Honeywell 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

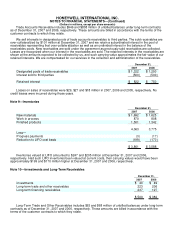

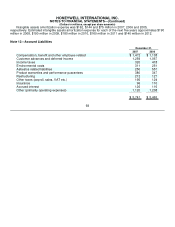

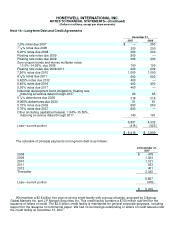

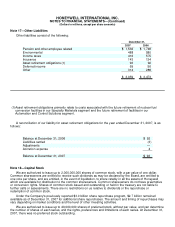

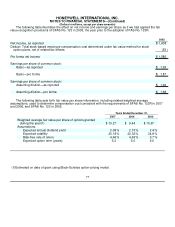

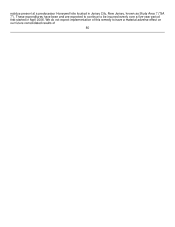

Note 17—Other Liabilities

Other liabilities consist of the following:

December 31,

2007 2006

Pension and other employee related $ 1,536 $ 1,748

Environmental 488 580

Income taxes 416 575

Insurance 143 134

Asset retirement obligations (1) 93 92

Deferred income 69 56

Other 314 288

$ 3,059 $ 3,473

(1) Asset retirement obligations primarily relate to costs associated with the future retirement of nuclear fuel

conversion facilities in our Specialty Materials segment and the future retirement of facilities in our

Automation and Control Solutions segment.

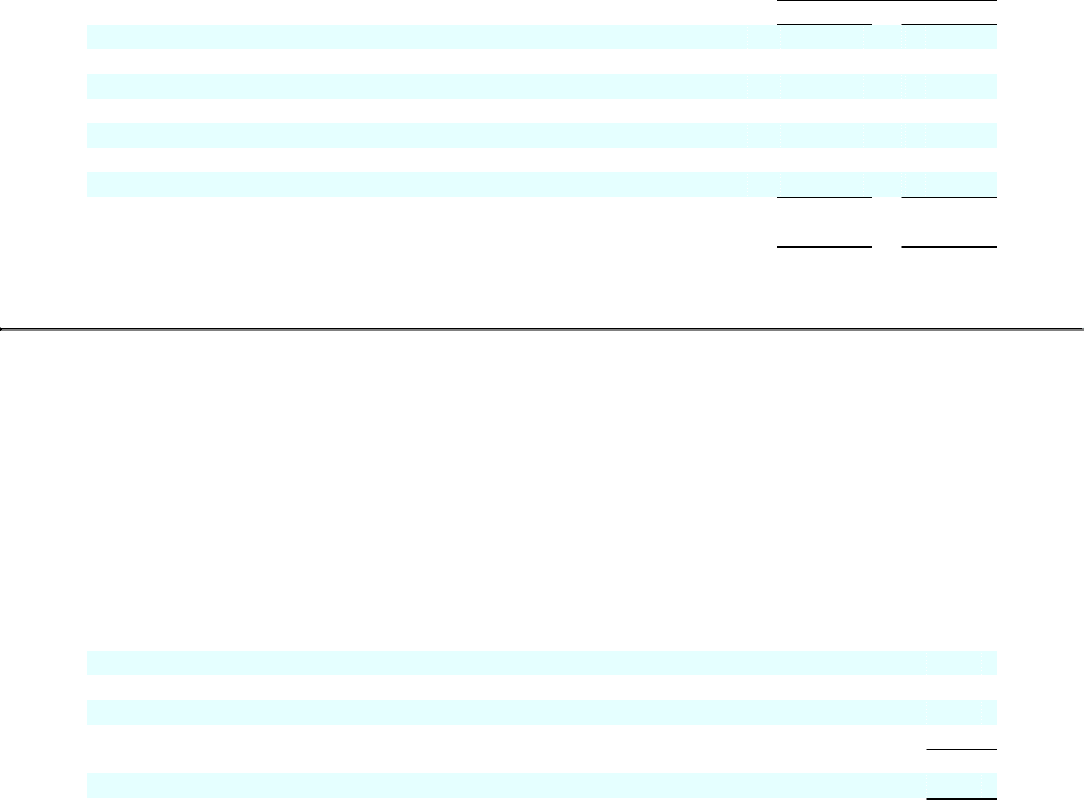

A reconciliation of our liability for asset retirement obligations for the year ended December 31, 2007, is as

follows:

Balance at December 31, 2006 $ 92

Liabilities settled (3)

Adjustments —

Accretion expense 4

Balance at December 31, 2007 $ 93

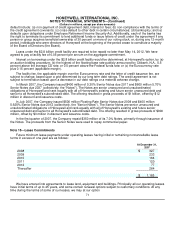

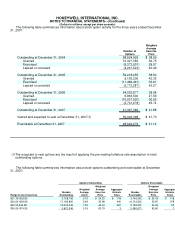

Note 18—Capital Stock

We are authorized to issue up to 2,000,000,000 shares of common stock, with a par value of one dollar.

Common shareowners are entitled to receive such dividends as may be declared by the Board, are entitled to

one vote per share, and are entitled, in the event of liquidation, to share ratably in all the assets of Honeywell

which are available for distribution to the common shareowners. Common shareowners do not have preemptive

or conversion rights. Shares of common stock issued and outstanding or held in the treasury are not liable to

further calls or assessments. There are no restrictions on us relative to dividends or the repurchase or

redemption of common stock.

Under the Company's previously reported $3.0 billion share repurchase program, $2.7 billion remained

available as of December 31, 2007 for additional share repurchases. The amount and timing of repurchases may

vary depending on market conditions and the level of other investing activities.

We are authorized to issue up to 40,000,000 shares of preferred stock, without par value, and can determine

the number of shares of each series, and the rights, preferences and limitations of each series. At December 31,

2007, there was no preferred stock outstanding.