HTC 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(21) STOCKHOLDERS' EQUITY

1. Capital Stock

(1) The Company's outstanding common stock as of January

1, 2010 amounted to NT$7,889,358 thousand, divided into

788,936 thousand common shares at NT$10.00 par value. In

April 2010, the Company retired 15,000 thousand treasury

shares amounting to NT$150,000 thousand. In June 2010, the

stockholders approved the transfer of retained earnings of

NT$386,968 thousand and employee bonuses of NT$50,206

thousand to capital stock. As a result, the amount of the

Company's outstanding common stock as of December 31,

2010 increased to NT$8,176,532 thousand, divided into 817,653

thousand common shares at NT$10.00 par value.

(2) In June 2011, the stockholders approved the transfer of retained

earnings of NT$403,934 thousand (US$13,340 thousand)

and employee bonuses of NT$40,055 thousand (US$1,323

thousand) to capital stock. Also, in December 2011, the

Company retired 10,000 thousand treasury shares amounting

to NT$100,000 thousand (US$3,303 thousand). As a result,

the amount of the Company's outstanding common stock

as of December 31, 2011 increased to NT$8,520,521 thousand

(US$281,400 thousand), divided into 852,052 thousand

common shares at NT$10.00 (US$0.33) par value.

2. Global Depositary Receipts

The Company issued 14,400 thousand common shares

corresponding to 3,600 thousand units of Global Depositary

Receipts (GDRs). For this GDR issuance, the Company's

stockholders, including Via Technologies, Inc., also issued

12,878.4 thousand common shares, corresponding to 3,219.6

thousand GDR units. Thus, the entire offering consisted of 6,819.6

thousand GDR units. Each GDR represents four common shares,

and was issued, at a premium, at NT$131.1. For this common

share issuance, net of related expenses, NT$1,696,855 thousand

was accounted for as capital surplus. This share issuance for

cash was completed and registered on November 19, 2003.

The holders of these GDRs have the same rights and obligations

as the stockholders of the Company. However, the distribution

of the offering and sales of GDRs and the shares represented

thereby in certain jurisdictions may be restricted by law. In

addition, the GDRs offered and the shares represented are not

transferable, except in accordance with the restrictions described

in the GDR offering circular and related laws applied in Taiwan.

Through the depositary custodian in Taiwan, GDR holders are

entitled to exercise these rights:

a. To vote; and

b. To receive dividends and participate in new share issuance for

cash subscription.

Taking into account the effect of stock dividends, the GDRs

increased to 9,015.1 thousand units (36,060.5 thousand

shares). The holders of these GDRs requested the Company to

redeem the GDRs to get the Company's common shares. As of

December 31, 2011, there were 6,404.4 thousand units of GDRs

redeemed, representing 25,617.5 thousand common shares, and

the outstanding GDRs represented 10,443 thousand common

shares or 1.25% of the Company's common shares.

3. Capital Surplus

Under the Company Law, capital surplus can only be used to

offset a deficit. However, the capital surplus from shares issued in

excess of par (additional paid-in capital from issuance of common

shares, conversion of bonds and treasury stock transactions)

and donations may be capitalized, with capitalization limited to

a certain percentage of the Company's paid-in capital. Also, the

capital surplus from long-term investments may not be used for

any purpose.

(1) Additional paid-in capital - issuance of shares in excess of par

The additional paid-in capital was NT$9,056,323 thousand as

of January 1, 2010. In April 2010, the retirement of treasury

stock caused a decrease of NT$172,188 thousand in additional

paid-in capital. The bonus to employees of NT$4,859,236

thousand for 2009 was approved in the stockholders' meeting

in June 2010. Of the approved bonus, NT$1,943,694 thousand

was in the form of common stock, consisting of 5,021 thousand

common shares at their fair value, which were distributed

in 2010. The difference between par value and fair value of

NT$1,893,488 thousand was accounted for as additional paid-

in capital in 2010. As a result, the additional paid-in capital as

of December 31, 2010 was NT$10,777,623 thousand.

Also, in June 2011, the bonus to employees of NT$8,491,704

thousand (US$280,449 thousand) for 2010 was approved

in the stockholders' meeting. Of the approved bonus,

NT$4,245,851 thousand (US$140,224 thousand) was in

the form of common stock, consisting of 4,006 thousand

common shares at their fair value, which were distributed

in 2011. The difference between par value and fair value

of NT$4,205,796 thousand (US$138,901 thousand) was

accounted for as additional paid-in capital in 2011. In

December 2011, the retirement of treasury stock caused a

decrease of NT$173,811 thousand (US$5,740 thousand) in

additional paid-in capital. As a result, the additional paid-in

capital as of December 31, 2011 was NT$14,809,608 thousand

(US$489,105 thousand).

4.

The provision for contingent loss on purchase orders is estimated

after taking into account the effects of changes in the product

market, in inventory management and in the Company's

purchases.

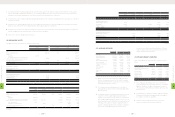

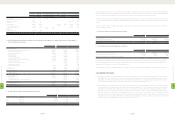

(19) LONG-TERM BANK LOANS

Long-term bank loans of Communication Global Certification Inc., a

direct subsidiary of HTC, as of December 31, 2010 and 2011 were as

follows:

2010 2011

NT$ NT$ US$ (Note 3)

Secured loans (Note 28)

NT$65,000 thousand, repayable

from July 2009 in 16 quarterly

installments; 1% annual interest

$24,376 $- $-

Less: Current portion (12,188) - -

$12,188 $- $-

(20) PENSION PLAN

The Labor Pension Act (the "Act), which provides for a new defined

contribution plan, took effect on July 1, 2005. Employees covered by

the Labor Standards Law (the "Law") before the enforcement of the

Act were allowed to choose to remain to be subject to the defined

benefit pension mechanism under the Law or to be subject instead

to the Act. Based on the Act, the rate of the required monthly

contributions of HTC and Communication Global Certification Inc.

(CGC) to the employees' individual pension accounts is at least 6% of

monthly wages and salaries, and these contributions are recognized

as pension expense in the income statement. The pension fund

contributions based on the Act were NT$220,769 thousand in 2010

and NT$351,762 thousand (US$11,618 thousand) in 2011.

Under the Law, which provides for a defined benefit pension plan,

retirement payments should be made according to the years of

service, with a payment of two units for each year of service but only

one unit per year after the 15th year; however, total units should not

exceed 45. The rate of the required contributions of HTC and CGC

to their respective pension funds was at 2% of monthly salaries and

wages after the Act took effect. The pension funds are deposited

in the Bank of Taiwan in the pension fund committees' name. The

pension fund balances were NT$448,631 thousand and NT$482,786

thousand (US$15,945 thousand) as of December 31, 2010 and 2011,

respectively.

H.T.C. (B.V.I.) Corp., HTC Investment Corporation, HTC I Investment

Corporation, Huada Digital Corporation, High Tech Computer Asia

Pacific Pte. Ltd. and HTC Investment One (BVI) Corporation have no

pension plans.

Under their respective local government regulations, other subsidiaries

have defined contribution pension plans covering all eligible

employees. The pension fund contributions were NT$72,115 thousand

in 2010 and NT$200,330 thousand (US$6,616 thousand) in 2011.

Based on the Statement of Financial Accounting Standards No. 18 -

"Accounting for Pensions" issued by the Accounting Research and

Development Foundation of the ROC, pension cost under a defined

benefit pension plan should be calculated by the actuarial method.

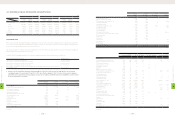

1. The net pension costs of HTC and CGC under the

defined benefit plan in 2010 and 2011 were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Service cost $4,915 $5,980 $197

Interest cost 6,560 6,882 227

Projected return on plan assets (8,598) (9,226) (305)

Amortization of unrecognized

net transition obligation, net 74 74 3

Amortization 305 507 17

Net pension cost $3,256 $4,217 $139

2. The reconciliations between pension fund status and

prepaid pension cost as of December 31, 2010 and 2011

were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Present actuarial value of benefit

obligation

Vested benefits $1,525 $10,026 $331

Non-vested benefits 191,930 193,962 6,406

Accumulated benefit

obligation 193,455 203,988 6,737

Additional benefits on future

salaries 150,645 163,087 5,386

Projected benefit obligation 344,100 367,075 12,123

Plan assets at fair value (448,631) (482,786) (15,945)

Funded status (104,531) (115,711) (3,822)

Unrecognized net transitional

obligation (416) (342) (11)

Unrecognized pension loss (54,414) (68,285) (2,255)

Additional minimum pension

liability 536 635 21

Prepaid pension cost $(158,825) $(183,703) $(6,067)

3. Assumptions used in actuarially determining the

present value of the projected benefit obligations of

HTC and CGC were as follows:

2010 2011

Weighted-average discount rate 2.00% 2.00%

Assumed rate of increase in future compensation 2.00%-3.75% 4.00%

Expected long-term rate of return on plan assets 2.00% 2.00%

The payments from the fund amounted to NT$1,702 thousand in 2010

and NT$793 thousand (US$26 thousand) in 2011.

8

FINANCIAL INFORMATION

| 202 |

8

FINANCIAL INFORMATION

| 203 |