Honeywell 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

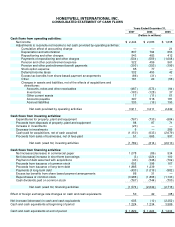

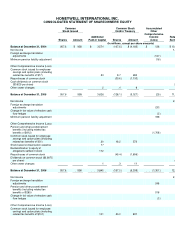

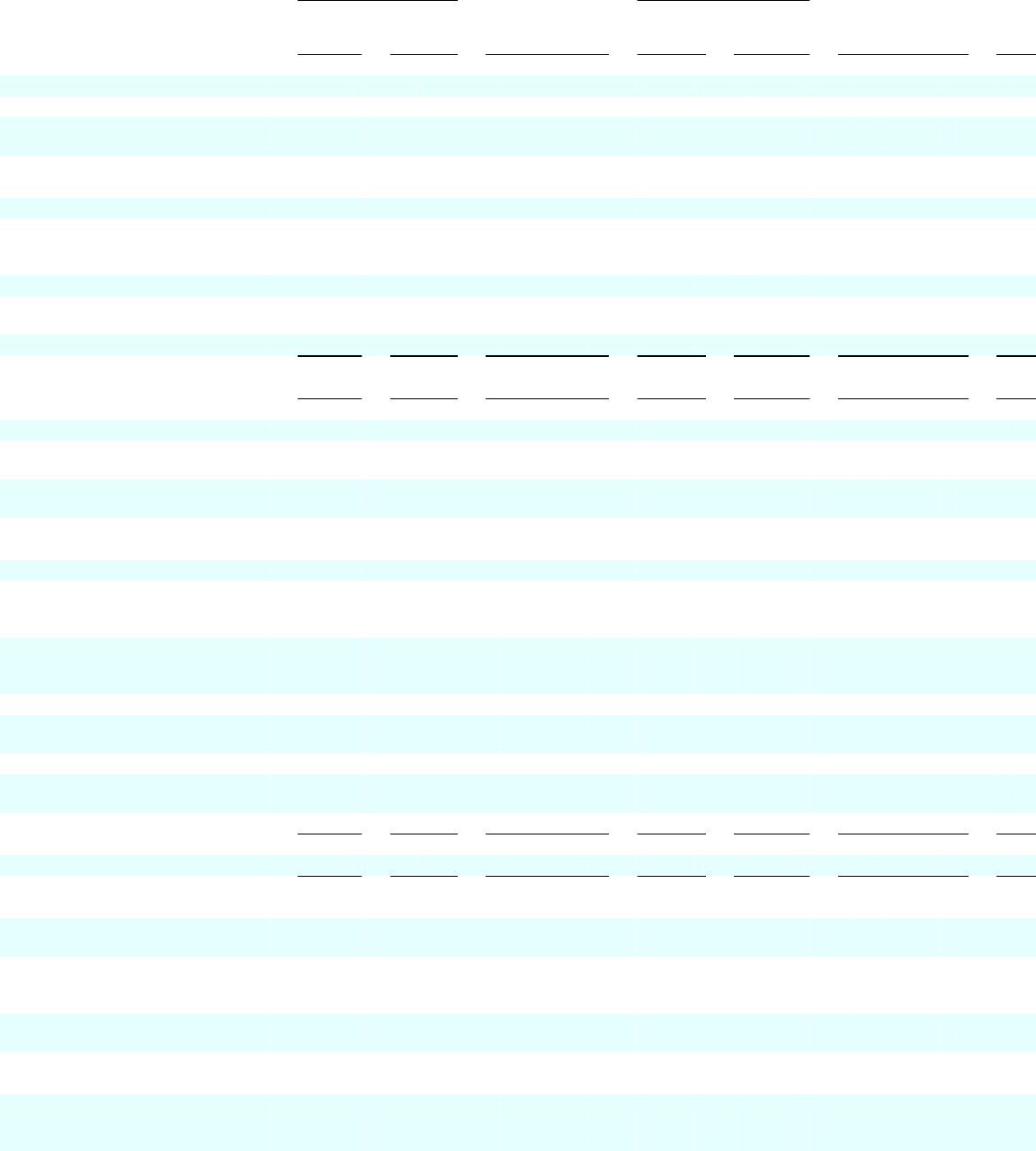

HONEYWELL INTERNATIONAL INC.

CONSOLIDATED STATEMENT OF SHAREOWNERS' EQUITY

Common

Stock Issued

Additional

Paid-in Capital

Common Stock

Held in Treasury

Accumulated

Other

Comprehensive

Income

(Loss) Retained

Earnings

Shares Amount Shares Amount

(In millions, except per share amounts)

Balance at December 31, 2004 957.6 $ 958 $ 3,574 (107.6) $ (4,185) $ 138 $ 10,292

Net income 1,638

Foreign exchange translation

adjustments (147)

Minimum pension liability adjustment (16)

Other Comprehensive Income (Loss)

Common stock issued for employee

savings and option plans (including

related tax benefits of $17) 50 9.7 283

Repurchases of common stock (30.6 ) (1,133 )

Cash dividends on common stock

($0.825 per share) (700

Other owner changes 2 .4 8

Balance at December 31, 2005 957.6 958 3,626 (128.1) (5,027) (25) 11,230

Net income 2,083

Foreign exchange translation

adjustments 233

Change in fair value of effective cash

flow hedges (3)

Minimum pension liability adjustment 196

Other Comprehensive Income (Loss)

Pension and other postretirement

benefits (including related tax

benefits of $912) (1,708)

Common stock issued for employee

savings and option plans (including

related tax benefits of $31) 29 16.2 573

Stock based compensation expense 77

Reclassification to equity of

obligations settled in stock 112

Repurchases of common stock (45.4 ) (1,896 )

Dividends on common stock ($0.9075

per share) (750

Other owner changes 1 .3 11

Balance at December 31, 2006 957.6 958 3,845 (157.0) (6,339) (1,307) 12,563

Net income 2,444

Foreign exchange translation

adjustments 248

Pension and other postretirement

benefits (including related tax

benefits of $285) 518

Change in fair value of effective cash

flow hedges (3)

Other Comprehensive Income (Loss)

Common stock issued for employee

savings and option plans (including

related tax benefits of $101) 101 20.0 837