HTC 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

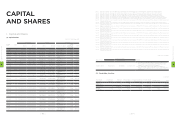

4. Global depository receipts

2012.03.31

Issue Date 2003.11.19

Issuance and Listing Luxembourg

Total amount USD 105,182,100.60

Offering price per GDR USD 15.4235

Units issued 9,015,121 units (note)

Underlying securities Cash offering and common shares from selling shareholders

Common shares represented 36,060,497 shares (note)

Rights and obligations of GDR holders Same as that of common share holders

Trustee Not applicable

Depositary bank Citibank, N.A.–New York

Custodian bank Citibank Taiwan Limited

GDRS outstanding 2,306,210 units

Apportionment of expenses for issuance and maintenance

All fees and expenses such as underwriting fees, legal fees, listing fees

and other expenses related to issuance of GDRS were borne by HTC

and the selling shareholders, while maintenance expenses such as

annual listing fees and accounting fees were borne by HTC.

Terms and conditions in the deposit agreement and custody agreement See deposit agreement and custody agreement for details

Closing price per GDR

2011

High USD 172.67

Low USD 50.00

Average USD 117.83

2012.01.01~

2012.03.31

High USD 89.90

Low USD 59.86

Average USD 75.66

Note: The total number of units issued includes the 6,819,600 units originally issued (representing 27,278,400 shares of common stock) plus additional units issued in stock dividends in

past years on common shares underlying the overseas depositary receipts, as itemized below.

18 August 2004: dividends issued on common shares underlying the overseas depositary receipts in the amount of 216,088 additional units (representing 864,352 common shares)

12 August 2005: dividends issued on common shares underlying the overseas depositary receipts in the amount of 70,290 additional units (representing 281,161 common shares)

1 August 2006: dividends issued on common shares underlying the overseas depositary receipts in the amount of 218,776 additional units (representing 875,107 common shares)

20 August 2007: dividends issued on common shares underlying the overseas depositary receipts in the amount of 508,556 additional units (representing 2,034,224 common shares)

21 July 2008: dividends issued on common shares underlying the overseas depositary receipts in the amount of 488,656 additional units (representing 1,954,626 common shares)

9 August 2009: dividends issued on common shares underlying the overseas depositary receipts in the amount of 170,996 additional units (representing 683,985 common shares)

3 August 2010: dividends issued on common shares underlying the overseas depositary receipts in the amount of 311,805 additional units (representing 1,247,223 common shares)

26 July 2011: dividends issued on common shares underlying the overseas depositary receipts in the amount of 210,354 additional units (representing 841,419 common shares)

5. Employee share warrants

1. During the current fiscal year up to the date of printing of this annual report, HTC has not issued any employee share

warrants.

2. During the current fiscal year up to the date of printing of this annual report, HTC does not have unexpired employee share

warrants outstanding.

6. Issuance of new shares for mergers and acquisitions

1. During the current fiscal year up to the date of printing of this annual report, the Company has not issued new shares for

mergers and acquisitions.

2. During the current fiscal year up to the date of printing of this annual report, the Board of Directors has not adopted any

resolution to issue new shares for mergers and acquisitions.

7. Implementation of the Company's funds utilization plan

The Company does not have unfinished funds utilization plans or plans that have not produced the desired benefits during the

fiscal year up to the date of printing of this annual report.

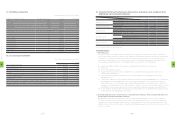

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 12/20/2011

Purpose of the share buy-back

To transfer stocks to employees. According to the Regulations Governing

Share Repurchase by Listed and OTC Companies, Article 2 requires to

buy back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 6,500,000,000

Buy-back period 12/20/2011~02/19/2012

Estimated number of buy-back shares

(as percentage of total outstanding shares) (Note 1)

10,000,000 shares

(1.16%)

Estimated buy-back price interval

Buy-back stock price is between NTD 445 to NTD 650. It is further

resolved by the Board of Directors to continue buy-back of shares if the

stock price falls under NTD 445.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 12/30/2011~02/17/2012

Number of buy-back shares

(as a percentage of total shares outstanding) (Note 2)

6,914,000 shares

(0.81%)

Total amount for buy-back shares NTD 3,750,055,902

Average price per buy-back share NTD 542.39

Number of shares cancelled or transferred 0 share

Cumulative number of own shares held 20,825,045 shares

Ratio of cumulative number of own shares held during the repurchase

period to the total number of the Company's issued shares 2.44%

(Concluded)

Note 1: The percentage is calculated based on the total outstanding shares when the Company reported share repurchase.

Note 2: The percentage is calculated based on the total outstanding shares when the Company reported expiration of repurchase period or

completion of the repurchase.

Note 3: The repurchase purpose was approved by the Board of Directors for the amendment of repurchase purpose on Oct. 28, 2011, and such

amendment was also approved by Financial Surpervisory Commission.

2. Issuance of corporate bonds

None

3. Status of Preferred shares

None

5

CAPITAL AND SHARES

| 102 |

5

CAPITAL AND SHARES

| 103 |