Honeywell 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

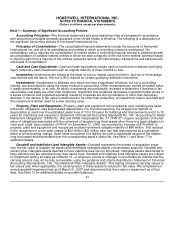

This reduction was recorded as a cumulative effect adjustment to shareowners' equity. Additionally, we

decreased a deferred tax asset and its associated valuation allowance by $44 million and increased goodwill by

$1 million. See Note 6 for additional FIN 48 information and disclosure.

In May 2007, the FASB issued FASB Staff Position ("FSP") FIN 48-1 "Definition of Settlement in FASB

Interpretation No. 48" (FSP FIN 48-1). FSP FIN 48-1 provides guidance on how to determine whether a tax

position is effectively settled for the purpose of recognizing previously unrecognized tax benefits. FSP FIN 48-1 is

effective retroactively to January 1, 2007. The implementation of this standard did not have a material impact on

our consolidated financial position or results of operations.

In September 2006, the FASB issued FSP AUG AIR-1 "Accounting for Planned Major Maintenance

Activities" (FSP AUG AIR-1). FSP AUG AIR-1 amends the guidance on the accounting for planned major

maintenance activities; specifically it precludes the use of the previously acceptable "accrue in advance" method.

FSP AUG AIR-1 is effective for fiscal years beginning after December 15, 2006. The implementation of this

standard did not have a material impact on our consolidated financial position or results of operations.

In September 2006, the FASB issued Statement of Financial Accounting Standard ("SFAS") No. 157, "Fair

Value Measurements" (SFAS No. 157). SFAS No. 157 establishes a common definition for fair value to be

applied to US GAAP requiring use of fair value, establishes a framework for measuring fair value, and expands

disclosure about such fair value measurements. SFAS No. 157 is effective for fiscal years beginning after

November 15, 2007.

In February 2008, the FASB issued FSP 157-2 "Partial Deferral of the Effective Date of Statement 157" (FSP

157-2). FSP 157-2 delays the effective date of SFAS No. 157, for all nonfinancial assets and nonfinancial

liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring

basis (at least annually) to fiscal years beginning after November 15, 2008. The Company is currently assessing

the impact of SFAS No. 157 for nonfinancial assets and nonfinancial liabilities on its consolidated financial

position and results of operations. The implementation of this standard, for financial assets and financial

liabilities, will not have a material impact on our consolidated financial position and results of operations.

In February 2007, the FASB issued SFAS No. 159 "The Fair Value Option for Financial Assets and Financial

Liabilities" (SFAS No. 159). SFAS No. 159 permits entities to choose to measure many financial assets and

financial liabilities at fair value. Unrealized gains and losses on items for which the fair value option has been

elected are reported in earnings. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007.

The implementation of this standard will not have a material impact on our consolidated financial position and

results of operations.

In March 2007, the FASB ratified Emerging Issues Task Force ("EITF") Issue No. 06-10 "Accounting for

Collateral Assignment Split-Dollar Life Insurance Agreements" (EITF 06-10). EITF 06-10 provides guidance for

determining a liability for postretirement benefit obligations as well as recognition and measurement of the

associated asset on the basis of the terms of the collateral assignment agreement. EITF 06-10 is effective for

fiscal years beginning after December 15, 2007. The implementation of this standard will not have a material

impact on our consolidated financial position and results of operations.

In June 2007, the FASB ratified EITF 06-11 "Accounting for the Income Tax Benefits of Dividends on Share-

Based Payment Awards" (EITF 06-11). EITF 06-11 provides that tax benefits associated with dividends on share-

based payment awards be recorded as a component of additional paid-in capital. EITF 06-11 is effective, on a

prospective basis, for fiscal years beginning after December 15, 2007. The implementation of this standard will

not have a material impact on our consolidated financial position and results of operations.

In December 2007, the FASB issued SFAS No. 141(revised 2007), "Business Combinations" (SFAS No.

141R). SFAS No. 141R provides revised guidance on how acquirers recognize and

56