HTC 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

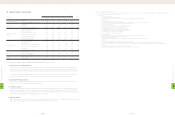

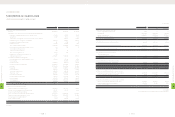

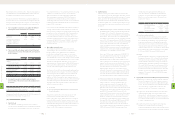

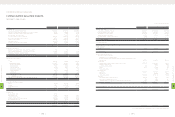

(16) ACCRUED EXPENSES

Accrued expenses as of December 31, 2010 and 2011 were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Marketing $15,742,853 $25,556,956 $844,049

Bonus to employees 8,491,704 7,238,637 239,065

Services 2,770,306 2,760,164 91,158

Salaries and bonuses 2,089,517 2,500,248 82,574

Research materials 726,105 1,848,332 61,043

Import, export and freight 1,060,399 1,197,075 39,535

Repairs and maintenance 138,747 264,044 8,720

Donation 217,800 235,800 7,788

Insurance 122,947 188,970 6,241

Meals and welfare 162,337 153,108 5,056

Pension cost 69,296 110,560 3,651

Travel 43,396 49,571 1,637

Others 28,222 260,766 8,612

$31,663,629 $42,364,231 $1,399,129

1.

Based on the resolutions passed by the Company's board of

directors, the employee bonuses for 2010 and 2011 should be

appropriated at 18% and 10%, respectively, of net income before

deducting employee bonus expenses.

2.

The Company accrued marketing expenses on the basis of

related agreements and other factors that would significantly

affect the accruals.

3.

In September 2009, the Company's board of directors resolved

to donate to the HTC Cultural and Educational Foundation

NT$300,000 thousand, consisting of (a) the second and third floors

of Taipei's R&D headquarters, with these two floors to be built at an

estimated cost of NT$217,800 thousand, and (b) cash of NT$82,200

thousand. This donation excludes the land, of which the ownership

remains with the Company. The difference between the estimated

building donation and the actual construction cost will be treated

as an adjustment in the year when the completed floors are actually

turned over to the HTC Cultural and Educational Foundation.

4.

Service fees accrued referred mainly to marketing activities,

research and design, and business consulting services provided

by related parties.

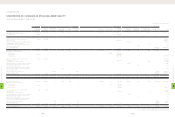

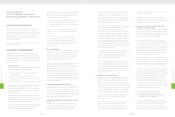

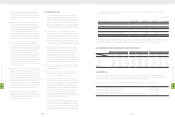

(17) OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2010 and 2011 were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Warranty provisions $9,057,050 $12,755,264 $421,258

Provisions for contingent loss on

purchase orders 1,942,147 2,052,881 67,799

Deferred credits - gain from

intercompany transactions 345,455 1,151,531 38,031

Other payables (Note 25) 601,717 709,129 23,420

Agency receipts 459,156 388,885 12,843

Advance receipts 333,282 134,748 4,450

Others 371,883 630,563 20,825

$13,110,690 $17,823,001 $588,626

1.

The Company provides warranty service for one year to two years

depending on the contract with customers. The warranty liability is

estimated on the basis of management's evaluation of the products

under warranty, past warranty experience, and pertinent factors.

2.

Other payables were payables for patents, treasury stock,

miscellaneous expenses of overseas sales offices and repair

materials.

3.

Agency receipts were primarily employees' income tax,

insurance, royalties and overseas value-added tax.

4.

Deferred credits - gains on intercompany transactions were

unrealized profit from intercompany transactions.

5.

The provision for contingent loss on purchase orders is estimated

after taking into account the effects of changes in the product

market, in inventory management and in the Company's purchases.

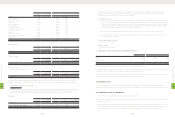

(18) PENSION PLAN

The Labor Pension Act (the "Act"), which provides for a new defined

contribution plan, took effect on July 1, 2005. Employees covered by

the Labor Standards Law (the "Law") before the enforcement of the

Act were allowed to choose to remain to be subject to the defined

benefit pension mechanism under the Law or to be subject instead

to the Act. Based on the Act, the rate of the Company's required

monthly contributions to the employees' individual pension accounts is

at least 6% of monthly wages and salaries, and these contributions are

recognized as pension expense in the income statement. The pension

fund contributions based on the Act were NT$219,565 thousand in

2010 and NT$350,450 thousand (US$11,574 thousand) in 2011.

Under the Law, which provides for a defined benefit pension plan,

retirement payments should be made according to the years of

service, with a payment of two units for each year of service but only

one unit per year after the 15th year; however, total units should not

exceed 45. The rate of the Company's contributions to a pension fund

was 2% after the Act took effect. The pension fund is deposited in the

9.

In October 2009, the Company and its subsidiary, High Tech

Computer Asia Pacific Pte. Ltd., acquired equity interests of 1%

and 99%, respectively in HTC Holding Cooperatief U.A. for NT$13

thousand and NT$1,325 thousand, respectively. As a result,

the Company has accounted for this investment by the equity

method since the acquisition date.

10.

In December 2009, the Company acquired 100% equity interest

in Huada Digital Corporation ("Huada") for NT$245,000

thousand and accounted for this investment by the equity

method. In September 2011, the Company increased this

investment by NT$5,000 thousand (US$164 thousand). As of

December 31, 2011, the Company's investment in Huada had

amounted to NT$250,000 thousand (US$8,256 thousand). In

September 2011, the Fair Trade Commission Executive Yuan,

R.O.C. (Taiwan) approved an investment by Chunghwa Telecom

Co., Ltd. (CHT) in Huada and the registration of this investment

was completed in October 2011. After CHT's investment, the

Company's ownership percentage declined from 100% to 50%,

resulting in an adjustment debited to capital surplus - long-term

equity investments of NT$374 thousand (US$12 thousand).

11.

In August 2011, the Company acquired 100% equity interest in HTC

Investment One (BVI) Corporation for NT$9,625,903 thousand

(US$317,906 thousand) and accounted for this investment by

the equity method. Because the registration of this investment

had not been completed as of December 31, 2011, an amount of

NT$316,782 thousand (US$10,462 thousand) was temporarily

accounted for under "prepayments for long-term investments."

12.

On its equity-method investments, the Company had gains of

NT$1,457,395 thousand in 2010 and NT$2,718,362 thousand

(US$89,777 thousand) in 2011.

13.

The financial statements of the equity-method investees for the

years ended December 31, 2010 and 2011 had been examined by

the Company's independent auditors.

14.

Under the revised Statement of Financial Accounting Standards No. 7

- "Consolidated Financial Statements," which took effect on January

1, 2005, the Company included the accounts of all its direct and

indirect subsidiaries in the consolidated financial statements as of

and for the years ended December 31, 2010 and 2011. All significant

intercompany balances and transactions have been eliminated.

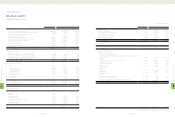

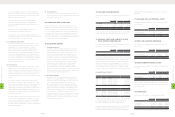

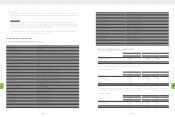

(15) PROPERTIES

Properties as of December 31, 2010 and 2011 were as follows:

2010 2011

Carrying Value Cost Accumulated

Depreciation Carrying Value

NT$ NT$ NT$ NT$ US$ (Note 3)

Land $5,690,718 $7,462,281 $- $7,462,281 $246,451

Buildings and structures 2,724,948 3,680,608 937,924 2,742,684 90,580

Machinery and equipment 2,035,978 7,100,072 4,212,153 2,887,919 95,377

Molding equipment - 172,632 172,632 - -

Computer equipment 85,412 398,289 300,428 97,861 3,232

Transportation equipment 4,407 6,570 2,793 3,777 125

Furniture and fixtures 30,720 204,185 135,689 68,496 2,262

Leased assets 785 4,712 4,647 65 2

Leasehold improvements 79,751 215,437 83,795 131,642 4,348

Prepayments for land, construction-in- progress and equipment-in-transit 288,511 2,027,620 - 2,027,620 66,964

$10,941,230 $21,272,406 $5,850,061 $15,422,345 $509,341

1.

In December 2008, the Company bought land - about 8.3 thousand square meters - from Yulon Motors Ltd. for NT$3,335,000 thousand to

build the Taipei R&D headquarters in Xindian City. The Company had paid 80% and 20% of the purchase price and completed the transfer

registration of the corresponding portions of the land in December 2008 and January 2010, respectively.

2.

In November 2010, the Company bought land and building for NT$404,000 thousand from a related party, VIA Technologies, Inc. to have more

office space in Xindian.

3.

In April 2011, the Company bought land adjacent to its Taoyuan plant for NT$1,770,000 thousand (US$58,456 thousand) from an unrelated

party to build a complete HTC technology park and meet future capacity expansion requirements.

4.

Prepayments for construction-in-progress and equipment-in-transit were for the construction of the Taipei R&D headquarters and Taoyuan

plant as well as miscellaneous equipment.

5. There were no interests capitalized for 2010 and 2011.

8

FINANCIAL INFORMATION

| 160 |

8

FINANCIAL INFORMATION

| 161 |