HTC 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12.

In 2011, the Company invested US$3,300 thousand (NT$99,921 thousand) in TransLink Capital Partners II, L.P.

13.

In May 2011, the Company acquired 17.70% equity interest in Shanghai F-road Commercial Co., Ltd. for US$5,500 thousand (NT$166,555

thousand).

14.

In 2011, the Company invested US$14,141 thousand (NT$428,179 thousand) in Primavera Capital (Cayman) Fund L.L.P.

15.

These unquoted equity instruments were not carried at fair value because their fair value could not be reliably measured; thus, the Company

accounted for these investments by the cost method.

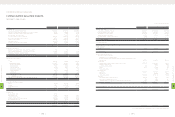

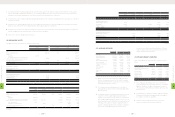

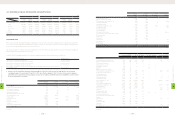

(14) INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD

The investment accounted for by the equity method as of December 31, 2010 and 2011 was as follows:

2010 2011

Carrying Value Ownership

Percentage Original Cost Carrying Value Ownership

Percentage

NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Vitamin D Inc. $- $- $- $- $- $-

SYNCTV Corporation - 76,214 2,500 71,732 2,369 20

$- $76,214 $2,500 $71,732 $2,369

1.

In April 2008, the Company made a bond investment of US$350 thousand and transferred its bond investment of US$1,000 thousand to

convertible preferred stocks issued by Vitamin D Inc. As a result, the Company acquired 27.27% equity interest in Vitamin D Inc. for NT$40,986

thousand, enabling the Company to exercise significant influence over this investee. Thus, the Company accounted for this investment by the

equity method. After that, the Company's ownership percentage declined from 27.27% to 25.59%, and there was a capital surplus - long-term

equity investments of NT$1,689 thousand in 2008 and NT$671 thousand in 2009. In addition, the Company determined that the recoverable

amount of this investment in 2009 was less than its carrying amount and thus recognized an impairment loss of NT$30,944 thousand. Vitamin

D was dissolved in August 2010.

2.

In September 2011, the Company acquired 20% equity interest in SYNCTV Corporation for US$2,500 thousand and accounts has since

accounted for this investment by the equity method.

3.

On its equity-method investments, the Company had a loss of NT$3,961 thousand (US$131 thousand) in 2011.

4.

The financial statements of the equity-method investees for the year ended December 31, 2011 had been examined by the Company's

independent auditors.

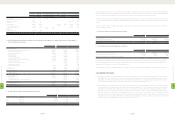

(15) PROPERTIES

Properties as of December 31, 2010 and 2011 were as follows:

2010 2011

Carrying Value Cost Accumulated

Depreciation Carrying Value

NT$ NT$ NT$ NT$ US$ (Note 3)

Land $5,862,076 $7,614,167 $- $7,614,167 $251,467

Buildings and structures 4,192,857 5,999,807 1,008,920 4,990,887 164,830

Machinery and equipment 3,034,967 11,298,070 5,390,749 5,907,321 195,096

Molding equipment - 172,632 172,632 - -

Computer equipment 163,642 765,177 411,448 353,729 11,682

Transportation equipment 4,709 7,710 3,788 3,922 130

Furniture and fixtures 69,689 368,025 201,148 166,877 5,511

Leased assets 1,398 6,730 5,811 919 30

Leasehold improvements 183,853 463,581 119,863 343,718 11,352

Prepayments for construction-in-progress and

equipment-in-transit 511,138 2,130,938 - 2,130,938 70,377

$14,024,329 $28,826,837 $7,314,359 $21,512,478 $710,475

2.

Prepayments to suppliers were primarily for discount purposes

and were classified as current or noncurrent on the basis of their

maturities. As of December 31, 2011, noncurrent prepayments

of NT$2,007,160 thousand (US$66,289 thousand) had been

classified as other assets.

3.

Prepayments for others were primarily for travel and insurance

expenses.

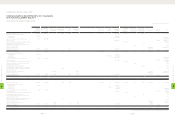

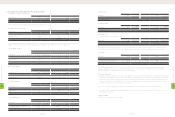

(12) HELD-TO-MATURITY FINANCIAL ASSETS

Held-to-maturity financial assets as of December 31, 2010 and 2011

were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Corporate bonds $207,946 $204,597 $6,757

In 2010, the Company bought the corporate bonds issued by Nan

Ya Plastics Corporation. These bonds will mature in 2013 and has an

effective interest rate of 0.90%.

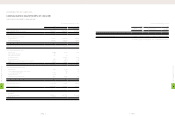

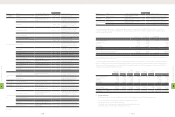

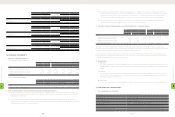

(13) FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31, 2010 and 2011

consisted of domestic unquoted stocks of the following companies:

2010 2011

NT$ NT$ US$

(Note 3)

Hua-Chuang Automobile Information

Technical Center Co., Ltd. $500,000 $500,000 $16,513

Answer Online, Inc. 1,192 1,192 39

BandRich Inc. 15,861 15,861 524

SoundHound Inc. 58,260 67,441 2,227

GSUO Inc. 145,650 242,232 8,000

Felicis Ventures II LP - 68,128 2,250

WI Harper Fund VII - 47,689 1,575

NETQIN MOBILE Inc. 72,825 75,698 2,500

Luminous Optical Technology Co., Ltd. 183,000 183,000 6,044

OnLive, Inc. - 1,211,160 40,000

KKBOX Inc. - 302,790 10,000

TransLink Capital Partners II, L.P. - 99,921 3,300

Shanghai F-road Commercial Co., Ltd. - 166,555 5,501

Primavera Capital (Cayman) Fund L.L.P. - 428,179 14,141

Prepayments for long-term

investments 48,065 - -

1,024,853 3,409,846 112,614

Less: Accumulated impairment loss (1,192) (1,192) (39)

$1,023,661 $3,408,654 $112,575

1.

In January 2007, the Company acquired 10% equity interest in

Hua-Chuang Automobile Information Technical Center Co., Ltd.

for NT$500,000 thousand.

2.

In March 2004, the Company merged with IA Style, Inc. and

acquired 1.82% equity interest in Answer Online, Inc. as a result of

the merger. In 2010, the Company determined that the recoverable

amount of this investment was less than its carrying amount and

thus recognized an impairment loss of NT$1,192 thousand.

3.

In April 2006, the Company acquired 92% equity interest in

BandRich Inc. for NT$135,000 thousand and accounted for this

investment by the equity method. After that, the Company's

ownership percentage declined from 92% to 18.08% and lost

its significant influence on this investee. When the Company's

ownership percentage changed in July 2010, the Company

transferred this investment to "financial assets carried at cost"

using book value.

4.

In 2009, the Company invested US$2,000 thousand in

SoundHound Inc. (known as Melodis Corporation until May 2010).

The Company increased this investment by US$227 thousand

in 2011. As of December 31, 2011, the Company's investment

in SoundHound Inc. had amounted to US$2,227 thousand

(NT$67,441 thousand), and the ownership percentage was 4.37%.

5.

In 2010, the Company invested US$5,000 thousand in GSUO Inc.

The Company increased this investment by US$3,000 thousand

in 2011. As of December 31, 2011, the Company's investment in

GSUO Inc. had amounted to US$8,000 thousand (NT$242,232

thousand), and the ownership percentage was 16.61%.

6.

In 2010, the Company invested US$750 thousand in Felicis

Ventures II LP But because the registration of this investment

had not been completed as of December 31, 2010, an amount

of US$750 (NT$23,220 thousand) was temporarily accounted

for under "prepayments for long-term investments." When the

registration was completed in 2011, this investment was transferred

to financial assets carried at cost. The Company increased this

investment by US$1,500 thousand in 2011. As of December 31,

2011, the Company's investment in Felicis Ventures II LP had

amounted to US$2,250 thousand (NT$68,128 thousand).

7.

In 2010, the Company invested US$900 thousand in WI Harper

Fund VII. Because the registration of this investment had not

been completed as of December 31, 2010, an amount of US$900

(NT$28,134 thousand) was temporarily accounted for under

"prepayments for long-term investments." When the registration

was completed in 2011, this investment was transferred to

financial assets carried at cost. The Company increased this

investment by US$675 thousand in 2011. As of December 31,

2011, the Company's investment had amounted to US$1,575

thousand (NT$47,689 thousand).

8.

In December 2010, the Company acquired 1.60% equity interest

in NETQIN MOBILE Inc. for US$2,500 thousand.

9.

In December 2010, the Company acquired 10.02% equity interest

in Luminous Optical Technology Co., Ltd. for NT$183,000

thousand.

10.

In February 2011, the Company acquired 3.79% equity interest in

OnLive, Inc. for US$40,000 thousand (NT$1,211,160 thousand).

11.

In March 2011, the Company acquired 11.11% equity interest in

KKBOX Inc. for US$10,000 thousand (NT$302,790 thousand).

8

FINANCIAL INFORMATION

| 198 |

8

FINANCIAL INFORMATION

| 199 |