Kodak 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

TABLE OF CONTENTS

MANAGEMENT’S LETTER

2 To Our Shareholders

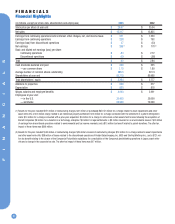

FINANCIALS

6 Financial Highlights

7 Management’s Discussion and Analysis

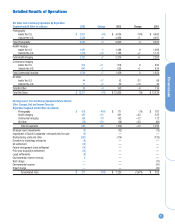

11 Detailed Results of Operations

39 Report of Independent Auditors

40 Consolidated Statement of Earnings

41 Consolidated Statement of Financial Position

42 Consolidated Statement of Shareholders’ Equity

44 Consolidated Statement of Cash Flows

45 Notes to Financial Statements

79 Summary of Operating Data

CORPORATE INFORMATION

139 2003 Kodak Health, Safety and Environment

140 2003 Global Diversity

142 Corporate Directory

143 Shareholder Information

PROXY STATEMENT

81 Letter to Shareholders

81 Notice of the 2004 Annual Meeting of Shareholders

82 Questions & Answers

86 Householding of Disclosure Documents

86 Audio Webcast of Annual Meeting

87 Proposals to Be Voted On

87 Item 1 – Election of Directors

87 Item 2 – Ratification of Election of Independent

Accountants

87 Item 3 – Re-Approval of the Material Terms

of the Performance Goals Under the 2000

Omnibus Long-Term Compensation Plan

91 Item 4 – Shareholder Proposal – Chemicals Policy

92 Item 5 – Shareholder Proposal – Compensation

Limits

93 Board Structure and Corporate Governance

93 Introduction

93 Corporate Governance Guidelines

93 Business Conduct Guide and Directors’

Code of Conduct

93 Board Independence

93 Audit Committee Financial Qualifications

94 Board of Directors

97 Committees of the Board

99 Other Board Matters

101 Beneficial Security Ownership Tables

103 Transactions with Management

104 Compensation of Named Executive Officers

104 Summary Compensation Table

106 Option/SAR Grants Table

107 Option/SAR Exercises and Year-End Values Table

107 Stock Options Outstanding Table

108 Long-Term Incentive Plan

110 Employment Contracts and Arrangements

111 Change in Control Arrangements

112 Retirement Plan

114 Report of the Audit Committee

115 Report of the Corporate Responsibility and

Governance Committee

117 Report of the Executive Compensation and

Development Committee

121 Section 16(a) Beneficial Ownership Reporting

Compliance

122 Performance Graph – Shareholder Return

123 Exhibit I – Audit Committee Charter

127 Exhibit II – Audit and Non-Audit Services

Pre-Approval Policy

129 Exhibit III – Corporate Governance Guidelines

137 2004 Annual Meeting Map, Directions

and Parking Information

Table of contents

-

Page 1

... Goals Under the 2000 Omnibus Long-Term Compensation Plan Item 4 - Shareholder Proposal - Chemicals Policy Item 5 - Shareholder Proposal - Compensation Limits Board Structure and Corporate Governance Introduction Corporate Governance Guidelines Business Conduct Guide and Directors' Code of Conduct... -

Page 2

...overall business strategy. Increased sales volumes were driven primarily by consumer digital cameras, printer dock products, inkjet media and motion picture print films in the Photography segment, digital products in Health Imaging and imaging services and document scanners in the Commercial Imaging... -

Page 3

... digital cameras, retail print kiosks, inkjet photo paper and online print fulfillment. We maintained our year-over-year blended U.S. consumer film share in the face of industry-wide volume declines. Our high-speed document scanners for commercial markets are perennial leaders. And in health markets... -

Page 4

... the network are retailers offering digital printing services, including many of the 50,000 Kodak picture maker kiosks sold worldwide since the product was launched. The new Kodak film processing station introduced in early 2004 is the only self-service kiosk that lets consumers develop and print in... -

Page 5

... as unit placements increased. A key acquisition for Commercial Printing was Scitex Digital Printing, now named Kodak Versamark, Inc. The company is a world leader in highspeed, variable inkjet printing systems. These are used for printing utility bills, credit card statements and other direct mail... -

Page 6

... of Kodak Global Imaging, Inc. (KGII) and Sterling Winthrop Inc.; and a $121 million tax benefit relating to the closure of the Company's PictureVision subsidiary, the consolidation of the Company's photofinishing operations in Japan, asset writeoffs and a change in the corporate tax rate. The... -

Page 7

...the increase to earnings through higher gross profit at the time the related undervalued inventory was sold. However, actual results have not differed materially from management's estimates. VALUATION OF LONG-LIVED ASSETS, INCLUDING GOODWILL AND PURCHASED INTANGIBLE ASSETS Financials 7 The Company... -

Page 8

... the last day of the year in the Company's reporting period as a guide. The long-term expected rate of return on plan assets is based on a combination of formal asset and liability studies, historical results of the portfolio, and management's expectation as to future returns that are expected to be... -

Page 9

...long-term trends. The Company evaluates its expected long-term rate of return on plan asset (EROA) assumption annually for the Kodak Retirement Income Plan (KRIP). To facilitate this evaluation, every two to three years, or when market conditions change materially, the Company undertakes a new asset... -

Page 10

... exclude the results of Remote Sensing Systems and Research Systems, Inc., which were part of the commercial and government systems products and services, as a result of the sale of these businesses to ITT Industries, Inc. that was announced in February 2004. • Commercial Printing Segment: As of... -

Page 11

... Other Charges, Net, and Income Taxes by Reportable Segment and All Other (in millions) Photography Health Imaging Commercial Imaging All Other Total of segments Strategic asset impairments Impairment of Burrell Companies' net assets held for sale Restructuring costs and other Donation to technology... -

Page 12

... Health Imaging Commercial Imaging All Other Total of segments Strategic asset and venture investment impairments Impairment of Burrell Companies' net assets held for sale Restructuring costs and other Donation to technology enterprise GE settlement Patent infringement claim settlement Prior year... -

Page 13

... were driven primarily by price/mix declines in traditional products and services, and consumer digital cameras in the Photography segment, film and laser imaging systems in the Health Imaging segment, and graphic arts products in the Commercial Imaging segment. Net sales in the U.S. were $5,829... -

Page 14

... million for the prior year, representing an increase of $452 million, or 9% as reported, or a decrease of 1% excluding the favorable impact of exchange. Net worldwide sales of consumer film products, including 35mm film, Advantix film and one-time-use cameras, decreased 9% in 2003 as compared with... -

Page 15

... Health Imaging On October 7, 2003, the Company completed the acquisition of all of the outstanding shares of PracticeWorks, Inc., a leading provider of dental practice management software and digital radiographic imaging systems for approximately $475 million in cash, inclusive of transaction costs... -

Page 16

... equipment), services, dental practice management software, and Healthcare Information Systems (HCIS) including Picture Archiving and Communications Systems (PACS), increased 14% in 2003 as compared with 2002. The increase in digital product sales was primarily attributable to favorable exchange... -

Page 17

...and development support, and certain inventory, assets, and employees of Heidelberg's regional operations or market centers. The Company will not pay any cash at closing for the businesses being acquired. Under the terms of the acquisition, Kodak and Heidelberg agreed to use a performance-based earn... -

Page 18

... in China resulted from strong business performance for health and consumer products. The increase in sales in Russia is a result of continued growth in the number of Kodak Express stores, which represent independently owned photo specialty retail outlets, and the Company's efforts to expand the... -

Page 19

... Company has broadly enabled the retail industry in the U.S. with its picture maker kiosks and is focused on bringing to market new kiosk offerings, creating new kiosk channels, expanding internationally and continuing to increase the media burn per kiosk. Net worldwide sales of thermal media used... -

Page 20

...impact of exchange. Net worldwide sales of digital products, which include laser printers (DryView imagers and wet laser printers), digital media (DryView and wet laser media), digital capture equipment (computed radiography capture equipment and digital radiography equipment), services and Picture... -

Page 21

... companies were formed into Kodak Global Imaging, Inc. (KGII), a wholly owned subsidiary, which was reported in the commercial and government products and services business in the Commercial Imaging segment. Due to a combination of factors, including the collapse of the telecommunications market... -

Page 22

... Costs and Other." Charges of $50 million ($34 million after tax) related to venture investment impairments and other asset write-offs incurred in the second, third and fourth quarters. See MD&A and Note 7, "Investments," for further discussion of venture investment impairments. Income tax benefits... -

Page 23

... in light of changing business conditions, it is probable that ongoing cost reduction activities will be required from time to time. In accordance with this, the Company periodically announces planned restructuring programs (Programs), which often consist of a number of restructuring initiatives... -

Page 24

..., 2003 Restructuring Program, the Company recorded $21 million of accelerated depreciation on long-lived assets in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The accelerated depreciation relates to long-lived assets accounted for... -

Page 25

...were reported in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represent non-cash items. Severance payments will... -

Page 26

...of long-lived asset impairments and $9 million of exit costs. The inventory write-downs were reported in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The longlived asset impairments and exit costs were reported in restructuring costs... -

Page 27

..., the Company recorded $24 million of accelerated depreciation on long-lived assets in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The accelerated depreciation relates to long-lived assets accounted for under the held and used model... -

Page 28

...15, 2003, the Company's Board of Directors declared a semi-annual cash dividend of $.90 per share on the outstanding common stock of the Company. This dividend was paid on July 16, 2003 to shareholders of record at the close of business on June 2, 2003. On September 24, 2003, the Company's Board of... -

Page 29

... redemption; (4) upon the occurrence of specified corporate transactions such as a consolidation, merger or binding share exchange pursuant to which the Company's common stock would be converted into cash, property or securities; and (5) if the credit rating assigned to the Convertible Securities by... -

Page 30

...medium term due to the Company's rising business risk, investment strategies, and the rapid pace at which it has made its recent acquisitions, and (6) the financial burden of its significant unfunded postretirement benefit liabilities. These credit rating actions have limited the Company's access to... -

Page 31

..., service providers and business partners. Further, the Company indemnifies its directors and officers who are, or were, serving at Kodak's request in such capacities. Historically, costs incurred to settle claims related to these indemnifications have not been material to the Company's financial... -

Page 32

... of its Company-owned life insurance policies of $187 million, and (5) an increase in liabilities excluding borrowings of $29 million, related primarily to severance payments for restructuring programs. The net cash used in investing activities of $758 million was utilized primarily for capital... -

Page 33

... reported in other long-term liabilities in the accompanying Consolidated Statement of Financial Position. The Company is currently implementing a Corrective Action Program required by the Resource Conservation and Recovery Act (RCRA) at the Kodak Park site in Rochester, NY. As part of this program... -

Page 34

... connection with the non-imaging health businesses in four active Superfund sites. Numerous other PRPs have also been designated at these sites. Although the law imposes joint and several liability on PRPs, the Company's historical experience demonstrates that these costs are shared with other PRPs... -

Page 35

... and timing of cost savings and cash flow that Kodak can achieve from its traditional consumer film and paper businesses; (2) the speed at which consumer transition from traditional photography to digital photography occurs; (3) Kodak's ability to develop new digital businesses in its commercial... -

Page 36

... digital products and services could also place pressures on Kodak's sales and market share. In the event Kodak is unable to successfully manage these issues in a timely manner, they could adversely impact the planned inventory reductions. If Kodak exceeds its 2004 capital spending plan, this factor... -

Page 37

... long-term investments, while short-term debt is used to meet working capital requirements. The Company does not utilize financial instruments for trading or other speculative purposes. Using a sensitivity analysis based on estimated fair value of open forward contracts using available forward rates... -

Page 38

... Senior Notes due 2033. The Company's financial instrument counterparties are high-quality investment or commercial banks with significant experience with such instruments. The Company manages exposure to counterparty credit risk by requiring specific minimum credit standards and diversification of... -

Page 39

...1 to the consolidated financial statements, the Company adopted Statement of Financial Accounting Standards No. 142, "Goodwill and Other Intangible Assets," and No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets," on January 1, 2002. Financials Rochester, New York February 10... -

Page 40

... net of income tax benefits of $13, $15 and $2, respectively Net earnings Basic and diluted net earnings (loss) per share: Continuing operations Discontinued operations Total Cash dividends per share The accompanying notes are an integral part of these consolidated financial statements. $ 2003 13... -

Page 41

...Statement of Financial Position At December 31, (in millions, except share and per share data) Assets Current Assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets Total current assets Property, plant and equipment, net Goodwill Other long-term... -

Page 42

Eastman Kodak Company Consolidated Statement of Shareholders' Equity Additional Paid in Capital $ 871 - Accumulated Other Comprehensive (Loss) Income $ (482) - Common (in millions, except share and per share data) Stock* Shareholders' Equity December 31, 2000 $ 978 Net earnings - Other ... -

Page 43

... Comprehensive income Cash dividends declared ($1.15 per common share) Treasury stock issued for stock option exercises (337,940 shares) Unearned restricted stock issuances (309,552 shares) Tax reductions-employee plans Shareholders' Equity December 31, 2003 Common Stock* $ 978 - Retained Earnings... -

Page 44

... Dividends to shareholders Exercise of employee stock options Stock repurchase programs Net cash provided by (used in) financing activities Effect of exchange rate changes on cash Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end... -

Page 45

Eastman Kodak Company Notes to Financial Statements NOTE 1: SIGNIFICANT ACCOUNTING POLICIES Company Operations Eastman Kodak Company (the Company or Kodak) is engaged primarily in developing, manufacturing, and marketing traditional and digital imaging products, services and solutions to consumers... -

Page 46

... 31, 2003 and 2002, the Company had available-for-sale equity securities of $31 million and $24 million, respectively, included in other long-term assets in the accompanying Consolidated Statement of Financial Position. Inventories Inventories are stated at the lower of cost or market. The cost of... -

Page 47

... to customers and costs incurred by the Company related to shipping and handling are included in net sales and cost of goods sold, respectively, in accordance with EITF Issue No. 00-10, "Accounting for Shipping and Handling Fees and Costs." Impairment of Long-Lived Assets Effective January 1, 2002... -

Page 48

... and accounted for as hedges. The Company does not use derivatives for trading or other speculative purposes. The Company has cash flow hedges to manage foreign currency exchange risk, commodity price risk and interest rate risk related to forecasted transactions. The Company also uses foreign... -

Page 49

... the 2002 voluntary stock option exchange program. See Note 20, "Stock Option and Compensation Plans." The Black-Scholes option pricing model was used with the following weighted-average assumptions for options issued in each year: 2000 Plan Risk-free interest rates Expected option lives Expected... -

Page 50

..., cash flows, benefit costs and other relevant information. Companies are required to disclose plan assets by category and a description of investment policies, strategies and target allocation percentages for these asset categories. Cash flows must include projections of future benefit payments... -

Page 51

... goods sold by $53 million and $31 million in 2003 and 2002, respectively. The Company reduces the carrying value of inventories to a lower of cost or market basis for those items that are potentially excess, obsolete or slow-moving based on management's analysis of inventory levels and future sales... -

Page 52

... Battery Corporation 50% 50% 50% 34% 30% ments do not meet the Regulation S-X significance test requiring the inclusion of the separate investee financial statements. The Company sells graphics film and other products to its equity affiliate, KPG. Sales to KPG for the years ended December 31, 2003... -

Page 53

...maximum borrowing level of $250 million. Under the Program, the Company sells certain of its domestic trade accounts receivable without recourse to EK Funding LLC, a Kodak wholly owned, consolidated, bankruptcy-remote, limited purpose, limited liability corporation (EKFC). Kodak continues to service... -

Page 54

... event, all secured borrowings under the Program shall be immediately due and payable. The Company was in compliance with all such covenants at December 31, 2003. Long-Term Debt Long-term debt and related maturities and interest rates were as follows at December 31, 2003 and 2002 (in millions... -

Page 55

...redemption; (4) upon the occurrence of specified corporate transactions such as a consolidation, merger or binding share exchange pursuant to which the Company's common stock would be converted into cash, property or securities; and (5) if the credit rating assigned to the Convertible Securities by... -

Page 56

... are reported in the other long-term liabilities in the accompanying Consolidated Statement of Financial Position. The Company is currently implementing a Corrective Action Program required by the Resource Conservation and Recovery Act (RCRA) at the Kodak Park site in Rochester, NY. As part of... -

Page 57

... is utilizing the services of Imaging Financial Services, Inc., a wholly owned subsidiary of General Electric Capital Corporation, as an alternative financing solution for prospective leasing activity with its customers. At December 31, 2003, the Company had outstanding letters of credit totaling... -

Page 58

...point of sale for a given product based on historical failure rates and related costs to repair. The change in the Company's accrued warranty obligations balance, which is reflected in accounts payable and other current liabilities in 58 the accompanying Consolidated Statement of Financial Position... -

Page 59

... not utilize financial instruments for trading or other speculative purposes. The Company has entered into foreign currency forward contracts that are designated as cash flow hedges of exchange rate risk related to forecasted foreign currency denominated intercompany sales. At December 31, 2003, the... -

Page 60

... rate and the (benefit) provision for income taxes for continuing operations were as follows: (in millions) Amount computed using the statutory rate Increase (reduction) in taxes resulting from: State and other income taxes, net of federal Goodwill amortization Export sales and manufacturing credits... -

Page 61

... earnings to the extent that it can do so tax-free. NOTE 16: RESTRUCTURING COSTS AND OTHER Financials Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position: (in millions) Deferred income taxes (current) Other long-term... -

Page 62

... Statement of Earnings for the year ended December 31, 2003. 2004-2006 Restructuring Program In addition to completing the remaining initiatives under the Third Quarter, 2003 Restructuring Program, the Company announced on January 22, 2004 that it plans to develop and execute a new cost... -

Page 63

..., 2003 Restructuring Program, the Company recorded $21 million of accelerated depreciation on long-lived assets in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The accelerated depreciation relates to long-lived assets accounted for... -

Page 64

...were reported in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represent non-cash items. Severance payments will... -

Page 65

... the Company recorded $24 million of accelerated depreciation on long-lived assets in cost of goods sold in the accompanying Consolidated Statement of Earnings for the year ended December 31, 2003. The accelerated depreciation relates to long-lived assets accounted for under the held and used model... -

Page 66

... 1, 2000. The Cash Balance Plus plan credits employees' accounts with an amount equal to 4% of their pay, plus interest based on the 30-year treasury bond rate. In addition, for employees participating in this plan and the Company's defined contribution plan, the Savings and Investment Plan (SIP... -

Page 67

... in the Statement of Financial Position for all major funded and unfunded U.S. and Non-U.S. defined benefit plans are as follows: 2003 (in millions) Prepaid pension cost Accrued benefit liability Additional minimum pension liability Intangible asset Accumulated other comprehensive income Net amount... -

Page 68

... costs and other in the Consolidated Statement of Earnings. The increase (decrease) in the additional minimum liability (net of the change in the intangible asset) included in other comprehensive income for the major funded and unfunded U.S. and Non-U.S. defined benefit plans is as follows: 2003... -

Page 69

... pay the full cost of their benefits under the plan. The Company's subsidiaries in the United Kingdom and Canada offer similar healthcare benefits. On December 8, 2003, the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the Act) was signed into law. The Act introduces two new... -

Page 70

...Omnibus Long-Term Compensation Plan (the 1990 Plan). The Plans are administered by the Executive Compensation and Development Committee of the Board of Directors. Under the 2000 Plan, 22 million shares of the Company's common stock may be granted to a variety of employees between January 1, 2000 and... -

Page 71

..."Accounting for Certain Transactions Involving Stock-Based Compensation." Also, the new options had an exercise price equal to the fair market value of the Company's common stock on the new grant date, so no compensation expense was recorded as a result of the exchange program. Further information... -

Page 72

.... The discount rate used for these projects was 14%. The charges for the write-off were included as research and development costs in the Company's Consolidated Statement of Earnings for the year ended December 31, 2003. The remaining $169 million of intangible assets have useful lives ranging from... -

Page 73

... completed before the end of 2003. Kodak India operates in each of the Company's reportable segments and is engaged in the manufacture, trading and marketing of cameras, films, photo chemicals and other imaging products. On December 31, 2002, an unaffiliated investor in KCCL exercised its rights... -

Page 74

..., scanners, other business equipment, media sold to commercial and government customers, long-term government contracts, and graphics film products sold to the Kodak Polychrome Graphics joint venture. The All Other group derives revenues from the sale of OLED displays, imaging sensor solutions and... -

Page 75

... $ Health Imaging Commercial Imaging All Other Total of segments Strategic asset and venture investment impairments Impairment of Burrell Companies' net assets held for sale Restructuring costs and other Donation to technology enterprise GE settlement Patent infringement claim settlement Prior year... -

Page 76

... 2002 2001 New Kodak Operating Model and Change in Reporting Structure $ $ 634 107 74 3 818 $ $ 599 96 69 1 765 As of and for the year ended December 31, 2003, the Company reported financial information for three reportable segments (Photography, Health Imaging and Commercial Imaging) and... -

Page 77

... included in other charges) for a charge related to asset impairments and other asset write-offs, which reduced net earnings by $12 million; and a $30 million (included in provision for income taxes) tax benefit related to changes in the corporate tax rate and asset write-offs. (10) Refer to Note... -

Page 78

...and development support, and certain inventory, assets, and employees of Heidelberg's regional operations or market centers. The Company will not pay any cash at closing for the businesses being acquired. Under the terms of the acquisition, Kodak and Heidelberg agreed to use a performance-based earn... -

Page 79

... assets Short-term borrowings and current portion of long-term debt Long-term debt, net of current portion Total shareholders' equity Supplemental Information Net sales from continuing operations -Photography -Health Imaging -Commercial Imaging -All Other Research and development costs Depreciation... -

Page 80

...-offs; and a $121 million tax benefit relating to the closure of the Company's PictureVision subsidiary, the consolidation of the Company's photofinishing operations in Japan, asset write-offs and a change in the corporate tax rate. These items improved net earnings by $7 million. (3) Includes $678... -

Page 81

... of Shareholders of Eastman Kodak Company will be held on Wednesday, May 12, 2004 at 10:00 a.m. at the Theater on the Ridge, 200 Ridge Road West, Rochester, New York. The following proposals will be voted on at the Meeting: 1. 2. 3. 4. 5. Election of the following directors for a term of three years... -

Page 82

... the 2000 Omnibus Long-Term Compensation Plan. • AGAINST the shareholder proposals. Q. A. Will any other matter be voted on? We are not aware of any other matters you will be asked to vote on at the Meeting. If you have returned your signed proxy card or otherwise given the Company's management... -

Page 83

... by your card represent all the shares of Kodak stock you own, including those in the Eastman Kodak Shares Program and the Employee Stock Purchase Plan, and those credited to your account in the Eastman Kodak Employees' Savings and Investment Plan and the Kodak Employees' Stock Ownership Plan. The... -

Page 84

..., and addressed to: Secretary Eastman Kodak Company 343 State Street Rochester, NY 14650-0218 Q. A. What other information about Kodak is available? The following information is available: • Annual Report on Form 10-K. • Transcript of the Annual Meeting. • Plan descriptions, annual reports... -

Page 85

...kodak.com/go/governance. • Business Conduct Guide on Kodak's website at www.kodak.com/US/en/corp/principles/businessConduct.shtml. You may request copies by contacting: Coordinator, Shareholder Services Eastman Kodak Company 343 State Street Rochester, NY 14650-0211 (585) 724-5492 Proxy Statement... -

Page 86

... your name, the name of your brokerage firm and your account number. Audio Webcast of Annual Meeting Available on the Internet Kodak's Annual Meeting will be webcast live. If you have internet access, you can listen to the webcast by going to Kodak's Investor Center webpage at: www.kodak.com/US... -

Page 87

... 2000 Omnibus Long-Term Compensation Plan (the "Plan"). This re-approval is required under Internal Revenue Service regulations in order to preserve the Company's federal income tax deduction when payments based on these performance goals are made to certain executive officers. These material terms... -

Page 88

... that of a company at the 60th percentile in terms of shareholder return within the Standard & Poor's 500 Composite Stock Price Index. The maximum number of shares of common stock that may be awarded to any one participant in a single calendar year in the form of stock awards, performance units or... -

Page 89

... awards under the Plan, all par- Proxy Statement A description of the Performance Stock Program as it operated prior to January 1, 2004 appears on page 108 under the heading "Long-Term Incentive Plan." Effective January 1, 2004, the Company created under the Plan a new performance-based, long-term... -

Page 90

... to enable any award granted by the Committee to a "covered employee" to qualify as performance-based compensation under Section 162(m). Other Information The closing price of the Company's common stock reported on the NYSE for March 1, 2004, was $29.03 per share. The Board of Directors recommends... -

Page 91

... these goals. Supporting Statement This policy makes business sense because preventing pollution is cost effective in the short term and avoids costly long-term liabilities related to toxic chemical exposures. It will improve our company's image if Kodak goes beyond its existing policy to minimize... -

Page 92

... Committee on pages 117-121. In November 2003, the Company introduced the Leadership Stock Program, which for most executives will replace stock option awards with the opportunity to earn performance stock units. However, corporate officers will continue to receive a portion of their long-term... -

Page 93

... at www.kodak.com/go/governance. BUSINESS CONDUCT GUIDE AND DIRECTORS' CODE OF CONDUCT All of our employees, including the Chief Executive Officer, the Chief Financial Officer, the Controller, all other Senior Financial Officers and all other executive officers, are required to comply with our long... -

Page 94

... Controller, Chemicals; Controller, Chemicals; Business Director, ABS Polymers; Assistant Corporate Controller; Vice President, Finance; and Chief Financial Officer, Borg-Warner Automotive, Inc. Earlier in his career, he was a financial analyst for Ford Motor Company. Mr. Hernandez received a BS... -

Page 95

... Chief Operating Officer from November 1995 to January 1997. Mr. Carp began his career with Kodak in 1970 and has held a number of increasingly responsible positions in market research, business planning, marketing management and line of business management. In 1986, Mr. Carp was named Assistant... -

Page 96

...Neill received a BA degree in economics from Fresno State College and a master's degree in public administration from Indiana University. Mr. O'Neill previously served as a director of Eastman Kodak Company from December 1997 to December 2000. He is also a director of Nalco Company, RAND Corporation... -

Page 97

... Company's Business Conduct Guide; and revised the Committee's written charter. Corporate Responsibility and Governance Committee - 5 meetings in 2003 Proxy Statement The Corporate Responsibility and Governance Committee assists the Board in overseeing the Company's corporate governance structure... -

Page 98

..., joint ventures and divestitures; risk management policies; and tax policy. A detailed list of the Committee's functions is included in its charter, which can be accessed at www.kodak.com/go/governance. In the past year, the Finance Committee: • reviewed the Company's financing strategies... -

Page 99

... information, in writing, to the Corporate Responsibility and Governance Committee, c/o Corporate Secretary, Eastman Kodak Company, 343 State Street, Rochester, NY 14650-0218: (i) the name, address and telephone number of the shareholder making the request; (ii) the number of shares of the Company... -

Page 100

... accounts will generally be paid in a single cash payment. Life Insurance The Company provides $100,000 of group term life insurance to each non-employee director. This decreases to $50,000 at retirement or age 65, whichever occurs later. Charitable Award Program This program, which was closed... -

Page 101

... Management, Inc. manages various accounts, including the account of Legg Mason Value Trust, Inc. which holds 16 million of the shares shown, or 5.58% of the Company's common shares. (2) As set forth in Shareholder's Schedule 13G, as of December 31, 2003, filed on February 17, 2004. Proxy Statement... -

Page 102

... include shares held for the account of the above persons in the Eastman Kodak Shares Program and the Kodak Employees' Stock Ownership Plan, and the interests of the above persons in the Kodak Stock Fund of the Eastman Kodak Employees' Savings and Investment Plan, stated in terms of Kodak shares... -

Page 103

... Management Under Mr. Brust's December 20, 1999 offer letter, the Company loaned Mr. Brust, Chief Financial Officer and Executive Vice President, the sum of $3,000,000 at an annual interest rate of 6.21%, the applicable federal rate for mid-term loans, compounded annually, in effect for January 2000... -

Page 104

... Stock Awards (c) $ Long-Term Compensation Awards Payouts LTIP Payouts (e) $ 883,670 0 0 478,899 All Other Compensation (f) $ 0 0 0 26,156 Securities Underlying Options/SARs (d) 72,000 175,000 410,000 551,500 Name and Principal Position Year D. A. Carp Chairman & CEO Salary Bonus (a) 2003... -

Page 105

... expenses paid under the Company's new hire relocation program and Mr. Perez's March 3, 2003 offer letter. (c) The awards shown represent grants of restricted stock or restricted stock units valued as of the date of grant. Dividends are paid on the restricted shares and restricted units as and when... -

Page 106

... of Statement of Financial Accounting Standards No. 123, "Accounting for Stock-Based Compensation." For the options granted in November 2003 under the officer stock option program, the following weighted-average assumptions were used: risk-free interest rate - 3.75%; expected option life - 7 years... -

Page 107

...Year-End* Value Exercisable $ 0 0 0 0 0 Unexercisable $ 84,960 60,770 16,992 16,992 19,765 *Based on the closing price on the NYSE - Composite Transactions of the Company's common stock on December 31, 2003 of $25.67 per share. STOCK OPTIONS AND SARS OUTSTANDING UNDER SHAREHOLDERAND NON-SHAREHOLDER... -

Page 108

... Executive Compensation and Development Committee approved a performance-based, long-term award program, i.e., the Executive Incentive Program, under the 2002-2004 cycle of the Performance Stock Program. The purposes of this one-time program were to increase by year-end 2003 investable cash flow and... -

Page 109

Long-Term Incentive Plan - Awards in Last Fiscal Year Estimated Future Payouts Under Non-Stock Price-Based Plans Name D. A. Carp Number of Shares, Units or Other Rights N/A Performance or Other Period Until Maturation or Payout 2001-2003 2002-2004 2003-2005 2001-2003 (b) 2002-2004 (b) 2003-2005 (b)... -

Page 110

...in this Proxy Statement, the amended offer letter provides Mr. Brust a special severance benefit. If, during the first seven years of Mr. Brust's employment, the Company terminates his employment without cause, he will receive severance pay equal to two times his base salary plus target annual bonus... -

Page 111

... the employee under the Internal Revenue Code. Another component of the program provides enhanced benefits under the Company's retirement plan. Any participant whose employment is terminated, for a reason other than death, disability, cause or voluntary resignation, within five years of a change in... -

Page 112

RETIREMENT PLAN The Company funds a tax-qualified defined benefit pension plan for virtually all U.S. employees. Effective January 1, 2000, the Company amended the plan to include a cash balance feature. Messrs. Carp and Morley are the only named executive officers who participate in the non-cash ... -

Page 113

... rate used under the Company's pension plan to calculate the retirement benefits of participants who retired effective November 1, 2003. Cash Balance Feature Under the cash balance feature of the Company's pension plan, the Company establishes an account for each participating employee. Every... -

Page 114

... Exchange Act of 1934. The Audit-Related Fees related primarily to advisory services in connection with the Sarbanes-Oxley Act of 2002, due diligence related to merger and acquisition activity, audits of the Company's employee benefit plans, and accounting and reporting consultations relating to new... -

Page 115

... directors, each of whom meets the definition of "independence" set forth in the NYSE's corporate governance listing standards. During 2003, the Committee met five times. The Charter of the Committee can be accessed electronically in the "Corporate Governance" section of www.kodak.com/go/governance... -

Page 116

... its five-year environmental goals; • developing, and recommending to the full Board for approval, a realignment of the Board's committee assignments; and • creating a statement of Board responsibilities for inclusion in the Company's Corporate Governance Guidelines. The Committee is committed... -

Page 117

..., the target compensation of the Company's senior executives is set at market-competitive levels. KEY EXECUTIVE COMPENSATION ACTIONS LAST YEAR During 2003, the Committee conducted an extensive review of the Company's long-term compensation practices. The Committee retained an external independent... -

Page 118

...Company earnings per share (EPS) performance over a two-year period. The program was created under the terms of the 2000 Omnibus Long-Term Compensation Plan. Under the program, all executives will be eligible for awards of performance stock units. These units will be performance-based, not just time... -

Page 119

... the corporate funding pool for the year, the Committee noted the significant positive impact that foreign exchange had on the Company's revenue for the year. The Committee also took into account management's performance in maintaining worldwide film market share, exceeding its 2003 investable cash... -

Page 120

... Statement In 2002, the Committee approved a one-time, performance-based, long-term award program (i.e., the Executive Incentive Program), under the 20022004 cycle of the Performance Stock Program. The purposes of this program were to improve by year-end 2003 investable cash flow and the financial... -

Page 121

...page 104. Stock Options Effective November 19, 2003, the Committee granted a stock option award to Mr. Carp of 72,000 shares. These options were granted under the same terms and conditions as awards made to all officers generally under the Company's stock option program. The Committee determined Mr... -

Page 122

... the changes in common stock prices from December 31, 1998, plus assumed reinvested dividends. $ 140 $ 120 $ 100 $ 80 $ 60 $ 40 $ 20 $ 0 12/31/1998 12/31/1999 12/31/2000 12/31/2001 12/31/2002 12/31/2003 EK DJIA S&P 500 â-² â-† Proxy Statement The graph assumes that $100 was invested on... -

Page 123

...Board in its business judgment, and shall be a "Financial Expert," as defined by the SEC; and 5. All members shall receive appropriate training and information necessary to fulfill the Committee's responsibilities. III. MEETINGS Proxy Statement The Committee shall meet at least four times per year... -

Page 124

... the independent accountant. Discuss with management financial information and earnings guidance provided to analysts and rating agencies; and (vii) Discuss with management any comment letters from the SEC relating to the Company's historical filings and the related responses. Proxy Statement 124 -

Page 125

... potential material related party transactions. 7. With respect to access and communication, the Committee shall: Proxy Statement (a) Meet separately and privately with the independent accountant, the Director of Corporate Auditing and Kodak's chief financial and accounting officers to ascertain... -

Page 126

... that the financial statements present fairly, in all material respects, Kodak's financial position, results of operations and cash flows. Kodak's internal audit function is responsible for providing an independent, objective appraisal of Kodak's business activities to support management in its... -

Page 127

...new accounting and financial reporting guidance from rulemaking authorities; financial audits of employee benefit plans; agreed-upon or expanded audit procedures performed at the request of management; and assistance with internal control reporting requirements. IV. TAX SERVICES The Audit Committee... -

Page 128

... client • Financial information systems design and implementation • Appraisal or valuation services, fairness opinions or contribution-in-kind reports • Actuarial services • Internal audit outsourcing services • Management functions • Human resources • Broker-dealer, investment adviser... -

Page 129

... its committees) also performs a number of specific functions including: • Maximize Shareholder Return Representing the interests of the Company's shareholders by maximizing the Company's long-term value. • Strategic Planning Reviewing and approving management's strategic and business plans, and... -

Page 130

... Company will maintain, and the Audit Committee will oversee compliance with, a code of business conduct and ethics for the directors. Such code as currently in effect is set forth in Appendix D, and such code may be modified and replaced from time to time by the Audit Committee. V. BOARD MEETINGS... -

Page 131

...meeting. Strategic Planning The Board will review the Company's long-term strategic plan during at least one Board meeting each year specifically devoted to this purpose. Executive Sessions The non-management directors will regularly meet in executive session, without management, at least four times... -

Page 132

... familiarizes new directors with, among other things, the Company's business, strategic plans, significant financial, accounting and risk management issues, compliance programs, conflicts policies, code of business conduct, corporate governance and principal officers. It also includes meetings with... -

Page 133

... impair a director's independence: • Commercial Relationship: if a director of the Company is an executive officer or an employee, or whose immediate family member is an executive officer of another company that makes payments to, or receives payments from, the Company for property or services in... -

Page 134

...by senior managers, to familiarize new Directors with the Company's overall business and operations, strategic plans and goals, financial statements, and key policies and practices, including corporate governance matters. APPENDIX C: DIRECTOR QUALIFICATION STANDARDS In addition to any other factors... -

Page 135

... must not use Company time, employees, supplies, equipment, buildings or other assets for personal benefit, unless the use is approved in advance by the Chair of the Audit Committee or is part of a compensation or expense reimbursement program available to all directors. Encouraging the Reporting of... -

Page 136

... is taken. Waivers of the Code of Business Conduct and Ethics Only the Board or the Audit Committee may waive a Company business conduct or ethics policy for a Kodak director, and the waiver must be promptly disclosed to shareholders. Annual Review The Board shall review and reassess the adequacy... -

Page 137

Eastman Kodak Company 2004 Annual Meeting THEATER ON THE RIDGE 200 Ridge Road West Rochester, NY DIRECTIONS From the West Take Ridge Road (Rt. 104) to Dewey Avenue. Turn left onto Dewey Avenue, then right on Eastman Avenue and make a quick left turn into Lot 42. From the East Take Route 104 and... -

Page 138

This page intentionally left blank. 138 -

Page 139

... www.kodak.com/go/hse.) Kodak has a long-standing, steadfast commitment to helping its customers use and dispose of Kodak products safely and responsibly. The Company has a "Design for Health, Safety and the Environment" program that works to ensure that knowledgeable design and management decisions... -

Page 140

... address educational opportunities in key markets. • Enable employees to obtain training and development for current and future career needs. • Institutionalize Winning & Inclusive Culture (WIC) as social system for the Kodak Operating System (KOS). COMMUNICATION Kodak conducts business... -

Page 141

...policies that support gay employees. • Working Mother magazine named Kodak among the 100 Best Companies for Working Mothers for the 14th consecutive year. In addition, Kodak's Resolution Support Services (RSS) program was profiled in the Washington Post and The Wall Street Journal. The RSS program... -

Page 142

... VanGelder Chief Information Officer; Vice President Michael P. Benard* Director, Communications & Public Affairs; Vice President Robert L. LaPerle General Manager, kodak.com; Vice President Robert L. Berman* Director, Human Resources; Vice President DIGITAL & FILM IMAGING SYSTEMS Bernard Masson... -

Page 143

...ANNUAL MEETING Theater on the Ridge 200 Ridge Road West Rochester, New York Wednesday, May 12, 2004 10:00 a.m. COMMON STOCK PRODUCT INFORMATION EASTMAN KODAK SHARES PROGRAM Ticker symbol: EK. Most newspaper stock tables list the Company's stock as "EKodak." The common stock is listed and traded... -

Page 144

This page intentionally left blank. 144