HTC 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

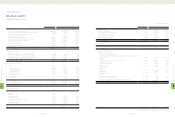

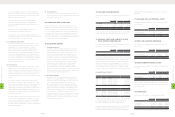

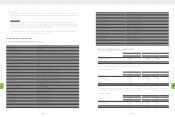

As of December 31, 2011, the Company had bought back 100 thousand shares for NT$49,710 thousand (US$1,642 thousand). Other treasury stock

information for 2010 and 2011 were as follows:

(In Thousands of Shares)

Purpose of Treasury Stock Number of Shares,

Beginning of Year

Addition

During the Year

Reduction

During the Year

Number of Shares,

End of Year

Year ended December 31, 2010

To maintain the Company's credibility and stockholders' interest - 15,000 15,000 -

For transferring shares to the Company's employees - 9,786 - 9,786

- 24,786 15,000 9,786

Year ended December 31, 2011

To maintain the Company's credibility and stockholders' interest - 10,000 10,000 -

For transferring shares to the Company's employees 9,786 10,100 5,875 14,011

9,786 20,100 15,875 14,011

8.

Based on the Securities and Exchange Act of the ROC, the number of reacquired shares should not exceed 10% of the Company's issued and

outstanding shares, and the total purchase amount should not exceed the sum of the retained earnings, additional paid-in capital in excess of

par, and paid-in capital reserve. In addition, the Company should not pledge its treasury shares nor exercise voting rights.

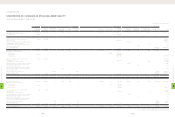

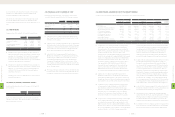

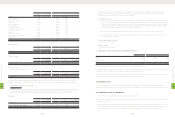

(21) PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

2010 2011

NT$ NT$ US$ (Note 3)

Function

Expense Item

Operating

Costs

Operating

Expenses Total Operating

Costs

Operating

Expenses Total Operating

Costs

Operating

Expenses Total

Personnel expenses $4,599,227 $12,688,670 $17,287,897 $5,280,875 $13,366,157 $18,647,032 $174,407 $441,433 $615,840

Salary 3,995,447 12,103,004 16,098,451 4,265,616 12,511,284 16,776,900 140,877 413,200 554,077

Insurance 204,932 212,854 417,786 366,969 305,644 672,613 12,120 10,094 22,214

Pension cost 80,857 141,877 222,734 156,967 197,607 354,574 5,184 6,526 11,710

Other 317,991 230,935 548,926 491,323 351,622 842,945 16,226 11,613 27,839

Depreciation 299,285 322,728 622,013 504,199 424,575 928,774 16,652 14,022 30,674

Amortization 34,987 23,634 58,621 387,103 9,919 397,022 12,784 328 13,112

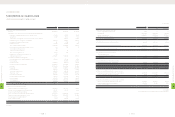

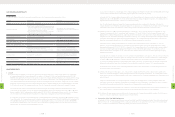

(22) INCOME TAX

The Company's income tax returns through 2008 had been examined by the tax authorities. However, the Company disagreed with the tax

authorities' assessment on its return for 2002 and applied for the administrative litigation of this return. Nevertheless, under the conservatism

guideline, the Company adjusted its income tax for the tax shortfall stated in the tax assessment notices.

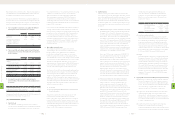

Under the Statute for Upgrading Industries, the Company was granted exemption from corporate income tax as follows:

Item Exempt from Corporate Income Tax Exemption Period

Sales of pocket PCs (wireless) and smartphones 2005.12.20-2010.12.19

Sales of wireless or smartphone which has 3G or GPS function 2006.12.20-2011.12.19

Sales of wireless or smartphone which has 3G or GPS function 2007.12.20-2012.12.19

Sales of wireless or smartphone which has 3.5G function 2010.01.01-2014.12.31

Sales of wireless or smartphone which has 3.5G function (application for exemption under review by the Ministry of Finance

as of December 31, 2011) 2012.01.01-2016.12.31

efficiency and meet its capital expenditure budget and

financial goals in determining the stock or cash dividends

to be paid. The Company's dividend policy stipulates that

at least 50% of total dividends may be distributed as cash

dividends.

(4) The bonus to employees of NT$4,859,236 thousand for

2009 was approved in the stockholders' meeting in June

2010. The bonus to employees consisted of a cash bonus of

NT$2,915,542 thousand and a share bonus of NT$1,943,694

thousand. The share number of 5,021 thousand was

determined by dividing the amount of share bonus by the

closing price (after considering the effect of cash and stock

dividends) of the shares of the day immediately preceding

the stockholders' meeting. The approved amounts of the

bonus to employees were the same as the accrued amounts.

(5) The bonus to employees of NT$8,491,704 thousand for

2010 was approved in the stockholders' meeting in June

2011. The bonus to employees consisted of a cash bonus of

NT$4,245,852 thousand and a share bonus of NT$4,245,852

thousand (the amounts were NT$4,245,853 thousand and

NT$4,245,851 thousand, respectively, after taking into

account the effect that the amount less than one share will

be distributed in the form of cash). The share number of

4,006 thousand was determined by dividing the amount

of share bonus by the closing price (after considering the

effect of cash and stock dividends) of the shares of the day

immediately preceding the stockholders' meeting. The

approved amounts of the bonus to employees were the same

as the accrued amounts.

(6) Based on the resolutions passed by the Company's board of

directors, the employee bonuses for 2010 and 2011 should

be appropriated at 18% and 10%, respectively, of net income

before deducting employee bonus expenses. If the actual

amounts subsequently resolved by the stockholders differ

from the proposed amounts, the differences are recorded in

the year of stockholders' resolution as a change in accounting

estimate. If bonus shares are resolved to be distributed to

employees, the number of shares is determined by dividing

the amount of bonus by the closing price (after considering

the effect of cash and stock dividends) of the shares of the

day immediately preceding the stockholders' meeting.

As of February 14, 2012, the date of the accompanying

independent auditors' report, the appropriation of the 2011

earnings had not been proposed by the Board of Directors.

Information on earnings appropriation can be accessed on

the Market Observation Post System website.

(20) TREASURY STOCK

1.

On February 9, 2010, the Company's board of directors passed a

resolution to buy back 15,000 thousand of its shares from the open

market. The repurchase period was between February 10, 2010

and April 9, 2010, and the repurchase price ranged from NT$280 to

NT$500 per share. If the Company's share price was lower than this

price range, the Company planned to continue to buy back its shares.

The Company bought back 15,000 thousand shares for NT$4,834,174

thousand during the repurchase period and retired them in April 2010.

2.

On July 11, 2010, the Company's board of directors passed a

resolution to buy back 10,000 thousand of its shares from the

open market. The repurchase period was between July 13, 2010

and September 12, 2010, and the repurchase price ranged from

NT$526 to NT$631 per share. If the Company's share price was

lower than this price range, the Company planned to continue to

buy back its shares. The Company bought back 4,786 thousand

shares for NT$2,865,990 thousand during the repurchase period.

3.

On October 29, 2010, the Company's board of directors passed

a resolution to buy back 5,000 thousand and 5,000 thousand of

its shares from the open market between November 1, 2010 and

November 30, 2010, and between December 1, 2010 and December

31, 2010, respectively, with the repurchase price ranging from

NT$565 to NT$850 per share. If the Company's share price was

lower than this price range, the Company planned to continue to buy

back its shares. The Company bought back 5,000 thousand shares

for NT$3,986,503 thousand during these repurchase periods.

4.

In June 2011, the Company resolved to transfer 6,000 thousand

treasury shares to employees; the number of shares actually

transferred was 5,875 thousand.

5.

The Company resolved to transfer 6,000 thousand treasury

stocks to employees in June 2011, and the number of shares

actually transferred was 5,875 thousand.

6.

On July 16, 2011, the Company's board of directors passed a

resolution to buy back 10,000 thousand and 10,000 thousand of

its shares from the open market between July 18, 2011 and August

17, 2011, and between August 18, 2011 and September 17, 2011,

respectively, with the repurchase price ranging from NT$900

(US$30) to NT$1,100 (US$36) per share. If the Company's share

price was lower than this price range, the Company planned

to continue to buy back its shares. The Company bought

back 20,000 thousand shares for NT$16,086,098 thousand

(US$531,262 thousand) during the repurchase period and retired

10,000 thousand shares in December 2011.

7.

On December 20, 2011, the Company's board of directors passed a

resolution to buy back 10,000 thousand of its shares from the open

market between December 20, 2011 and February 19, 2012, with the

repurchase price ranged from NT$445 (US$15) to NT$650 (US$21)

per share. If the Company's share price becomes lower than this

price range, the Company planned to continue to buy back its shares.

8

FINANCIAL INFORMATION

| 164 |

8

FINANCIAL INFORMATION

| 165 |