Honeywell 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional sources of short-term and long-term liquidity to fund current operations, debt maturities, and future

investment opportunities. Based on our current financial position and expected economic performance, we do not

believe that our liquidity will be adversely impacted by an inability to access our sources of financing.

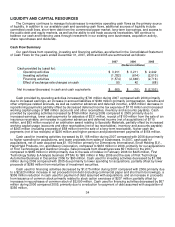

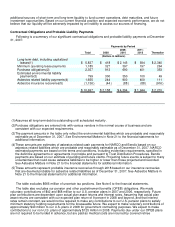

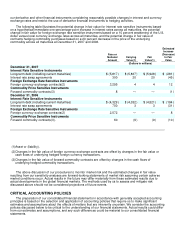

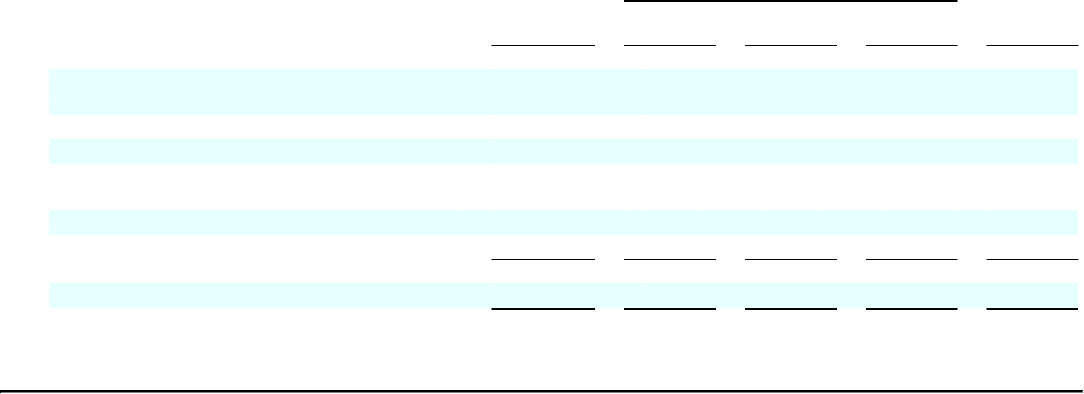

Contractual Obligations and Probable Liability Payments

Following is a summary of our significant contractual obligations and probable liability payments at December

31, 2007:

Total

Payments by Period

Thereafter

2008 2009-

2010 2011-

2012

(Dollars in millions)

Long-term debt, including capitalized

leases(1) $ 5,837 $ 418 $ 2,145 $ 934 $ 2,340

Minimum operating lease payments 1,185 327 397 197 264

Purchase obligations(2) 2,357 913 690 401 353

Estimated environmental liability

payments(3) 799 300 350 100 49

Asbestos related liability payments(4) 1,655 244 900 400 111

Asbestos insurance recoveries(5) (1,136) (44) (88) (88) (916)

$ 10,697 $ 2,158 $ 4,394 $ 1,944 $ 2,201

(1) Assumes all long-term debt is outstanding until scheduled maturity.

(2)

Purchase obligations are entered into with various vendors in the normal course of business and are

consistent with our expected requirements.

(3)

The payment amounts in the table only reflect the environmental liabilities which are probable and reasonably

estimable as of December 31, 2007. See Environmental Matters in Note 21 to the financial statements for

additional information.

(4)

These amounts are estimates of asbestos related cash payments for NARCO and Bendix based on our

asbestos related liabilities which are probable and reasonably estimable as of December 31, 2007. NARCO

estimated payments are based on the terms and conditions, including evidentiary requirements, specified in

the definitive agreements or agreements in principle and pursuant to Trust Distribution Procedures. Bendix

payments are based on our estimate of pending and future claims. Projecting future events is subject to many

uncertainties that could cause asbestos liabilities to be higher or lower than those projected and recorded.

See Asbestos Matters in Note 21 to the financial statements for additional information.

(5)

These amounts represent probable insurance recoveries through 2018 based on our insurance recoveries

that are deemed probable for asbestos related liabilities as of December 31, 2007. See Asbestos Matters in

Note 21 to the financial statements for additional information.

The table excludes $666 million of uncertain tax positions. See Note 6 to the financial statements.

The table also excludes our pension and other postretirement benefits (OPEB) obligations. We made

voluntary contributions of $42 and $68 million to our U.S. pension plans in 2007 and 2006, respectively. Future

plan contributions are dependent upon actual plan asset returns and interest rates. Assuming that actual plan

asset returns are consistent with our expected plan return of 9 percent in 2008 and beyond, and that interest

rates remain constant, we would not be required to make any contributions to our U.S. pension plans to satisfy

minimum statutory funding requirements for the foreseeable future. We expect to make voluntary contributions of

approximately $40 million to our U.S. plans in 2008 for government contracting purposes. We expect to make

contributions to our non-U.S. plans of approximately $125 million in 2008. Payments due under our OPEB plans

are not required to be funded in advance, but are paid as medical costs are incurred by covered retiree