $12 million;

and a $30 million (included in provision for income taxes) tax benefit related to

changes in the corporate tax rate and asset write-offs.

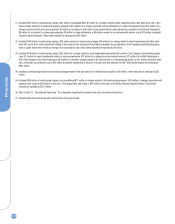

(10) Refer to Note 22, “Discontinued Operations,” for a discussion regarding loss

from discontinued operations.

(11) Each quarter is calculated as a discrete period and the sum of the four quar-

ters may not equal the full year amount.

Changes in Estimates Recorded During the Fourth

Quarter Ended December 31, 2003

During the fourth quarter ended December 31, 2003, the Company record-

ed approximately $38 million relating to changes in estimates with respect

to certain of its employee benefit and incentive compensation accruals.

These changes in estimates favorably impacted the results for the fourth

quarter by $.11 per share.