HTC 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

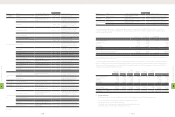

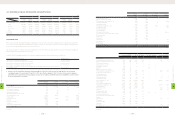

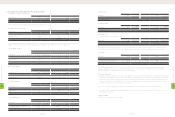

2010

Income Tax Expense

(Benefit)

Income

Tax Payable

Income

Tax Receivable

Deferred Tax Assets

(Liabilities)

NT$ NT$ NT$ NT$

HTC Belgium BVBA/SPRL $10,468 $11,005 $- $733

High Tech Computer (H.K.) Limited 1,435 640 - -

HTC (Australia and New Zealand) Pty. Ltd. 6,292 5,132 - (1,189)

HTC India Private Limited 1,837 5,929 21 16

HTC (Thailand) Limited 1,206 720 - -

HTC Electronics (Shanghai) Co., Ltd. 86,172 123,994 63,647 46,288

HTC Malaysia Sdn. Bhd. 1,334 (227) - 256

HTC Innovation Limited 1,060 1,005 - -

HTC Netherlands B.V. 1,029 958 - -

HTC FRANCE CORPORATION 2,074 3,155 - (78,724)

HTC South Eastern Europe Limited Liability Company 456 424 - -

HTC Germany GmbH 2,502 605 - -

HTC Spain, S.L. 757 419 - -

HTC Italia SRL 3,705 (1,263) - -

HTC Nordic ApS 1,092 275 - (55)

HTC Poland sp. z.o.o. 225 - - 734

HTC HK, Limited 58 54 - -

HTC America Innovation Inc. 8,035 12,601 - 5,174

$5,449,544 $6,809,417 $130,287 $3,417,684

(Concluded)

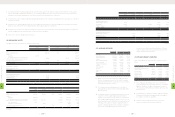

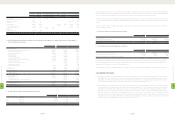

2011

Income

Tax Expense (Benefit) Income Tax Payable Income Tax Receivable Deferred

Tax Assets (Liabilities)

NT$ US$ (Note 3) NT$ US$ (Note 3) NT$ US$ (Note 3) NT$ US$ (Note 3)

HTC Corporation $7,873,875 $260,044 $9,653,090 $318,805 $- $- $5,113,822 $168,890

Communication Global Certification Inc. 7,072 234 6,047 200 - - 1,677 55

High Tech Computer Asia Pacific Pte. Ltd. 11,128 368 10,507 347 - - 37 1

HTC Investment Corporation 229 8 26 1 - - - -

HTC I Investment Corporation 167 6 - - 29 1 - -

Huada Digital Corporation 271 9 15 1 - - - -

Exedea Inc. 656 22 - - 152 5 - -

High Tech Computer (H.K.) Limited 2,630 87 - - - - - -

HTC (Australia and New Zealand) PTY LTD. 11,261 372 11,775 389 - - (884) (29)

PT. High Tech Computer Indonesia 223 7 226 7 - - - -

HTC (Thailand) Limited 3,621 120 2,285 75 - - - -

HTC India Private Limited 2,772 92 - - - - - -

HTC Malaysia Sdn. Bhd. 3,448 114 769 25 - - 301 10

HTC Innovation Limited 2,677 88 1,542 51 - - - -

HTC Communication Co., Ltd. 43,337 1,431 532,692 17,593 - - 689,907 22,785

HTC HK, Limited 3,343 110 4,877 161 - - - -

HTC Corporation (Shanghai WGQ) 3,917 129 2,082 69 - - - -

HTC Electronics (Shanghai) Co., Ltd. 254,684 8,411 185,536 6,127 - - 48,090 1,588

HTC Netherlands B.V. 1,400 46 1,630 54 - - - -

HTC EUROPE CO., LTD. 159,811 5,278 125,595 4,148 - - 9,451 312

HTC BRASIL 196 6 - - - - 2,720 90

HTC Belgium BVBA/SPRL 1,043 34 5,983 197 - - - -

HTC NIPPON Corporation 3,213 106 - - 221 8 - -

HTC FRANCE CORPORATION 314 10 582 19 - - - -

HTC South Eastern Europe Limited Liability

Company 1,267 42 1,282 42 - - - -

HTC Nordic ApS 6,466 214 423 14 - - (79) (3)

HTC Italia SRL 4,177 138 - - - - - -

HTC Germany GmbH. 7,543 249 4,869 161 - - - -

HTC Iberia S.L. 3,305 109 3,313 109 - - - -

HTC Poland sp. z o.o. 15 1 - - - - 1,794 59

HTC Communication Canada, Ltd. 90 3 91 3 - - - -

(Continued)

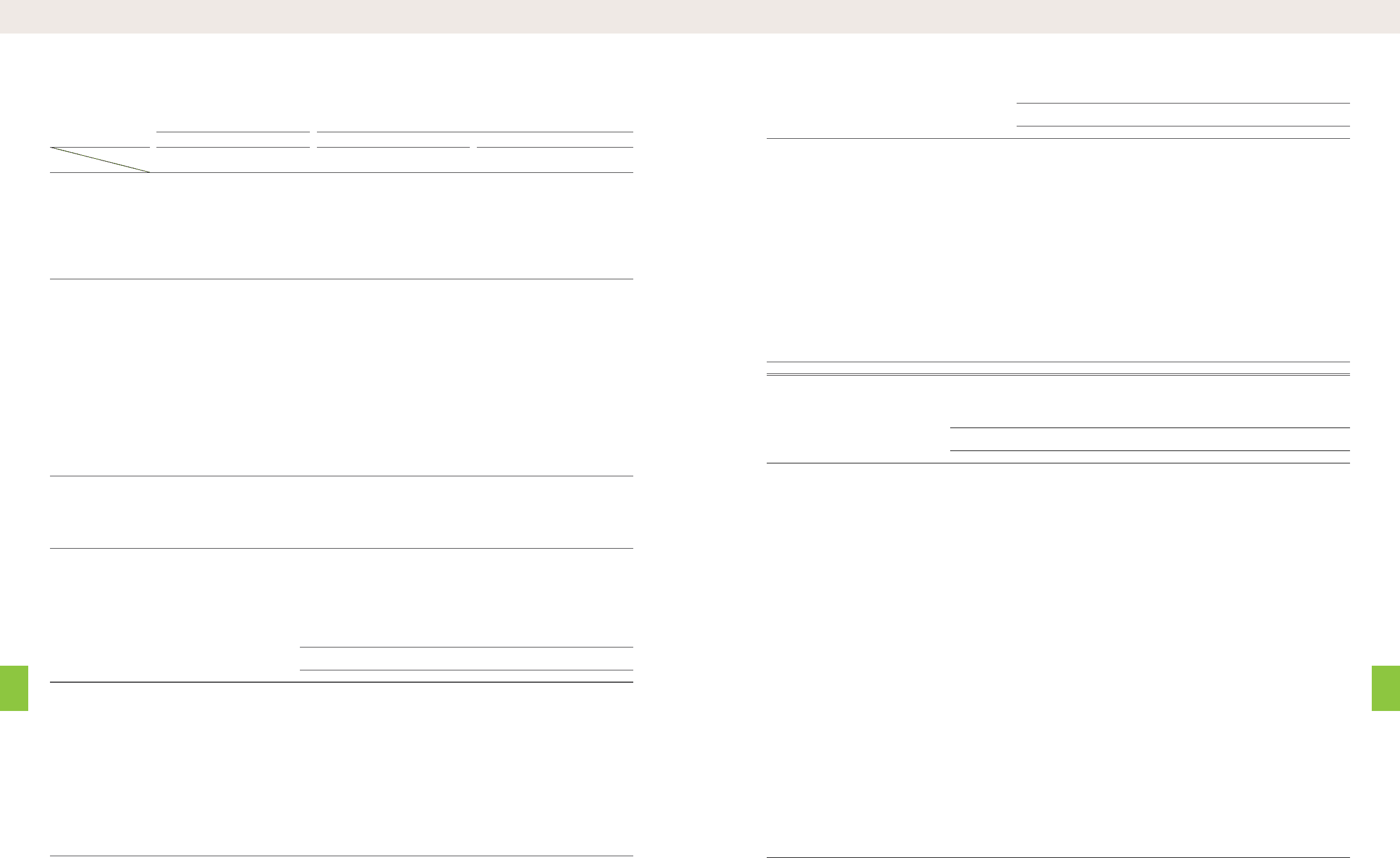

(23) PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

2010 2011

NT$ NT$ US$ (Note 3)

Function

Expense Item

Operating

Costs

Operating

Expenses Total Operating

Costs

Operating

Expenses Total Operating

Costs

Operating

Expenses Total

Personnel expenses $5,265,747 $15,813,869 $21,079,616 $6,546,170 $20,198,025 $26,744,195 $216,195 $667,064 $883,259

Salary 4,544,387 14,879,114 19,423,501 5,285,153 18,609,790 23,894,943 174,548 614,611 789,159

Insurance 224,738 446,621 671,359 375,386 599,600 974,986 12,398 19,802 32,200

Pension cost 101,749 194,391 296,140 232,408 323,901 556,309 7,676 10,697 18,373

Other 394,873 293,743 688,616 653,223 664,734 1,317,957 21,573 21,954 43,527

Depreciation 469,145 435,568 904,713 963,947 600,278 1,564,225 31,835 19,825 51,660

Amortization 36,244 60,952 97,196 33,681 802,930 836,611 1,112 26,518 27,630

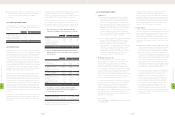

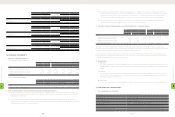

(24) INCOME TAX

HTC's income tax returns through 2008 had been examined by the tax authorities. However, HTC disagreed with the tax authorities' assessment

on its return for 2002 and applied for the administrative litigation of this return. Nevertheless, under the conservatism guideline, HTC adjusted its

income tax for the tax shortfall stated in the tax assessment notices.

The income tax returns of Communication Global Certification Inc., HTC Investment Corporation and HTC I Investment Corporation through 2009

had been examined and cleared by the tax authorities.

Under the Statute for Upgrading Industries, the Company was granted exemption from corporate income tax as follows:

Item Exempt from Corporate Income Tax Exemption Period

Sales of pocket PCs (wireless) and smartphones 2005.12.20-2010.12.19

Sales of wireless or smartphone which has 3G or GPS function 2006.12.20-2011.12.19

Sales of wireless or smartphone which has 3G or GPS function 2007.12.20-2012.12.19

Sales of wireless or smartphone which has 3.5G function 2010.01.01-2014.12.31

Sales of wireless or smartphone which has 3.5G function (application for exemption under review by the Ministry of Finance

as of December 31, 2011) 2012.01.01-2016.12.31

1. In May 2010, the Legislative Yuan passed the amendment of Article 5 of the Income Tax Law, which reduced a profit-

seeking enterprise's income tax rate from 20% to 17%, also effective January 1, 2010. Provision for income tax expense

(benefit) in 2010 and 2011; income tax payable, income tax receivables and deferred tax assets (liabilities) as of December

31, 2010 and 2011 were as follows:

2010

Income Tax Expense

(Benefit)

Income

Tax Payable

Income

Tax Receivable

Deferred Tax Assets

(Liabilities)

NT$ NT$ NT$ NT$

HTC Corporation $4,957,709 $6,416,667 $- $3,345,010

Communication Global Certification Inc. 500 735 23 1,843

HTC Investment Corporation 132 - 216 -

HTC I Investment Corporation 159 32 - -

Huada Digital Corporation 116 28 - -

High Tech Computer Asia Pacific Pte. Ltd. 1,016 287 - 36

HTC Communication Co., Ltd. (17,031) 80,600 - 56,370

HTC America Inc. 213,608 - 59,070 27,787

HTC EUROPE CO., LTD. 138,709 137,426 - 8,612

Exedea Inc. 19,356 - 4,894 2,505

HTC NIPPON Corporation 4,028 3,692 - -

HTC BRASIL 5,006 3,575 - 2,607

HTC Corporation (Shanghai WGQ) 1,533 949 - -

One & Company Design, Inc. (5,034) - 2,416 (319)

(Continued)

8

FINANCIAL INFORMATION

| 206 |

8

FINANCIAL INFORMATION

| 207 |