HTC 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

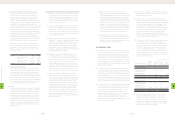

Accounting Issues Description of Differences

Changes in a parent's ownership interest in a

subsidiary

1. Not resulting in a loss of control: Under ROC GAAP, upon disposal of the investment in a subsidiary, irrespective

of whether the changes result in a loss of control, the difference between the selling price and book value of the

investment should be recognized as a disposal gain or loss. And if a subsidiary issues new shares and the parent

company does not buy new shares proportionately, the parent's ownership percentage and the interest in net assets

of the investment will be changed. These changes should then be used to adjust the additional paid-in capital. By

contrast, under IFRSs, the changes should be accounted for as equity transactions of the consolidated entity; thus, no

gain or loss is reported.

2. Result in a loss of control: Under ROC GAAP, when the long-term equity investment is sold, if there is a balance on

additional paid-in capital or other equity adjustment items of the investment, an investor company should calculate

its share so that the pro rata gains or losses from the disposal of the long-term investment can be accounted for. In

addition, the carrying amount of any investment retained in the former subsidiary at the date when control is lost

should be regarded as the new cost of the financial asset.

However, under IFRSs, the parent company should account for all amounts recognized in other comprehensive

income (OCI) in relation to that subsidiary on the same basis as would be required had the parent company had

directly disposed of the related assets or liabilities. In addition, this applies to the entire amount recognized in OCI,

irrespective of whether the parent company retains any interest in the former subsidiary. Further, the fair value of

any investment retained in the former subsidiary at the date when control is lost should be recognized as the new fair

value of the financial asset.

Business combinations achieved in stages (step

acquisition)

Under ROC GAAP, no matter whether the acquirer has pre-acquisition controlling interests in an investee, at the

acquisition date, the acquirer does not remeasure the pre-acquisition interest at fair value. However, under IFRSs:

1. When an acquirer does not have pre-acquisition controlling interests in an acquiree, the acquirer should remeasure on

the effective combination date its previously held equity interest at fair value and recognize the resulting gain or loss,

if any, in profit or loss or OCI, as appropriate. The amount recognized in OCI should be recognized on the same basis

as would be required had the acquirer disposed directly of the previously held equity interest.

2. When the acquirer has pre-acquisition controlling interests in the investee, the acquisition transaction should be

accounted for as an equity transaction with owners and no gain or loss is recognized.

3.

The Company has prepared the above assessments in compliance with (a) the 2010 version of the IFRSs translated by the ARDF and issued

by the FSC and (b) the Guidelines Governing the Preparation of Financial Reports by Securities Issuers amended and issued by the FSC on

December 22, 2011. These assessments may be changed as the International Accounting Statements Board (IASB) continues to issue or amend

standards, and as the FSC may issue new rules governing the adoption of IFRSs by companies with shares listed on the TWSE or traded on

the Taiwan GreTai Securities Market or Emerging Stock Market. Actual accounting policies adopted under IFRSs in the future may differ from

those contemplated during the assessments. New and revised standards, amendments or interpretations that have been issued by IASB and

approved but are not yet effected by the FSC are as follows:

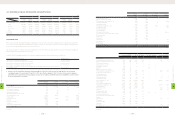

Standards or interpretations Content Effective Date by IASB

IFRSs (Amendments) Improvements to 2010 IFRS July 1, 2010 and January 1, 2011

IFRSs (Amendments) Improvements to 2009 IFRS, which amends IAS 39 (see note below) January 1, 2009 and January 1, 2010

IFRS 1 (Amendment) Limited exemption from comparative IFRS 7 disclosures for first-time adopters July 1, 2010

IFRS 1 (Amendment) Severe hyperinflation and removal of fixed dates for first-time adopters July 1, 2011

IFRS 7 (Amendment) Disclosures - transfers of financial assets July 1, 2011

IFRS 9 (Amendment) Financial instruments January 1, 2015

IAS 12 (Amendment) Deferred tax: Recovery of underlying assets January 1, 2012

IAS 39 (Amendment) Eligible hedged items (See note below) Effective for a fiscal year ending on or

after June 30, 2009

Note: In the ROC, Taiwan Financial Reporting Standards (TFRS) is in compliance with the 2009 version of the IAS 39, but the amendment to IAS 39 that was issued by IASB in

2009 is not applicable temporarily.

The Company believes that the first-time and subsequent adoption of the foregoing new and revised standards, amendments or interpretations

approved by FSC will not affect its financial statements, except for the following areas:

IFRS 9: Financial instruments

All recognized financial assets are subsequently measured in their entirety at either amortized cost or fair value, depending on the classification

of the financial assets. In addition, financial assets that meet the following conditions are measured at amortized cost and assessed for

impairment in subsequent periods:

• The asset is held within a business model whose objective is to hold assets in order to collect contractual cash flows; and

• The contractual terms on the instrument state specific dates corresponding to cash flows that are solely payments of principal and interest

on the principal outstanding.

All other financial assets are subsequently measured at fair value. However, upon initial recognition, the Company may choose to designate a

financial asset as at FVTPL if such designation eliminates or significantly reduces a measurement or recognition inconsistency.

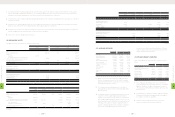

Contents of Plan Responsible Department Status of Execution

• Assess the adjustments of the existing accounting policies Finance and accounting Completed

• Assess the applicability of the IFRS 1 - "First-time Adoption of International Financial

Reporting Standards" Finance and accounting Completed

• Assess the adjustments of the related information technology system and internal control Finance and accounting, intrenal audit and

information technology Completed

2. Preparation phase: From January 1, 2011 to December 31, 2012

• Determine how to adjust the existing accounting policies in accordance with IFRSs Finance and accounting Completed

• Determine how to apply to the IFRS 1 - "First-time Adoption of International Financial

Reporting Standards" Finance and accounting Completed

• Adjust the related information technology system and internal control Finance and accounting, intrenal audit and

information technology In progress

• Conduct phase II internal training for employees Finance and accounting and talent

management Completed

3. Implementation Phase: From

January 1, 2012 to December 31, 2013

• Test run the adjusted related information technology system Finance and accounting and information

technology In progress

• Gather information to prepare the opening balance sheets and comparative financial

statements in conformity with IFRSs Finance and accounting In progress

• Prepare financial statements in conformity with IFRSs Finance and accounting In progress

(Concluded)

2.

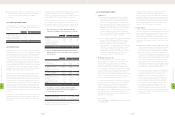

As of December 31, 2011, the Company had assessed the material differences, shown below, between the existing accounting policies and the

accounting policies to be adopted under IFRSs:

Accounting Issues Description of Differences

Deferred income tax assets and liabilities of

intergroup sales, classification of deferred

income tax assets and liabilities and valuation

allowance account.

1. Under ROC GAAP, deferred income tax assets or liabilities of intergroup sales are recognized for the change in tax

basis using the seller's tax rates. However, under IFRSs, the buyer's tax rates are used instead.

2. Under ROC GAAP, a deferred income tax asset or liability should, according to the classification of its related asset

or liability, be classified as current or noncurrent. However, a deferred income tax asset or liability that is not related

to an asset or liability for financial reporting should be classified as current or noncurrent according to the expected

reversal or realization date of the temporary difference. By contrast, under IFRSs, a deferred income tax asset or

liability is always classified as noncurrent.

3. Under ROC GAAP, deferred tax assets are recognized in full but are reduced by a valuation allowance account if there

is evidence showing that a portion of or all the deferred tax assets will not be realized. However, under IFRSs, an

entity recognizes deferred tax assets only if realization is "probable" and a valuation allowance account is not used.

Actuarial gains and losses Under ROC GAAP, the Company amortizes actuarial gains and losses using the corridor approach. However, under

IFRSs, actuarial gains and losses may be recognized immediately as other comprehensive income (OCI).

Accumulated compensated absences

This issue is not addressed in existing ROC GAAP; thus, the Company has not recognized the expected cost of employee

benefits in the form of accumulated compensated absences at the end of reporting periods. However, under IFRSs,

when the employees render services that increase their entitlement to future compensated absences, an entity should

recognize the expected cost of employee benefits at the end of reporting periods.

Definition of cash and cash equivalents and

reclassification

Under ROC GAAP, the term "cash" used in the financial statements includes cash on hand, demand deposits, check

deposits, time deposits that are cancellable but without any loss of principal and negotiable certificates of deposit that

are readily salable without any loss of principal. However, under IFRSs, cash equivalents are held for the purpose of

meeting short-term cash commitments rather than for investment or other purposes. An investment normally qualifies

as a cash equivalent only when it has a short maturity of three months or less from the date of acquisition.

Definition of provisions and reclassification

Under ROC GAAP, if an obligation is probable (i.e., likely to occur) and the amount could be reasonably estimated, it is a

contingent liability and should be accounted for, but under which account is not clearly defined. However, under IFRSs,

it defines "provisions" as obligations that are probable (i.e., more likely than not) and the amount could be reasonably

estimated.

Goodwill arising on the acquisiton of a foreign

operation and any fair value adjustment.

This issue is not addressed in the ROC GAAP. However, under IFRSs, any goodwill and any fair value adjustment arising

on the acquisition of a foreign operaton should be treated as assets and liabilities of the foreign operation. Thus, they

should be expressed in the functional currency of the foreign operation and should be translated at the closing rate.

(Continued)

8

FINANCIAL INFORMATION

| 218 |

8

FINANCIAL INFORMATION

| 219 |