Kodak 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

67

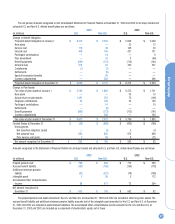

The net pension amounts recognized on the Consolidated Statement of Financial Position at December 31, 2003 and 2002 for all major funded and

unfunded U.S. and Non-U.S. defined benefit plans are as follows:

2003 2002

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Change in Benefit Obligation

Projected benefit obligation at January 1 $ 6,213 $ 2,594 $ 5,939 $ 2,099

New plans ——25 13

Service cost 119 38 106 33

Interest cost 408 148 421 131

Participant contributions —14—9

Plan amendment —183 (46)

Benefit payments (692) (173) (713) (141)

Actuarial loss 512 92 432 227

Curtailments (1) (2) ——

Settlements — (6) ——

Special termination benefits —26——

Currency adjustments — 382 — 269

Projected benefit obligation at December 31 $ 6,559 $ 3,131 $ 6,213 $ 2,594

Change in Plan Assets

Fair value of plan assets at January 1 $ 5,790 $ 1,805 $ 6,372 $ 1,731

New plans ——33 13

Actual return on plan assets 1,381 378 75 (106)

Employer contributions 24 126 23 105

Participant contributions —14—10

Settlements — (6) ——

Benefit payments (692) (173) (713) (141)

Currency adjustments — 288 — 193

Fair value of plan assets at December 31 $ 6,503 $ 2,432 $ 5,790 $ 1,805

Funded Status at December 31 $ (56) $ (699) $ (423) $ (789)

Unrecognized:

Net transition obligation (asset) — (3) 2 (7)

Net actuarial loss 682 856 975 899

Prior service cost (gain) 7368 (21)

Net amount recognized at December 31 $ 633 $ 190 $ 562 $ 82

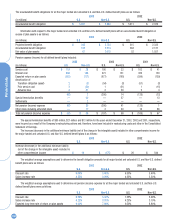

Amounts recognized in the Statement of Financial Position for all major funded and unfunded U.S. and Non-U.S. defined benefit plans are as follows:

2003 2002

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Prepaid pension cost $ 790 $ 350 $ 712 $ 260

Accrued benefit liability (157) (160) (150) (178)

Additional minimum pension

liability (91) (572) (78) (706)

Intangible asset 3955112

Accumulated other comprehensive

income 88 477 73 594

Net amount recognized at

December 31 $ 633 $ 190 $ 562 $ 82

The prepaid pension cost asset amounts for the U.S. and Non-U.S. at December 31, 2003 and 2002 are included in other long-term assets. The

accrued benefit liability and additional minimum pension liability amounts (net of the intangible asset amounts) for the U.S. and Non-U.S. at December

31, 2003 and 2002 are included in postretirement liabilities. The accumulated other comprehensive income amounts for the U.S. and Non-U.S. at

December 31, 2003 and 2002 are included as a component of shareholders’ equity, net of taxes.