Honeywell 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

technical or legal information becomes available. Given the uncertainties regarding the status of laws,

regulations, enforcement policies, the impact of other potentially responsible parties, technology and information

related to individual sites, we do not believe it is possible to develop an estimate of the range of reasonably

possible environmental loss in excess of our recorded liabilities. We expect to fund expenditures for these

matters from operating cash flow. The timing of cash expenditures depends on a number of factors, including the

timing of litigation and settlements of remediation liability, personal injury and property damage claims, regulatory

approval of cleanup projects, execution timeframe of projects, remedial techniques to be utilized and agreements

with other parties.

Remedial response and voluntary cleanup payments were $267, $264 and $247 million in 2007, 2006, and

2005, respectively, and are currently estimated to be approximately $300 million in 2008. We expect to fund such

expenditures from operating cash flow.

Remedial response and voluntary cleanup costs charged against pretax earnings were $230, $210 and $186

million in 2007, 2006 and 2005, respectively. At December 31, 2007 and 2006, the recorded liabilities for

environmental matters was $799 and $831 million, respectively. In addition, in 2007 and 2006 we incurred

operating costs for ongoing businesses of approximately $81 and $101 million, respectively, relating to

compliance with environmental regulations.

Although we do not currently possess sufficient information to reasonably estimate the amounts of liabilities

to be recorded upon future completion of studies, litigation or settlements, and neither the timing nor the amount

of the ultimate costs associated with environmental matters can be determined, they could be material to our

consolidated results of operations or operating cash flows in the periods recognized or paid. However,

considering our past experience and existing reserves, we do not expect that environmental matters will have a

material adverse effect on our consolidated financial position.

See Note 21 to the financial statements for a discussion of our commitments and contingencies, including

those related to environmental matters and toxic tort litigation.

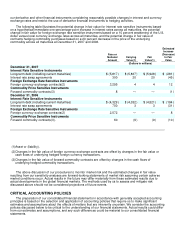

Financial Instruments

As a result of our global operating and financing activities, we are exposed to market risks from changes in

interest and foreign currency exchange rates and commodity prices, which may adversely affect our operating

results and financial position. We minimize our risks from interest and foreign currency exchange rate and

commodity price fluctuations through our normal operating and financing activities and, when deemed

appropriate, through the use of derivative financial instruments. We do not use derivative financial instruments for

trading or other speculative purposes and do not use leveraged derivative financial instruments. A summary of

our accounting policies for derivative financial instruments is included in Note 1 to the financial statements.

We conduct our business on a multinational basis in a wide variety of foreign currencies. Our exposure to

market risk from changes in foreign currency exchange rates arises from international financing activities

between subsidiaries, foreign currency denominated monetary assets and liabilities and anticipated transactions

arising from international trade. Our objective is to preserve the economic value of non-functional currency cash

flows. We attempt to hedge transaction exposures with natural offsets to the fullest extent possible and, once

these opportunities have been exhausted, through foreign currency forward and option agreements with third

parties. Our principal currency exposures relate to the U.S. dollar, Euro, British pound, Canadian dollar, Hong

Kong dollar, Mexican peso, Swiss franc, Czech koruna, Chinese renminbi and Japanese yen.

Our exposure to market risk from changes in interest rates relates primarily to our net debt and pension

obligations. As described in Notes 14 and 16 to the financial statements, we issue both fixed and variable rate

debt and use interest rate swaps to manage our exposure to interest rate movements and reduce overall

borrowing costs.

Financial instruments, including derivatives, expose us to counterparty credit risk for nonperformance and to

market risk related to changes in interest or currency exchange rates. We manage our exposure to counterparty

credit risk through specific minimum credit standards, diversification of counterparties, and procedures to monitor

concentrations of credit risk. Our counterparties are substantial investment and commercial banks with significant

experience using such derivative instruments. We monitor the impact of market risk on the fair value and

expected future cash flows of

39