Honeywell 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

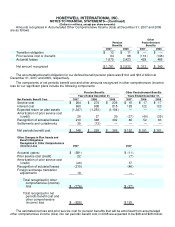

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

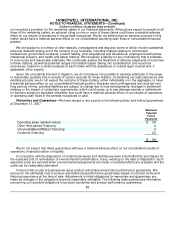

It is not possible to predict whether resolution values for Bendix related asbestos claims will increase,

decrease or stabilize in the future.

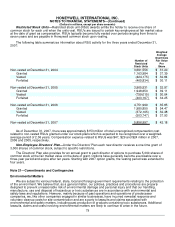

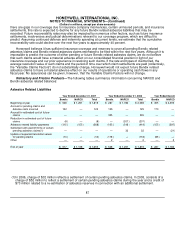

Our consolidated financial statements reflect an estimated liability for resolution of pending and future Bendix

related asbestos claims of $517 and $528 million at December 31, 2007 and 2006, respectively. Prior to

December 2006, we only accrued for the estimated cost of pending Bendix related asbestos claims as we could

not reasonably estimate losses which could arise from future Bendix related asbestos claims. Due to the steady

three-year decline in the rate of Bendix related asbestos claims filed and reduced volatility in those rates, we felt

that it was now possible to determine a reasonable estimate of the costs that would be incurred for claims filed

over the next five years. Accordingly, during the fourth quarter of 2006, we recorded a reserve of $335 million for

the estimated cost of future Bendix related asbestos claims based on the historic claims filing experience,

disease classifications, expected resolution values, and historic dismissal rates. In December 2007, we updated

our analysis of the estimated cost of future Bendix related asbestos claims which resulted in a reduction of the

reserve to $327 million at December 31, 2007. In December 2006, we also changed our methodology for valuing

Bendix pending and future claims from using average resolution values for the previous five years to using

average resolution values for the previous two years which resulted in a reduction of $118 million in the reserve

for pending Bendix claims in the fourth quarter of 2006. The claims filing experience and resolution data for

Bendix related claims has become more reliable over the past several years. Accordingly, in the fourth quarter of

2007, we updated our methodology for valuing Bendix pending and future claims using the average resolution

values for the past three years of data, which resulted in a $10 million reduction in the reserve for pending Bendix

claims. We will continue to update the expected resolution values used to estimate the cost of pending and future

Bendix claims during the fourth quarter each year.

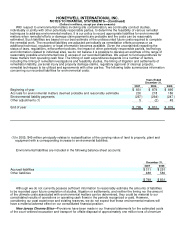

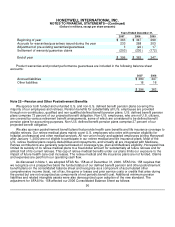

The estimated liability for future claims represents the estimated value of future asbestos related bodily injury

claims expected to be asserted against Bendix over the next five years. In light of the uncertainties inherent in

making long-term projections, as well as certain factors unique to friction product asbestos claims, we do not

believe that we have a reasonable basis for estimating asbestos claims beyond the next five years under SFAS

No. 5, "Accounting for Contingencies". The estimate is based upon Bendix historical experience in the tort system

for the three years ended December 31, 2007 with respect to claims filing and resolution values. The

methodology used to estimate the liability for future claims has been commonly accepted by numerous courts. It

is similar to that used to estimate the future NARCO related asbestos claims liability.

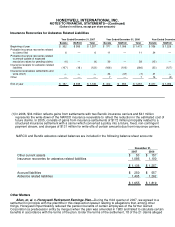

Honeywell currently has approximately $1.9 billion of insurance coverage remaining with respect to pending

and potential future Bendix related asbestos claims, of which $197 and $302 million are reflected as receivables

in our consolidated balance sheet at December 31, 2007 and 2006, respectively. This coverage is provided by a

large number of insurance policies written by dozens of insurance companies in both the domestic insurance

market and the London excess market. Insurance receivables are recorded in the financial statements

simultaneous with the recording of the liability for the estimated value of the underlying asbestos claims. The

amount of the insurance receivable recorded is based on our ongoing analysis of the insurance that we estimate

is probable of recovery. This determination is based on our analysis of the underlying insurance policies, our

historical experience with our insurers, our ongoing review of the solvency of our insurers, our interpretation of

judicial determinations relevant to our insurance programs, and our consideration of the impacts of any

settlements reached with our insurers. Insurance receivables are also recorded when structured insurance

settlements provide for future fixed payment streams that are not contingent upon future claims or other events.

Such amounts are recorded at the net present value of the fixed payment stream.

On a cumulative historical basis, Honeywell has recorded insurance receivables equal to approximately 50

percent of the value of the underlying asbestos claims recorded. However, because

86