Honeywell 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181

|

|

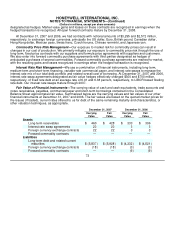

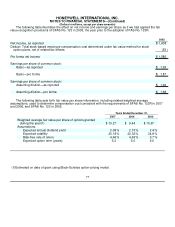

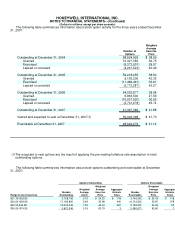

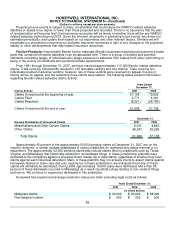

41,397,369 5.73 41.88 $ 822 28,624,279 41.14 $ 592

(1) Average remaining contractual life in years.

There were 37,902,956 and 42,416,585 options exercisable at weighted average exercise prices of $40.16

and $40.01 at December 31, 2006 and 2005, respectively. There were 38,279,009 shares available for future

grants under the terms of our stock option plans at December 31, 2007.

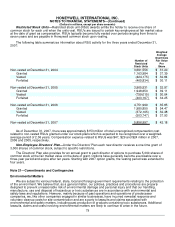

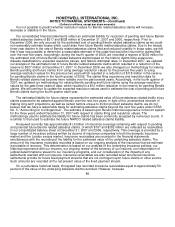

The total intrinsic value of options (which is the amount by which the stock price exceeded the exercise price

of the options on the date of exercise) exercised during 2007 and 2006 was $281 and $92 million, respectively.

During 2007 and 2006, the amount of cash received from the exercise of stock options was $592 and $385

million, respectively, with an associated tax benefit realized of $101 and $31 million, respectively. Consistent with

the requirements of SFAS No. 123R, in 2007 and 2006 we classified $86 and $31 million, respectively, of this

benefit as a financing cash inflow in the Consolidated Statement of Cash Flows, and the balance was classified

as cash from operations.

At December 31, 2007, there was $73 million of total unrecognized compensation cost related to non-vested

stock option awards which is expected to be recognized over a weighted-average period of 2.18 years. The total

fair value of options vested during 2007 and 2006 was $83 and $70 million, respectively.

78