Honeywell 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(principally to aircraft operators). The United States Government is also a major customer for our defense and

space products.

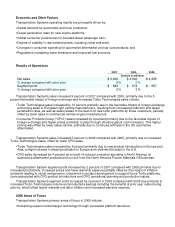

Economic and Other Factors

Aerospace operating results are principally driven by:

•

Global demand for air travel as reflected in new aircraft production, as well as the demand for spare parts

and maintenance and repair services for aircraft currently in use;

•

Aircraft production by commercial air transport, regional jet, business and general aviation OE

manufacturers, as well as global flying hours and airline profitability; and

•

Level and mix of U.S. Government appropriations for defense and space programs and military activity; and

•

Availability and price volatility of raw materials such as titanium and other metals.

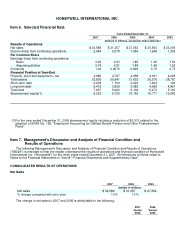

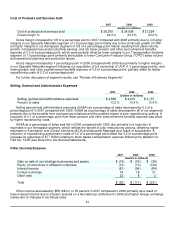

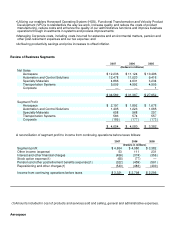

Results of Operations

2007 2006 2005

(Dollars in millions)

Net sales $ 12,236 $ 11,124 $ 10,496

% change compared with prior year 10% 6%

Segment profit $ 2,197 $ 1,892 $ 1,676

% change compared with prior year 16% 13%

Aerospace sales by major customer end-markets were as follows:

Customer End-Markets

% of Aerospace

Sales % Change in

Sales

2007 2006 2005

2007

Versus

2006

2006

Versus

2005

Commercial:

Air transport and regional original equipment 16% 16% 15% 10% 14%

Air transport and regional aftermarket 22 22 23 8 4

Business and general aviation original equipment 11 12 11 16 16

Business and general aviation aftermarket 10 10 10 16 1

Defense and Space 41 40 41 8 3

Total 100% 100% 100% 10% 6%

Aerospace sales increased by 10 percent and 6 percent in 2007 and 2006, respectively. Details regarding

the net increase in sales by customer end-markets for both 2007 and 2006 are as follows:

• Air transport and regional original equipment (OE) sales increased by 10 percent in 2007 and 14 percent in

2006 driven by increased deliveries to air transport customers primarily due to higher aircraft production

rates at major OE manufacturers.

•

Air transport and regional aftermarket sales increased by 8 percent in 2007 and 4 percent in 2006. The 2007

increase was a result of increased sales volume and price of spare parts and maintenance activity relating

to the approximately 6 percent increase in global flying hours. The 2006 increase over 2005 was a result of

increased sales of spare parts and maintenance activity relating to a more than 5 percent increase in global

flying hours which more than offset the anticipated decline in the sales of upgrades and retrofits of avionics

equipment to meet certain mandated regulatory standards.

•

Business and general aviation OE sales increased by 16 percent in both 2007 and 2006 due to continued

demand in the business jet end market as evidenced by an increase in new business jet deliveries, as well

as the launch of new aircraft platforms in 2007 and high demand in the fractional ownership market in 2006.

In both 2007 and 2006, sales to this end-market primarily

25