Honeywell 2007 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181

|

|

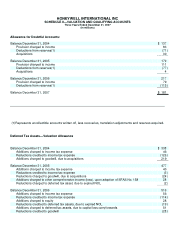

HONEYWELL INTERNATIONAL INC

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

Three Years Ended December 31, 2007

(In millions)

Allowance for Doubtful Accounts:

Balance December 31, 2004 $ 137

Provision charged to income 83

Deductions from reserves(1) (71)

Acquisitions 30

Balance December 31, 2005 179

Provision charged to income 111

Deductions from reserves(1) (77)

Acquisitions 4

Balance December 31, 2006 217

Provision charged to income 79

Deductions from reserves(1) (115)

Balance December 31, 2007 $ 181

(1) Represents uncollectible accounts written off, less recoveries, translation adjustments and reserves acquired.

Deferred Tax Assets—Valuation Allowance

Balance December 31, 2004 $ 338

Additions charged to income tax expense 46

Reductions credited to income tax expense (126)

Additions charged to goodwill, due to acquisitions 219

Balance December 31, 2005 477

Additions charged to income tax expense 40

Reductions credited to income tax expense (3)

Reductions charged to goodwill, due to acquisitions (24)

Additions charged to other comprehensive income (loss), upon adoption of SFAS No. 158 28

Reductions charged to deferred tax asset, due to expired NOL (2)

Balance December 31, 2006 516

Additions charged to income tax expense 56

Reductions credited to income tax expense (114)

Additions charged to equity 28

Reductions credited to deferred tax assets, due to expired NOL (19)

Additions charged to deferred tax assets, due to capital loss carryforwards 51

Reductions credited to goodwill (28)