HTC 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

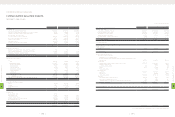

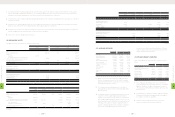

Year Ended December 31, 2011

Patents Goodwill Deferred

Pension Cost Other Total

NT$ NT$ NT$ NT$ NT$ US$ (Note 3)

Balance, end of year $11,608,540 $10,905,878 $342 $911,962 $23,426,722 $773,695

Accumulated amortization

Balance, beginning of year 12,362 - - - 12,362 408

Amortization 443,551 - - 330,812 774,363 25,574

Owned by acquirees 475 - - - 475 16

Translation adjustment 54 - - (14,634) (14,580) (482)

Balance, end of year 456,442 - - 316,178 772,620 25,516

Accumulated impairment losses

Balance, beginning of year - 71,508 - - 71,508 2,362

Impairment losses - 18,608 - - 18,608 615

Translation adjustment - 3,198 - - 3,198 105

Balance, end of year - 93,314 - - 93,314 3,082

Net book value, end of year $11,152,098 $10,812,564 $342 $595,784 $22,560,788 $745,097

(Concluded)

(17) ACCRUED EXPENSES

2010 2011

NT$ NT$ US$ (Note 3)

Marketing $17,323,446 $29,104,665 $961,216

Bonus to employees 8,491,704 7,238,637 239,065

Salaries and bonuses 2,642,916 3,433,649 113,400

Services 1,843,017 1,324,631 43,748

Import, export and freight 1,321,198 1,397,747 46,162

Research materials 780,501 1,854,932 61,261

Repairs and maintenance 250,638 466,135 15,395

Donation 217,800 236,630 7,815

Meals and welfare 197,590 193,721 6,398

Insurance 127,905 191,931 6,339

Pension cost 69,610 123,877 4,091

Travel 49,691 96,085 3,173

Others 110,012 508,650 16,799

$33,426,028 $46,171,290 $1,524,862

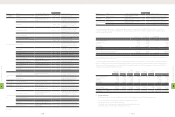

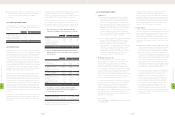

1.

Based on the resolutions passed by the Company's board of

directors, the employee bonuses for 2010 and 2011 should be

appropriated at 18% and 10%, respectively, of net income before

deducting employee bonus expenses.

2.

The Company accrued marketing expenses on the basis of

related agreements and other factors that would significantly

affect the accruals.

3.

In September 2009, the Company's board of directors resolved

to donate to the HTC Cultural and Educational Foundation

NT$300,000 thousand, consisting of (a) the second and third

floors of Taipei's R&D headquarters, with these two floors to be

built at an estimated cost of NT$217,800 thousand, and (b) cash

of NT$82,200 thousand. This donation excludes the land, of

which the ownership remains with the Company. The difference

between the estimated building donation and the actual

construction cost will be treated as an adjustment in the year

when the completed floors are actually turned over to the HTC

Cultural and Educational Foundation.

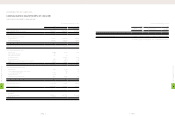

(18) OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2010 and 2011 were as

follows:

2010 2011

NT$ NT$ US$ (Note 3)

Warranty provisions $9,104,973 $13,080,394 $431,996

Provisions for contingent loss on

purchase orders 1,942,147 2,052,881 67,799

Other payable 269,045 512,941 16,940

Agency receipts 476,948 440,862 14,560

Advance receipts 805,838 433,072 14,302

Advance revenues - 140,815 4,651

Others 377,886 646,390 21,348

$12,976,837 $17,307,355 $571,596

1.

The Company provides warranty service for one year to two

years depending on the contract with customers. The warranty

liability is estimated on the basis of management's evaluation

of the products under warranty, past warranty experience, and

pertinent factors.

2.

Other payables were payables for patents, unpaid consideration

for treasury stock buyback and agreed installments payable to

the original stockholders of subsidiaries.

3.

Agency receipts were primarily employees' income tax,

insurance, royalties and overseas value-added tax.

1.

In December 2008, the Company bought land - about 8.3 thousand square meters - from Yulon Motors Ltd. for NT$3,335,000 thousand to

build the Taipei R&D headquarters in Xindian City. The Company had paid 80% and 20% of the purchase price and completed the transfer

registration of the corresponding portions of the land in December 2008 and January 2010, respectively.

2.

In November 2010, the Company bought land and building for NT$404,000 thousand from a related party, VIA Technologies, Inc. to have more

office space in Xindian.

3.

In April 2011, the Company bought land adjacent to its Taoyuan plant for NT$1,770,000 thousand (US$58,456 thousand) from an unrelated

party to build a complete HTC technology park and meet future capacity expansion requirements.

4.

Prepayments for construction-in-progress and equipment-in-transit were for the construction of the Taipei R&D headquarters, Taoyuan plant

and the Shanghai employees' dormitory and as well as miscellaneous equipment.

5.

There were no interests capitalized for 2010 and 2011.

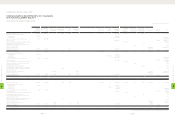

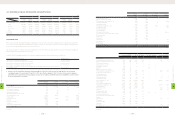

(16) INTANGIBLE ASSETS

Intangible assets as of December 31, 2010 and 2011 were as follows:

Year Ended December 31, 2011

Patents Goodwill Deferred

Pension Cost Other Total

NT$ NT$ NT$ NT$ NT$

Cost

Balance, beginning of year $- $286,467 $490 $- $286,957

Additions

Acquisition 220,943 - - - 220,943

The difference between the cost of investment

and the Company's share in investees' net assets - 328,921 - 257,015 585,936

The changes in deferred pension cost - - (74) - (74)

Translation adjustment - (46,077) - (28,165) (74,242)

Balance, end of year 220,943 569,311 416 228,850 1,019,520

Accumulated amortization

Balance, beginning of year - - - - -

Amortization 12,362 - - - 12,362

Balance, end of year 12,362 - - - 12,362

Accumulated impairment losses

Balance, beginning of year - 46,475 - - 46,475

Impairment losses - 31,579 - - 31,579

Translation adjustment - (6,546) - - (6,546)

Balance, end of year - 71,508 - - 71,508

Net book value, end of year $208,581 $497,803 $416 $228,850 $935,650

Year Ended December 31, 2011

Patents Goodwill Deferred

Pension Cost Other Total

NT$ NT$ NT$ NT$ NT$ US$ (Note 3)

Cost

Balance, beginning of year $220,943 $569,311 $416 $228,850 $1,019,520 $33,671

Additions

Acquisition 2,282,409 - - 11,951 2,294,360 75,774

The difference between the cost of investment

and the Company's share in investees' net assets 9,033,450 10,240,332 - 603,852 19,877,634 656,483

Owned by acquirees 21,527 - - 62,929 84,456 2,789

Adjustments of acquisition cost - 81,183 - - 81,183 2,681

The changes in deferred pension cost - - (74) - (74) (3)

Translation adjustment 50,211 15,052 - 4,380 69,643 2,300

(Continued)

8

FINANCIAL INFORMATION

| 200 |

8

FINANCIAL INFORMATION

| 201 |