Kodak 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

105

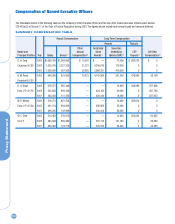

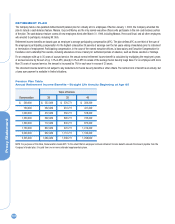

(a) This column shows Executive Compensation for Excellence and Leadership Plan (EXCEL), and its predecessor, Management Variable Compensation Plan, awards for

services performed, not paid, in each year indicated. For M. P. Morley for 2003, the amount includes a retention bonus of $350,000 paid under the October 23, 2003

amendment to his retention agreement; for 2002, the amount includes a retention bonus of $370,000 paid under the March 13, 2001 amendment to his retention

agreement.

(b) Where no amount is shown, the value of personal benefits provided was less than the minimum amount required to be reported. For D. A. Carp, the amounts shown in

this column represent tax payments made by the Company relating to his use of Company transportation. The Company requires D. A. Carp to use Company trans-

portation for security reasons. For A. M. Perez, the amount shown includes tax allowances for relocation expenses paid under the Company’s new hire relocation

program and Mr. Perez’s March 3, 2003 offer letter.

(c) The awards shown represent grants of restricted stock or restricted stock units valued as of the date of grant. Dividends are paid on the restricted shares and restrict-

ed units as and when dividends are paid on Kodak common stock. The restrictions on the awards granted under the Executive Incentive Program lapsed on December

31, 2003.

D. A. Carp – For 2002, 100,000 shares granted as a retention based award, valued on December 2, 2002 at $36.73 per share and 18,611 shares awarded under the

Executive Incentive Program, valued on February 18, 2003 at $30.95 per share. For 2001, 20,000 shares granted in recognition of his election as Chairman, valued on

January 12, 2001, at $40.875 per share and 52,630 shares granted in substitution of, and not in addition to, the stock option grant D. A. Carp would otherwise have

received in January 2001 under the management stock option program, valued on January 16, 2001, at $40.875 per share.

A. M. Perez – For 2003, 100,000 shares granted as a signing bonus, valued on April 2, 2003 at $30.97 per share and 50,000 shares granted as a retention based

award, valued on October 1, 2003 at $20.93 per share.

R. H. Brust – For 2002, 5,000 shares granted as a retention based award, valued on December 2, 2002 at $36.73 per share and 7,771 shares awarded under the

Executive Incentive Program, valued on February 18, 2003 at $30.95 per share. For 2001, 10,530 shares granted in substitution of, and not in addition to, the stock

option grant R. H. Brust would otherwise have received in January 2001 under the management stock option program, valued on January 16, 2001 at $40.875 per

share.

M. P. Morley – For 2002, 5,000 shares granted as a retention based award, valued on December 2, 2002 at $36.73 per share and 5,978 shares awarded under the

Executive Incentive Program, valued on February 18, 2003 at $30.95 per share. For 2001, 10,530 shares granted in substitution of, and not in addition to, the stock

option grant M. P. Morley would otherwise have received in January 2001 under the management stock option program, valued on January 16, 2001 at

$40.875 per share.

W. C. Shih – For 2002, 5,000 shares granted as a retention based award, valued on December 2, 2002 at $36.73 per share and 5,540 shares awarded under the

Executive Incentive Program, valued on February 18, 2003 at $30.95 per share. For 2001, 11,280 shares granted in substitution of, and not in addition to, the stock

option grant W. C. Shih would otherwise have received in January 2001 under the management stock option program, valued on January 16, 2001 at

$40.875 per share.

The total number and value of restricted stock held as of December 31, 2003 for each named individual (valued at $25.67 per share) were: D. A. Carp – 175,724

shares – $4,510,835; A. M. Perez – 150,000 shares – $3,850,500; R. H. Brust – 21,890 shares – $561,916; M. P. Morley – 10,265 shares – $263,502; and W. C.

Shih – 15,640 shares – $401,478.

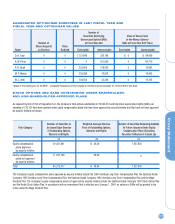

(d) On April 2, 2003, A. M. Perez received stock options to purchase 500,000 shares as a sign-on bonus. The remaining amounts for 2003 represent grants made in the

fourth quarter of 2003 under the officer stock option program. The amounts for 2002 represent grants made under the management stock option program; except that

W. C. Shih received on August 26, 2002, stock options to purchase 104,700 shares under the Stock Option Exchange Program. For 2001, the amounts represent

grants made under the management stock option program; except that the amount for D. A. Carp includes a grant of stock options to purchase 160,000 shares in

recognition of his election as Chairman.

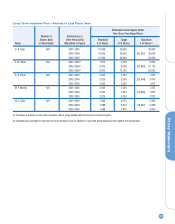

(e) No awards were paid for the periods 2001-2003, 2000-2002, and 1999-2001 under the Performance Stock Program. The amounts shown are the value of awards

paid under the Executive Incentive Plan of the 2002-2004 performance cycle of the Performance Stock Program based on performance over the period 2002-2003,

computed as of the date of the award, February 17, 2004, at $29.07 per share: D. A. Carp – 30,398; A. M. Perez – 16,474; R. H. Brust – 12,693; M. P. Morley – 9,763;

and W. C. Shih – 9,049. The awards were paid in shares of Kodak common stock.

(f) For R. H. Brust for 2003, the amount represents $428,100 of principal and interest forgiven in connection with the loan from the Company as described on page 103

and $79,898 as the Company contribution in the cash balance feature of the Kodak Retirement Income Plan; for 2002, the amount represents $446,400 of principal

and interest forgiven in connection with the loan and $41,639 as the Company contribution in the cash balance feature; and for 2001, the amount represents

$786,300 of principal and interest forgiven in connection with the loan and $41,623 as the Company contribution to the cash balance feature. For A. M. Perez and W.

C. Shih, the amounts represent the Company contribution in the cash balance feature.