Honeywell 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

subordinated interest in the pool of receivables representing that over-collateralization as well as an undivided

interest in the balance of the receivables pools. New receivables are sold under the agreement as previously sold

receivables are collected. The retained interests in the receivables are reflected at the amounts expected to be

collected by us, and such carrying value approximates the fair value of our retained interests. The sold

receivables were $500 million at both December 31, 2007 and 2006.

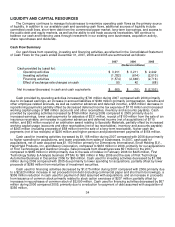

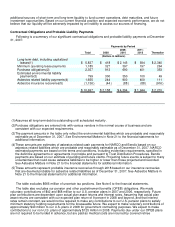

In addition to our normal operating cash requirements, our principal future cash requirements will be to fund

capital expenditures, debt repayments, dividends, employee benefit obligations, environmental remediation

costs, asbestos claims, severance and exit costs related to repositioning actions, share repurchases and any

strategic acquisitions.

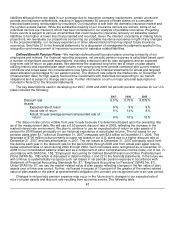

Specifically, we expect our primary cash requirements in 2008 to be as follows:

• Capital expenditures—we expect to spend approximately $900 million for capital expenditures in 2008

primarily for growth, replacement, production capacity expansion, cost reduction and maintenance.

•

Debt repayments—there are $418 million of scheduled long-term debt maturities in 2008. We expect to

refinance substantially all of these maturities in the debt capital markets during 2008.

•

Share repurchases—We intend to continue to repurchase outstanding shares from time to time in the open

market principally using cash generated from operations. Under the Company's previously announced $3.0

billion share repurchase program, $2.7 billion remained available as of December 31, 2007 for additional

share repurchases. The amount and timing of repurchases may vary depending on market conditions and

the level of other investing activities.

•

Dividends—we expect to pay approximately $800 million in dividends on our common stock in 2008,

reflecting the 10 percent increase in the dividend rate announced by Honeywell's Board of Directors in

December 2007.

•

Asbestos claims—we expect our cash spending for asbestos claims and our cash receipts for related

insurance recoveries to be approximately $244 and $44 million, respectively, in 2008. See Asbestos Matters

in Note 21 to the financial statements for further discussion.

•

Pension contributions—assuming that actual pension plan returns are consistent with our expected rate of

return of 9 percent in 2008 and beyond and that interest rates remain constant, we would not be required to

make any contributions to our U.S. pension plans to satisfy minimum statutory funding requirements for the

foreseeable future. However, we expect to make voluntary contributions of approximately $40 million to our

U.S. pension plans in 2008 for government contracting purposes. We also expect to make contributions to

our non-U.S. plans of approximately $125 million in 2008. See Note 22 to the financial statements for further

discussion of pension contributions.

•

Repositioning actions—we expect that cash spending for severance and other exit costs necessary to

execute the remaining repositioning actions will approximate $150 million in 2008.

•

Environmental remediation costs—we expect to spend approximately $300 million in 2008 for remedial

response and voluntary clean-up costs. See Environmental Matters in Note 21 to the financial statements

for additional information.

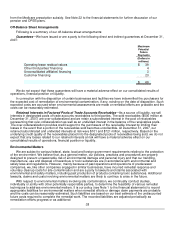

We continuously assess the relative strength of each business in our portfolio as to strategic fit, market

position, profit and cash flow contribution in order to upgrade our combined portfolio and identify business units

that will most benefit from increased investment. We identify acquisition candidates that will further our strategic

plan and strengthen our existing core businesses. We also identify businesses that do not fit into our long-term

strategic plan based on their market position, relative profitability or growth potential. These businesses are

considered for potential divestiture, restructuring or other repositioning actions subject to regulatory constraints.

In 2007, we realized $51 million in cash proceeds from sales of non-strategic businesses.

Based on past performance and current expectations, we believe that our operating cash flows will be

sufficient to meet our future cash needs. Our available cash, committed credit lines, access to the public debt and

equity markets as well as our ability to sell trade accounts receivables, provide

36