Honeywell 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

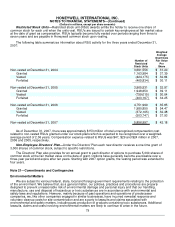

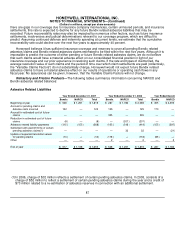

by previously owned subsidiaries primarily fall into two general categories: refractory products and friction

products.

Refractory Products—Honeywell owned North American Refractories Company (NARCO) from 1979 to

1986. NARCO produced refractory products (high temperature bricks and cement) that were sold largely to the

steel industry in the East and Midwest. Less than 2 percent of NARCO'S products contained asbestos.

When we sold the NARCO business in 1986, we agreed to indemnify NARCO with respect to personal injury

claims for products that had been discontinued prior to the sale (as defined in the sale agreement). NARCO

retained all liability for all other claims. On January 4, 2002, NARCO filed for reorganization under Chapter 11 of

the U.S Bankruptcy Code.

As a result of the NARCO bankruptcy filing, all of the claims pending against NARCO are automatically

stayed pending the reorganization of NARCO. In addition, the bankruptcy court enjoined both the filing and

prosecution of NARCO-related asbestos claims against Honeywell. The stay has remained in effect continuously

since January 4, 2002. In connection with NARCO's bankruptcy filing, we paid NARCO's parent company $40

million and agreed to provide NARCO with up to $20 million in financing. We also agreed to pay $20 million to

NARCO's parent company upon the filing of a plan of reorganization for NARCO acceptable to Honeywell (which

amount was paid in December 2005 following the filing of NARCO's Third Amended Plan of Reorganization), and

to pay NARCO's parent company $40 million, and to forgive any outstanding NARCO indebtedness to

Honeywell, upon the effective date of the plan of reorganization.

We believe that, as part of NARCO plan of reorganization, a trust will be established for the benefit of all

asbestos claimants, current and future, pursuant to Trust Distribution Procedures negotiated with the NARCO

Asbestos Claimants Committee and the Court-appointed legal representative for future asbestos claimants. If the

trust is put in place and approved by the Court as fair and equitable, Honeywell as well as NARCO will be entitled

to a permanent channeling injunction barring all present and future individual actions in state or federal courts

and requiring all asbestos related claims based on exposure to NARCO products to be made against the

federally-supervised trust. Honeywell has reached agreement with the representative for future NARCO

claimants and the Asbestos Claimants Committee to cap its annual contributions to the trust with respect to

future claims at a level that would not have a material impact on Honeywell's operating cash flows.

In November 2007, the Bankruptcy Court entered an amended order confirming the NARCO Plan without

modification and approving the 524(g) trust and channeling injunction in favor of NARCO and Honeywell. In

December 2007, certain insurers filed an appeal from the Bankruptcy Court's amended confirmation order. This

appeal is pending in the United States District Court for the Western District of Pennsylvania. No assurances can

be given as to the time frame or outcome of this appeal. We expect that the stay enjoining litigation against

NARCO and Honeywell to remain in effect during the pendency of these proceedings.

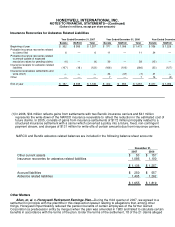

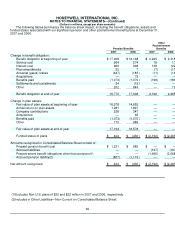

Our consolidated financial statements reflect an estimated liability for settlement of pending and future

NARCO-related asbestos claims as of December 31, 2007 and 2006 of $1.1 and $1.3 billion, respectively. The

estimated liability for pending claims is based on terms and conditions, including evidentiary requirements, in

definitive agreements with approximately 260,000 current claimants, and an estimate of the unsettled claims

pending as of the time NARCO filed for bankruptcy protection. Substantially all settlement payments with respect

to current claims have been made as of December 31, 2007. Approximately $95 million of payments due

pursuant to these settlements is due only upon establishment of the NARCO trust.

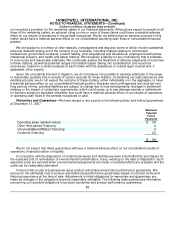

The estimated liability for future claims represents the estimated value of future asbestos related bodily injury

claims expected to be asserted against NARCO through 2018 and the aforementioned obligations to NARCO's

parent. In light of the uncertainties inherent in making long-term projections we

83