Honeywell 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

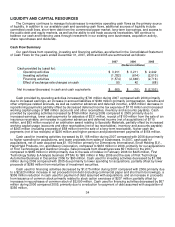

LIQUIDITY AND CAPITAL RESOURCES

The Company continues to manage its businesses to maximize operating cash flows as the primary source

of liquidity. In addition to our available cash and operating cash flows, additional sources of liquidity include

committed credit lines, short-term debt from the commercial paper market, long-term borrowings, and access to

the public debt and equity markets, as well as the ability to sell trade accounts receivables. We continue to

balance our cash and financing uses through investment in our existing core businesses, acquisition activity,

share repurchases and dividends.

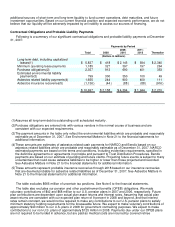

Cash Flow Summary

Our cash flows from operating, investing and financing activities, as reflected in the Consolidated Statement

of Cash Flows for the years ended December 31, 2007, 2006 and 2005 are summarized as follows:

2007 2006 2005

(Dollars in millions)

Cash provided by (used for):

Operating activities $ 3,911 $ 3,211 $ 2,442

Investing activities (1,782) (614) (2,010)

Financing activities (1,574) (2,649) (2,716)

Effect of exchange rate changes on cash 50 42 (68)

Net increase/(decrease) in cash and cash equivalents $ 605 $ (10) $ (2,352)

Cash provided by operating activities increased by $700 million during 2007 compared with 2006 primarily

due to increased earnings, an increase in accrued liabilities of $349 million (primarily compensation, benefits and

other employee related accruals, as well as customer advances and deferred income), a $55 million decrease in

repositioning payments partially offset by decreased deferred income tax expense of $118 million and increased

working capital usage of $68 million (accounts and other receivables, inventory and accounts payable). Cash

provided by operating activities increased by $769 million during 2006 compared to 2005 primarily due to

increased earnings, lower cash payments for asbestos of $331 million, receipt of $100 million from the sale of an

insurance receivable, an increase in customer advances and deferred income (net of acquisitions) of $115

million, and $93 million receipt of an arbitration award relating to Specialty Materials, partially offset by increased

working capital usage (accounts and other receivables (net of tax receivables), inventory and accounts payable)

of $263 million (including proceeds of $58 million from the sale of a long-term receivable), higher cash tax

payments (net of tax receipts) of $236 million and higher pension and postretirement payments of $154 million.

Cash used for investing activities increased by $1,168 million during 2007 compared with 2006 due primarily

to higher spending for acquisitions, and lower proceeds from sales of businesses. In 2007, cash paid for

acquisitions, net of cash acquired was $1,150 million primarily for Dimensions International, Enraf Holding B.V.,

Hand Held Products, Inc, and Maxon Corporation, compared to $633 million in 2006, primarily for our acquisitions

of First Technologies and Gardiner Groupe. Sale proceeds from divestitures was $51 million in the 2007,

compared to $665 million in 2006 primarily due to the sale of Indalex in February 2006 for $425 million, First

Technology Safety & Analysis business (FTSA) for $93 million in May 2006 and the sale of First Technology

Automotive Business in December 2006 for $90 million. Cash used for investing activities decreased by $1,396

million during 2006 compared with 2005 due primarily to lower spending for acquisitions, partially offset by lower

proceeds of $285 million from maturities of investment securities.

Cash used for financing activities decreased by $1,075 million during 2007 compared with 2006 primarily due

to a $2,620 million increase in net proceeds from debt (including commercial paper and short term borrowings), a

$306 million reduction in cash used for payment of debt assumed with acquisitions, and an increase in proceeds

from issuance of common stock primarily related to stock option exercises of $207 million; partially offset by

increases in repurchases of common stock of $2,090 million. Cash used for financing activities decreased by $67

million during 2006 compared 2005, primarily due to a reduction for payment of debt assumed with acquisition of

$356 million,

34