Honeywell 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

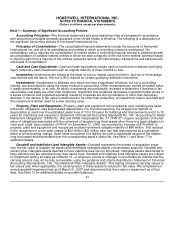

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

measure the consideration transferred, identifiable assets acquired, liabilities assumed, noncontrolling interests,

and goodwill acquired in a business combination. SFAS No. 141R also expands required disclosures surrounding

the nature and financial effects of business combinations. SFAS No. 141R is effective, on a prospective basis, for

fiscal years beginning after December 15, 2008. The Company is currently assessing the impact of SFAS No.

141R on its consolidated financial position and results of operations.

In December 2007, the FASB issued SFAS No. 160, "Noncontrolling Interests in Consolidated Financial

Statements" (SFAS No. 160). SFAS No. 160 establishes requirements for ownership interests in subsidiaries

held by parties other than the Company (sometimes called "minority interests") be clearly identified, presented,

and disclosed in the consolidated statement of financial position within equity, but separate from the parent's

equity. All changes in the parent's ownership interests are required to be accounted for consistently as equity

transactions and any noncontrolling equity investments in deconsolidated subsidiaries must be measured initially

at fair value. SFAS No. 160 is effective, on a prospective basis, for fiscal years beginning after December 15,

2008. However, presentation and disclosure requirements must be retrospectively applied to comparative

financial statements. The Company is currently assessing the impact of SFAS No. 160 on its consolidated

financial position and results of operations.

Note 2—Acquisitions and Divestitures

We acquired businesses for an aggregate cost of $1,190, $979 and $3,500 million in 2007, 2006 and 2005,

respectively. All of our acquisitions were accounted for under the purchase method of accounting, and

accordingly, the assets and liabilities of the acquired businesses were recorded at their estimated fair values at

the dates of acquisition. Significant acquisitions made in these years are discussed below.

In July 2007, the Company completed the acquisition of Dimensions International, a defense logistics

business, for a purchase price of approximately $230 million. The purchase price for the acquisition was

allocated to the tangible and identifiable intangible assets acquired and liabilities assumed based on their

estimated fair values at the acquisition date. The Company has assigned $21 million to identifiable intangible

assets, predominantly contractual relationships. These intangible assets are being amortized over their estimated

life of 5 years using straight-line and accelerated amortization methods. The excess of the purchase price over

the estimated fair values of net assets acquired approximating $180 million, was recorded as goodwill. This

goodwill is non-deductible for tax purposes. This acquisition was accounted for by the purchase method, and,

accordingly, results of operations are included in the consolidated financial statements from the date of

acquisition. The results from the acquisition date through December 31, 2007 are included in the Aerospace

segment and were not material to the consolidated financial statements.

In July 2007, the Company completed the acquisition of Enraf Holding B.V., a provider of comprehensive

solutions for the control and management of transportation, storage and blending operations in the oil and gas

industry, for a purchase price of approximately $264 million, including the assumption of approximately $40

million of debt. The purchase price for the acquisition was allocated to the tangible and identifiable intangible

assets acquired and liabilities assumed based on their estimated fair values at the acquisition date. The

Company has assigned $90 million to identifiable intangible assets, predominantly customer relationships,

existing technology and trademarks. These intangible assets are being amortized over their estimated life of 8-15

years using straight-line and accelerated amortization methods. The excess of the purchase price over the

estimated fair values of net assets acquired approximating $167 million, was recorded as goodwill. Goodwill will

be deducted over a 15 year period for tax purposes. This acquisition was accounted for by the purchase method,

and, accordingly, results of operations are included in the consolidated financial statements from the date of

acquisition. The results from the acquisition date through December 31, 2007 are included in

57