Honeywell 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

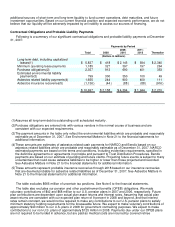

our derivative and other financial instruments considering reasonably possible changes in interest and currency

exchange rates and restrict the use of derivative financial instruments to hedging activities.

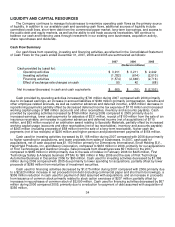

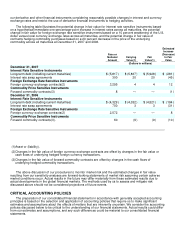

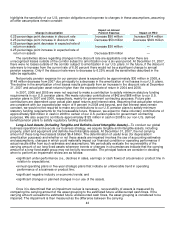

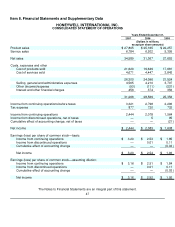

The following table illustrates the potential change in fair value for interest rate sensitive instruments based

on a hypothetical immediate one-percentage-point increase in interest rates across all maturities, the potential

change in fair value for foreign exchange rate sensitive instruments based on a 10 percent weakening of the U.S.

dollar versus local currency exchange rates across all maturities, and the potential change in fair value of

contracts hedging commodity purchases based on a 20 percent decrease in the price of the underlying

commodity across all maturities at December 31, 2007 and 2006.

Face or

Notional

Amount Carrying

Value(1) Fair

Value(1)

Estimated

Increase

(Decrease)

In Fair

Value

(Dollars in millions)

December 31, 2007

Interest Rate Sensitive Instruments

Long-term debt (including current maturities) $ (5,817) $ (5,837) $ (5,928) $ (281)

Interest rate swap agreements 300 20 20 (45)

Foreign Exchange Rate Sensitive Instruments

Foreign currency exchange contracts(2) 3,295 4 4 12

Commodity Price Sensitive Instruments

Forward commodity contracts(3) 8 — — (1)

December 31, 2006

Interest Rate Sensitive Instruments

Long-term debt (including current maturities) $ (4,329) $ (4,332) $ (4,521) $ (194)

Interest rate swap agreements 700 3 3 (31)

Foreign Exchange Rate Sensitive Instruments

Foreign currency exchange contracts(2) 2,572 — — 8

Commodity Price Sensitive Instruments

Forward commodity contracts(3). 60 (9) (9) (10)

(1) Asset or (liability).

(2)

Changes in the fair value of foreign currency exchange contracts are offset by changes in the fair value or

cash flows of underlying hedged foreign currency transactions.

(3)

Changes in the fair value of forward commodity contracts are offset by changes in the cash flows of

underlying hedged commodity transactions.

The above discussion of our procedures to monitor market risk and the estimated changes in fair value

resulting from our sensitivity analyses are forward-looking statements of market risk assuming certain adverse

market conditions occur. Actual results in the future may differ materially from these estimated results due to

actual developments in the global financial markets. The methods used by us to assess and mitigate risk

discussed above should not be considered projections of future events.

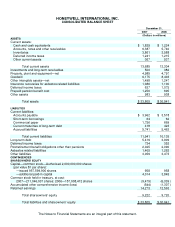

CRITICAL ACCOUNTING POLICIES

The preparation of our consolidated financial statements in accordance with generally accepted accounting

principles is based on the selection and application of accounting policies that require us to make significant

estimates and assumptions about the effects of matters that are inherently uncertain. We consider the accounting

policies discussed below to be critical to the understanding of our financial statements. Actual results could differ

from our estimates and assumptions, and any such differences could be material to our consolidated financial

statements.