Honeywell 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

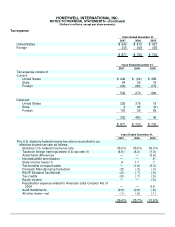

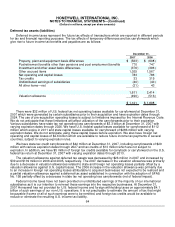

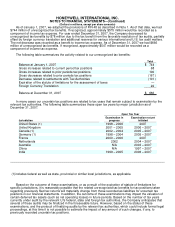

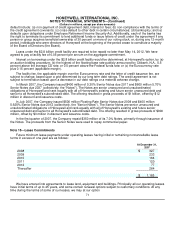

Unrecognized tax benefits for the above listed examinations in progress were $502 million and $373 million

as of January 1, 2007 and December 31, 2007, respectively. This decrease is primarily due to the settlement of

tax examinations during the year.

Estimated interest and penalties related to the underpayment of income taxes are classified as a component

of Tax Expense in the Consolidated Statement of Operations and totaled $20 million for the twelve months ended

December 31, 2007. Accrued interest and penalties were $98 million and $118 million as of January 1, 2007 and

December 31, 2007, respectively.

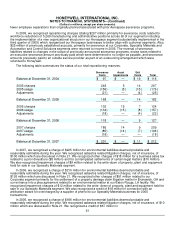

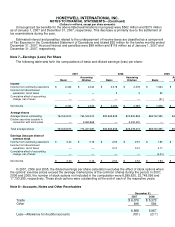

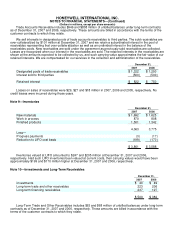

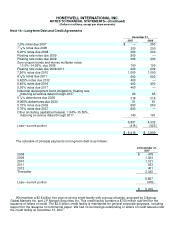

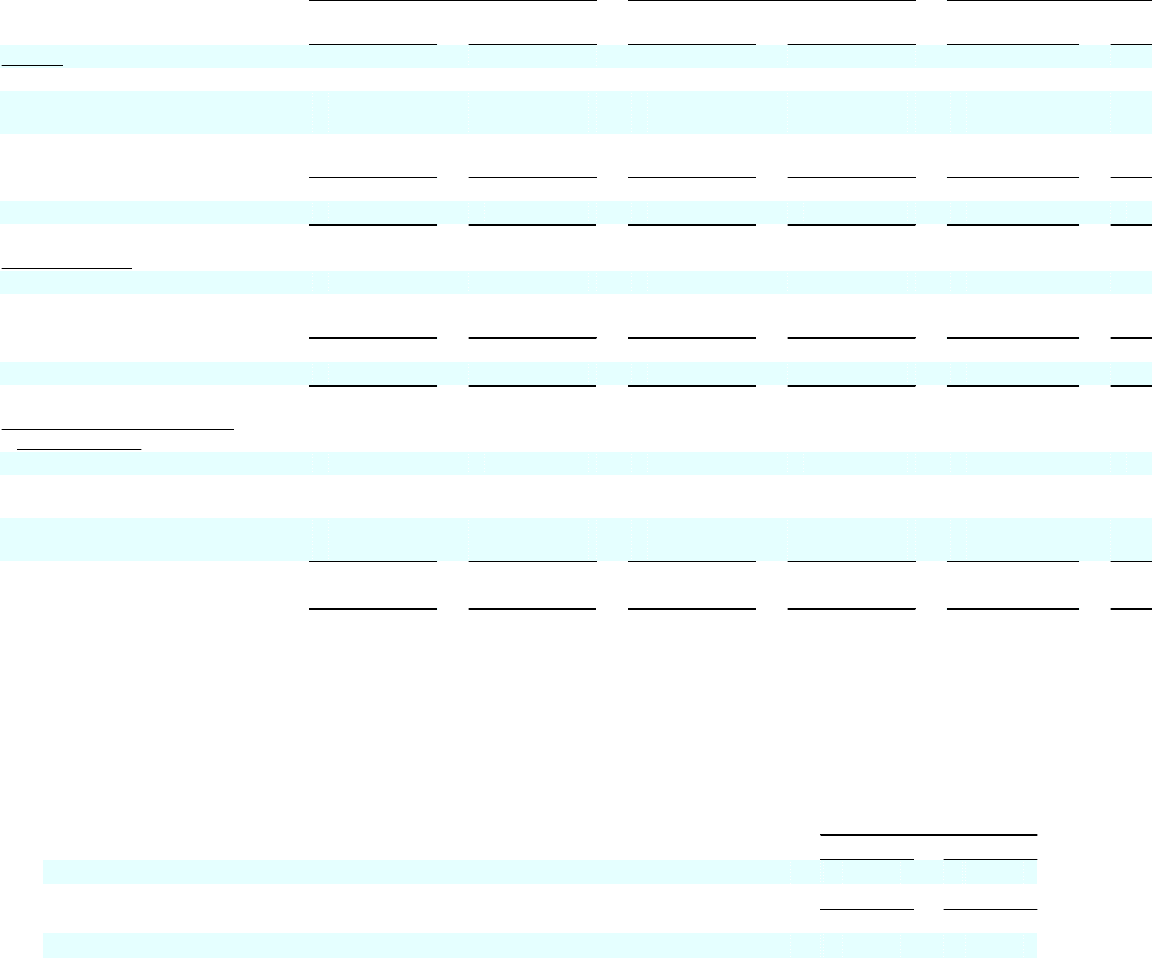

Note 7—Earnings (Loss) Per Share

The following table sets forth the computations of basic and diluted earnings (loss) per share:

2007 2006 2005

Basic Assuming

Dilution Basic Assuming

Dilution Basic Assuming

Dilution

Income

Income from continuing operations $ 2,444 $ 2,444 $ 2,078 $ 2,078 $ 1,564 $

Income from discontinued

operations, net of taxes — — 5 5 95

Cumulative effect of accounting

change, net of taxes — — — — (21 )

Net income $ 2,444 $ 2,444 $ 2,083 $ 2,083 $ 1,638 $

Average shares

Average shares outstanding 764,543,613 764,543,613 820,845,838 820,845,838 848,740,395 848,740,395

Dilutive securities issuable in

connection with stock plans — 9,683,868 — 5,432,435 — 3,594,592

Total average shares 764,543,613 774,227,481 820,845,838 826,278,273 848,740,395 852,334,987

Earnings (loss) per share of

common stock

Income from continuing operations $ 3.20 $ 3.16 $ 2.53 $ 2.51 $ 1.85 $

Income from discontinued

operations, net of taxes — — 0.01 0.01 0.11

Cumulative effect of accounting

change, net of taxes — — — — (0.03 )

Net income $ 3.20 $ 3.16 $ 2.54 $ 2.52 $ 1.93 $

In 2007, 2006 and 2005, the diluted earnings per share calculation excludes the effect of stock options when

the options' exercise prices exceed the average market price of the common shares during the period. In 2007,

2006 and 2005, the number of stock options not included in the computation were 8,599,620, 22,749,056 and

17,793,385, respectively. These stock options were outstanding at the end of each of the respective years.

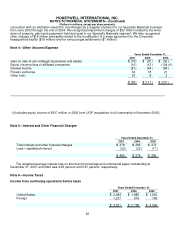

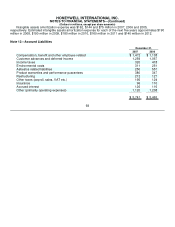

Note 8—Accounts, Notes and Other Receivables

December 31,

2007 2006

Trade $ 6,070 $ 5,373

Other 498 584

6,568 5,957

Less—Allowance for doubtful accounts (181) (217)