Honeywell 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

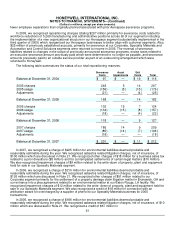

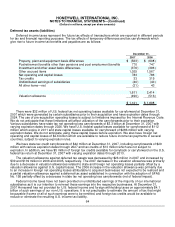

Note 3—Repositioning and Other Charges

A summary of repositioning and other charges follows:

Years Ended December 31,

2007 2006 2005

Severance $ 186 $ 102 $ 248

Asset impairments. 14 15 5

Exit costs 9 7 14

Reserve adjustments (18) (22) (25)

Total net repositioning charge. 191 102 242

Asbestos related litigation charges, net of insurance 100 126 10

Probable and reasonably estimable environmental liabilities. 225 210 186

Business impairment charges 9 12 23

Arbitration award related to phenol supply agreement — (18) (67)

Other 18 51 18

Total net repositioning and other charges. $ 543 $ 483 $ 412

The following table summarizes the pretax distribution of total net repositioning and other charges by income

statement classification.

Years Ended December 31,

2007 2006 2005

Cost of products and services sold $ 495 $ 472 $ 357

Selling, general and administrative expenses 48 11 43

Other (income) expense — — 12

$ 543 $ 483 $ 412

The following table summarizes the pretax impact of total net repositioning and other charges by segment.

Years Ended December 31,

2007 2006 2005

Aerospace $ 37 $ 10 $ 96

Automation and Control Solutions 127 39 85

Specialty Materials 14 5 (34)

Transportation Systems 119 293 82

Corporate 246 136 183

$ 543 $ 483 $ 412

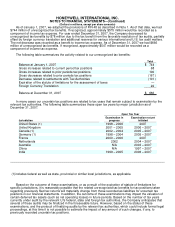

In 2007, we recognized repositioning charges totaling $209 million primarily for severance costs related to

workforce reductions of 3,408 manufacturing and administrative positions mainly in our Automation and Control

Solutions and Aerospace segments. Also, $18 million of previously established accruals, primarily for severance

at our Transportation Systems and Aerospace segments, were returned to income in 2007 due mainly to

changes in the scope of previously announced severance programs and due to fewer employee separations than

originally planned associated with prior severance programs.

In 2006, we recognized repositioning charges totaling $124 million primarily for severance costs related to

workforce reductions of 2,253 manufacturing and administrative positions across all of our segments. Also, $22

million of previously established accruals, primarily for severance at our Aerospace, Transportation Systems and

Specialty Materials segments were returned to income in 2006 due mainly to changes in the scope of previously

announced severance programs and due to