Honeywell 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

liabilities although there are gaps in our coverage due to insurance company insolvencies, certain uninsured

periods and insurance settlements, resulting in approximately 50 percent of these claims on a cumulative

historical basis being reimbursable by insurance. Our insurance is with both the domestic insurance market and

the London excess market. While the substantial majority of our insurance carriers are solvent, some of our

individual carriers are insolvent, which has been considered in our analysis of probable recoveries. Projecting

future events is subject to various uncertainties that could cause the insurance recovery on asbestos related

liabilities to be higher or lower than that projected and recorded. Given the inherent uncertainty in making future

projections, we reevaluate our projections concerning our probable insurance recoveries in light of any changes

to the projected liability, our recovery experience or other relevant factors that may impact future insurance

recoveries. See Note 21 to the financial statements for a discussion of management's judgments applied in the

recognition and measurement of insurance recoveries for asbestos related liabilities.

Defined Benefit Pension Plans—We maintain defined benefit pension plans covering a majority of our

employees and retirees. For financial reporting purposes, net periodic pension expense is calculated based upon

a number of significant actuarial assumptions, including a discount rate for plan obligations and an expected

long-term rate of return on plan assets. We determine the expected long-term rate of return on plan assets

utilizing historic and expected plan asset returns over varying long-term periods combined with current market

conditions and broad asset mix considerations (see Note 22 to the financial statements for actual and targeted

asset allocation percentages for our pension plans). The discount rate reflects the market rate on December 31

(measurement date) for high-quality fixed-income investments with maturities corresponding to our benefit

obligations and is subject to change each year. Further information on all our major actuarial assumption is

included in Note 22 to the financial statements.

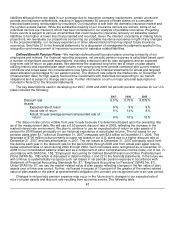

The key assumptions used in developing our 2007, 2006 and 2005 net periodic pension expense for our U.S.

plans included the following:

2007 2006 2005

Discount rate 6.0% 5.75% 5.875%

Assets:

Expected rate of return 9% 9% 9%

Actual rate of return 9% 14% 8%

Actual 10 year average annual compounded rate of

return 9% 10% 10%

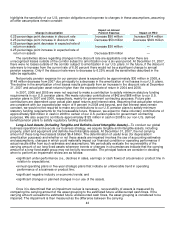

The discount rate can be volatile from year to year because it is determined based upon the prevailing rate

as of the measurement date. We will use a 6.50 percent discount rate in 2008, reflecting the increase in the

market interest rate environment. We plan to continue to use an expected rate of return on plan assets of 9

percent for 2008 based principally on our historical experience of actual plan returns. The net losses for our

pension plans were $1.7 billion at December 31, 2007 compared with $2.4 billion at December 31, 2006. This

decrease of $700 million is due primarily to lower net losses in our U.S. plans due to a higher discount rate at

December 31, 2007 and loss amortization in 2007. The net losses at December 31, 2007 principally result from

the decline each year in the discount rate for the period 2002 through 2006 and from actual plan asset returns

below expected rates of return during 2000 through 2002. Such net losses were recognized as of December 31,

2006 on our consolidated balance sheet and as a component of other comprehensive income (loss), net of tax, in

accordance with SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement

Plans (SFAS No. 158) which is discussed in detail in Notes 1 and 22 to the financial statements. In the future we

will continue to systematically recognize such net losses in net periodic pension expense in accordance with

Statement of Financial Accounting Standards No. 87, "Employers Accounting for Pensions" (SFAS No. 87).

Under SFAS No. 87, we use the market-related value of plan assets reflecting changes in the fair value of plan

assets over a three-year period. Further, net losses in excess of 10 percent of the greater of the market-related

value of plan assets or the plans' projected benefit obligation (the corridor) are recognized over a six-year period.

Changes in net periodic pension expense may occur in the future due to changes in our expected rate of

return on plan assets and discount rate resulting from economic events. The following table

42