Honeywell 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

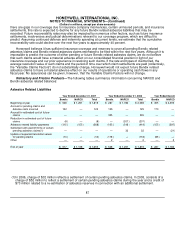

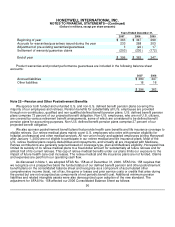

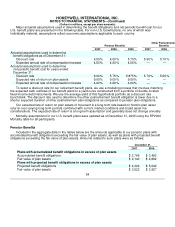

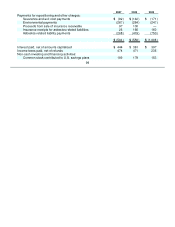

Major actuarial assumptions used in determining the benefit obligations and net periodic benefit cost for our

U.S. benefit plans are presented in the following table. For non-U.S. benefit plans, no one of which was

individually material, assumptions reflect economic assumptions applicable to each country.

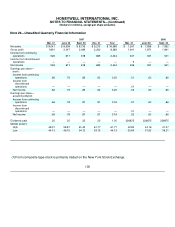

Pension Benefits Other Postretirement

Benefits

2007 2006 2005 2007 2006

Actuarial assumptions used to determine

benefit obligations as of December 31:

Discount rate 6.50% 6.00% 5.75% 5.90% 5.70%

Expected annual rate of compensation increase 4.50% 4.00% 4.00% — —

Actuarial assumptions used to determine

net periodic benefit cost for years ended

December 31:

Discount rate 6.00% 5.75% 5.875% 5.70% 5.50%

Expected rate of return on plan assets 9.00% 9.00% 9.00% — —

Expected annual rate of compensation increase 4.00% 4.00% 4.00% — —

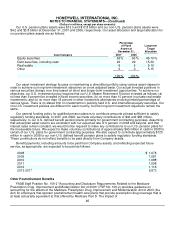

To select a discount rate for our retirement benefit plans, we use a modeling process that involves matching

the expected cash outflows of our benefit plans to a yield curve constructed from a portfolio of double A rated

fixed-income debt instruments. We use the average yield of this hypothetical portfolio as a discount rate

benchmark. The discount rate used to determine the other postretirement benefit obligation is lower due to a

shorter expected duration of other postretirement plan obligations as compared to pension plan obligations.

Our expected rate of return on plan assets of 9 percent is a long-term rate based on historic plan asset

returns over varying long-term periods combined with current market conditions and broad asset mix

considerations. The expected rate of return is a long-term assumption and generally does not change annually.

Mortality assumptions for our U.S. benefit plans were updated as of December 31, 2005 using the RP2000

Mortality table for all participants.

Pension Benefits

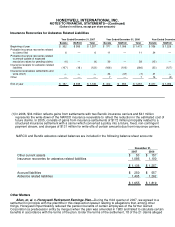

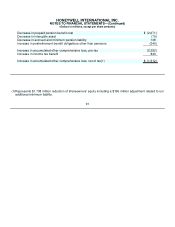

Included in the aggregate data in the tables below are the amounts applicable to our pension plans with

accumulated benefit obligations exceeding the fair value of plan assets, as well as plans with projected benefit

obligations exceeding the fair value of plan assets. Amounts related to such plans were as follows:

December 31,

2007 2006

Plans with accumulated benefit obligations in excess of plan assets

Accumulated benefit obligations $ 2,766 $ 3,493

Fair value of plan assets $ 2,140 $ 2,692

Plans with projected benefit obligations in excess of plan assets

Projected benefit obligations $ 4,329 $ 5,042

Fair value of plan assets $ 3,522 $ 3,927

94