Kodak 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

68

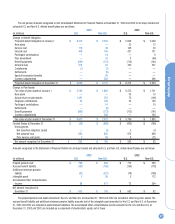

The accumulated benefit obligations for all the major funded and unfunded U.S. and Non-U.S. defined benefit plans are as follows:

2003 2002

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Accumulated benefit obligation $ 5,657 $ 2,864 $ 5,411 $ 2,376

Information with respect to the major funded and unfunded U.S. and Non-U.S. defined benefit plans with an accumulated benefit obligation in

excess of plan assets is as follows: 2003 2002

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Projected benefit obligation $ 342 $ 2,754 $ 315 $ 2,333

Accumulated benefit obligation 315 2,514 284 2,137

Fair value of plan assets 67 2,075 52 1,557

Pension expense (income) for all defined benefit plans included:

2003 2002 2001

(in millions) U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Service cost $ 119 $ 38 $ 106 $ 33 $ 102 $ 41

Interest cost 408 148 421 131 426 120

Expected return on plan assets (582) (177) (677) (165) (599) (159)

Amortization of:

Transition obligation (asset) 2 (3) (54) (3) (57) (3)

Prior service cost 2 (30) 1 (21) 1 (15)

Actuarial loss 431339 2 4

(47) 7 (200) 14 (125) (12)

Special termination benefits —30—27 —13

Settlements —2—— ——

Net pension (income) expense (47) 39 (200) 41 (125) 1

Other plans including unfunded plans —17349 1666

Total net pension (income) expense $ (47) $ 56 $ (197) $ 90 $ (109) $ 67

The special termination benefits of $30 million, $27 million and $13 million for the years ended December 31, 2003, 2002 and 2001, respectively,

were incurred as a result of the Company’s restructuring actions and, therefore, have been included in restructuring costs and other in the Consolidated

Statement of Earnings.

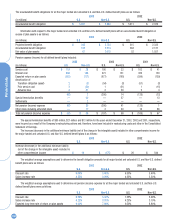

The increase (decrease) in the additional minimum liability (net of the change in the intangible asset) included in other comprehensive income for

the major funded and unfunded U.S. and Non-U.S. defined benefit plans is as follows:

2003 2002

U.S. Non-U.S. U.S. Non-U.S.

Increase (decrease) in the additional minimum liability

(net of the change in the intangible asset) included in

other comprehensive income $ 14 $ (175) $26 $ 544

The weighted-average assumptions used to determine the benefit obligation amounts for all major funded and unfunded U.S. and Non-U.S. defined

benefit plans were as follows: 2003 2002

U.S. Non-U.S. U.S. Non-U.S.

Discount rate 6.00% 5.40% 6.50% 5.40%

Salary increase rate 4.25% 3.20% 4.25% 3.30%

The weighted-average assumptions used to determine net pension (income) expense for all the major funded and unfunded U.S. and Non-U.S.

defined benefit plans were as follows: 2003 2002

U.S. Non-U.S. U.S. Non-U.S.

Discount rate 6.50% 5.40% 7.25% 5.90%

Salary increase rate 4.25% 3.30% 4.25% 3.10%

Expected long-term rate of return on plan assets 9.00% 7.90% 9.50% 8.60%