Honeywell 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

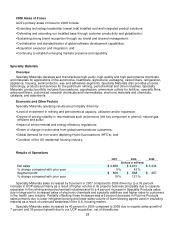

2008 Areas of Focus

ACS's primary areas of focus for 2008 include:

• Extending technology leadership: lowest total installed cost and integrated product solutions;

•

Defending and extending our installed base through customer productivity and globalization;

•

Sustaining strong brand recognition through our brand and channel management;

•

Centralization and standardization of global software development capabilities;

•

Acquisition execution and integration; and

•

Continuing to establish emerging markets presence and capability.

Specialty Materials

Overview

Specialty Materials develops and manufactures high-purity, high-quality and high-performance chemicals

and materials for applications in the automotive, healthcare, agricultural, packaging, carpet fibers, refrigeration,

appliance, housing, semiconductor, wax and adhesives segments. Specialty Materials also provides process

technology, products and services for the petroleum refining, petrochemical and other industries. Specialty

Materials' product portfolio includes fluorocarbons, caprolactam, ammonium sulfate for fertilizer, specialty films,

advanced fibers, customized research chemicals and intermediates, electronic materials and chemicals,

catalysts, and adsorbents.

Economic and Other Factors

Specialty Materials operating results are principally driven by:

• Level of investment in refining and petrochemical capacity, utilization and/or expansion,

•

Degree of pricing volatility in raw materials such as benzene (the key component in phenol), natural gas,

ethylene and sulfur;

•

Impact of environmental and energy efficiency regulations;

•

Extent of change in order rates from global semiconductor customers;

•

Global demand for non-ozone depleting Hydro fluorocarbons (HFC's); and

•

Condition of the US residential housing industry.

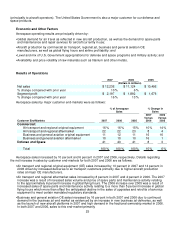

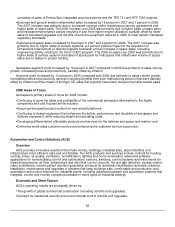

Results of Operations

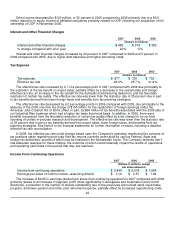

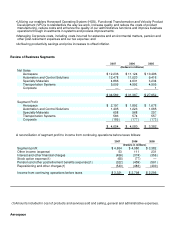

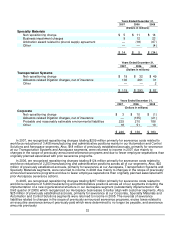

2007 2006 2005

(Dollars in millions)

Net sales $ 4,866 $ 4,631 $ 3,234

% change compared with prior year 5% 43%

Segment profit $ 658 $ 568 $ 257

% change compared with prior year 16% 121%

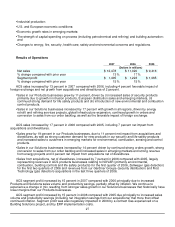

Specialty Materials sales increased by 5 percent in 2007 compared to 2006 driven by (i) a 16 percent

increase in UOP sales primarily as a result of higher volume in its projects business principally due to capacity

expansion in the refining and petrochemical industries and (ii) a 4 percent increase in Specialty Products sales

due in large part to increased sales of electronic chemicals and specialty additives and higher sales to customers

in the health care industry. Partially offsetting these increases was a 6 percent decrease in Fluorine Products

sales primarily due to lower refrigerant pricing and lower sales volume of foam blowing agents used in insulating

material as a result of continued weakness in the U.S. housing market.

Specialty Materials sales increased by 43 percent in 2006 compared to 2005 due to organic sales growth of

7 percent and 36 percent growth due to our UOP acquisition, net of divestitures.

28