HTC 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

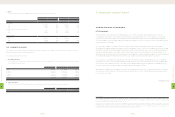

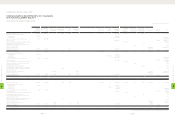

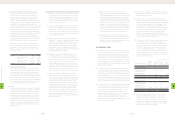

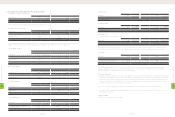

Forward Exchange Contracts

2010

Buy/Sell Currency Settlement Period/Date Contract Amount

Buy USD/CAD 2011.01.26 USD 250

Buy USD/JPY 2011.01.12∼2011.02.23 USD 18,187

Sell EUR/USD 2011.01.05∼2011.03.18 EUR 531,000

Sell GBP/USD 2011.01.12∼2011.03.25 GBP 57,400

Sell USD/NTD 2011.01.03∼2011.01.31 USD 447,000

2011

Buy/Sell Currency Settlement Period/Date Contract Amount

Buy USD/CAD 2012.01.11∼2012.02.22 USD 28,010

Buy USD/RMB 2012.01.04∼2012.01.31 USD 105,000

Sell EUR/USD 2012.01.04∼2012.03.30 EUR 339,000

Sell GBP/USD 2012.01.11∼2012.02.22 GBP 17,100

Net gain on derivative financial instruments in 2010 was NT$759,889

thousand, including a realized settlement gain of NT$309,613

thousand and a valuation gain of NT$450,276 thousand.

Net gain on derivative financial instruments in 2011 was NT$172,501

thousand (US$5,697 thousand), including a realized settlement loss

of NT$84,367 thousand (US$2,786 thousand) and a valuation gain

of NT$256,868 thousand (US$8,483 thousand). Note 26 has more

information.

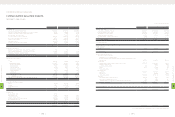

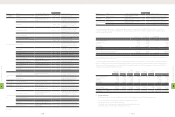

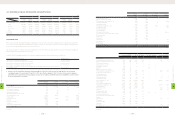

(7) AVAILABLE-FOR-SALE FINANCIAL ASSETS

Available-for-sale financial assets as of December 31, 2010 and 2011

were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Mutual funds $441,948 $736,031 $24,308

Domestic quoted stocks 538 279 9

Less: Current portion (441,948) (736,031) (24,308)

$538 $279 $9

(8) NOTES AND ACCOUNTS RECEIVABLE

Notes and accounts receivable as of December 31, 2010 and 2011

were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Notes receivable $- $755,450 $24,950

Accounts receivable 62,620,703 65,518,876 2,163,839

Accounts receivable from

related parties 2,143 473 16

Less: Allowance for doubtful

accounts (1,008,491) (1,555,008) (51,356)

$61,614,355 $64,719,791 $2,137,449

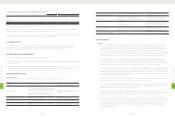

(9) OTHER CURRENT FINANCIAL ASSETS

Other current financial assets as of December 31, 2010 and 2011 were

as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Other receivables $747,983 $1,129,204 $37,293

Agency payments 22,139 249,644 8,245

Interest receivables 11,376 23,261 768

Others 2,042 3,802 126

$783,540 $1,405,911 $46,432

Other receivables were primarily prepayments on behalf of vendors

or customers, withholding income tax on employees' bonuses, and

other compensation.

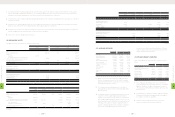

(10) INVENTORIES

Inventories as of December 31, 2010 and 2011 were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Finished goods $1,859,010 $2,189,984 $72.327

Work-in-process 6,707,423 8,868,137 292,881

Raw materials 13,075,800 17,251,140 569,739

Inventory in transit 4,771,514 121,329 4,007

$26,413,747 $28,430,590 $938,954

As of December 31, 2010 and 2011, the allowances for inventory

devaluation were NT$3,535,521 thousand and NT$4,930,857 thousand

(US$162,847 thousand), respectively.

The write-down of inventories to their net realizable value, which

amounted to NT$2,686,168 thousand in 2010 and NT$3,381,137 thousand

and (US$111,666 thousand) in 2011, was recognized as cost of sales.

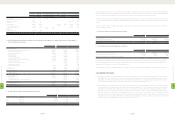

(11) PREPAYMENTS

Prepayments as of December 31, 2010 and 2011 were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Royalty $1,837,341 $4,828,102 $159,454

Prepayments to suppliers 38,990 1,248,922 41,247

Net input VAT 361,152 320,544 10,586

Software and hardware

maintenance 115,425 311,416 10,285

Molding equipment 91,058 188,242 6,217

Marketing 66,295 43,200 1,427

Rent 40,812 15,488 511

Others 69,665 119,317 3,941

$2,620,738 $7,075,231 $233,668

1. Prepayments for royalty were primarily for discount purposes

and were classified as current or noncurrent on the basis of their

maturities. As of December 31, 2010 and 2011, the noncurrent

prepayments of NT$2,484,156 thousand and NT$6,489,046

thousand and (US$214,309 thousand), respectively, were

classified as other assets (Note 30 has more information).

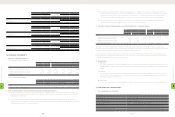

24. Treasury Stock

The Company adopted the Statement of Financial Accounting

Standards No. 30 - "Accounting for Treasury Stocks," which requires

the treasury stock held by the Company to be accounted for by the

cost method. The cost of treasury stock is shown as a deduction to

arrive at stockholders' equity, while gain or loss from selling treasury

stock is treated as an adjustment to capital surplus.

When treasury stocks are sold and the selling price is above

the book value, the difference should be credited to the capital

surplus - treasury stock transactions. If the selling price is below

the book value, the difference should first be offset against

capital surplus from the same class of treasury stock transactions,

and any remainder should be debited to retained earnings. The

carrying value of treasury stocks should be calculated using the

weighted-average method.

When the Company's treasury stock is retired, the treasury stock

account should be credited, and the capital surplus - premium

on stock account and capital stock account should be debited

proportionately according to the share ratio. The difference

should be credited to capital surplus or debited to capital surplus

and/or retained earnings.

25. Reclassifications

Certain 2010 accounts have been reclassified to be consistent

with the presentation of the consolidated financial statements as

of and for the year ended December 31, 2011.

(3) TRANSLATION INTO U.S. DOLLARS

The consolidated financial statements are stated in New Taiwan

dollars. The translation of the 2011 New Taiwan dollar amounts

into U.S. dollar amounts are included solely for the convenience of

readers, using the noon buying rate of NT$30.279 to US$1.00 quoted

by Reuters on December 31, 2011. The convenience translation

should not be construed as representations that the New Taiwan

dollar amounts have been, could have been, or could in the future be,

converted into U.S. dollars at this or any other exchange rate.

(4) ACCOUNTING CHANGES

1. Financial Instruments

On January 1, 2011, the Company adopted the newly revised

Statement of Financial Accounting Standards (SFAS) No. 34 -

"Financial Instruments: Recognition and Measurement." The main

revisions include (1) finance lease receivables are now covered

by SFAS No. 34; (2) the scope of the applicability of SFAS No.

34 to insurance contracts is amended; (3) loans and receivables

originated by the Company are now covered by SFAS No. 34; (4)

additional guidelines on impairment testing of financial assets

carried at amortized cost when a debtor has financial difficulties

and the terms of obligations have been modified; and (5)

accounting treatment by a debtor for modifications in the terms

of obligations. This accounting change had no material effect on

the Company's consolidated financial statements as of and for the

year ended December 31, 2011.

2. Operating Segments

On January 1, 2011, the Company adopted the newly issued

SFAS No. 41 - "Operating Segments." The requirements of the

statement are based on the information about the components

of the Company that management uses to make decisions

about operating matters. SFAS No. 41 requires identification

of operating segments on the basis of internal reports that are

regularly reviewed by the Company's chief operating decision

maker in order to allocate resources to the segments and assess

their performance. This statement supersedes SFAS No. 20 -

"Segment Reporting." For this accounting change, the Company

restated the segment information as of and for the year ended

December 31, 2010 to conform to the disclosures as of and for

the year ended December 31, 2011.

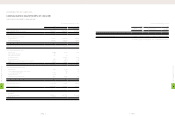

(5) CASH AND CASH EQUIVALENTS

Cash and cash equivalents as of December 31, 2010 and 2011 were as

follows:

2010 2011

NT$ NT$ US$ (Note 3)

Cash on hand $4,304 $6,436 $212

Cash in banks 22,343,340 28,207,009 931,570

Time deposits 52,115,217 59,288,063 1,958,059

$74,462,861 $87,501,508 $2,889,841

On time deposits, interest rates ranged from 0.14% to 1.50% and from

0.15% to 1.345% as of December 31, 2010 and 2011, respectively.

(6) FINANCIAL ASSETS AND LIABILITIES AT FAIR

VALUE THROUGH PROFIT OR LOSS

Financial assets and liabilities at fair value through profit or loss as of

December 31, 2010 and 2011 were as follows:

2010 2011

NT$ NT$ US$ (Note 3)

Derivatives - financial assets

Exchange contracts $450,276 $256,868 $8,483

The Company had derivative transactions in 2010 and 2011 to manage

exposures related to exchange rate fluctuations. However, these

transactions did not meet the criteria for hedge accounting under

Statement of Financial Accounting Standards No. 34 - "Financial

Instruments: Recognition and Measurement." Thus, the Company

had no hedge accounting in 2010 and 2011. Outstanding forward

exchange contracts as of December 31, 2010 and 2011 were as follows:

8

FINANCIAL INFORMATION

| 196 |

8

FINANCIAL INFORMATION

| 197 |