Google 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

Uncertain Tax Positions

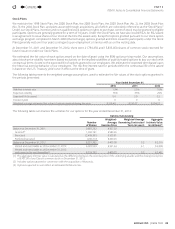

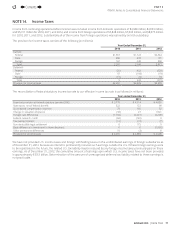

The following table summarizes the activity related to our gross unrecognized tax benefi ts from January1, 2010 to December31,2012

(in millions):

Balance as of January1, 2010 $1,188

Increases related to prior year tax positions 37

Decreases related to prior year tax positions (197)

Decreases related to settlement with tax authorities (47)

Decreases as a result of a lapse of applicable statute of limitation (97)

Increases related to current year tax positions 256

Balance as of December31, 2010 1,140

Increases related to prior year tax positions 77

Decreases related to prior year tax positions (9)

Increases related to current year tax positions 361

Decreases related to settlement with tax authorities (5)

Balance as of December31,2011 1,564

Increases related to prior year tax positions 43

Decreases related to prior year tax positions (40)

Decreases related to settlement with tax authorities (62)

Increases related to acquisition 17

Increases related to current year tax positions 411

Balance as of December31, 2012 $1,933

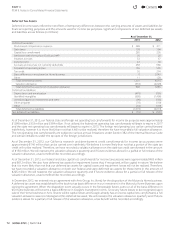

Our total unrecognized tax benefi ts that, if recognized, would aff ect our eff ective tax rate were $951million, $1,350million, and

$1,749million as of December31,2010, 2011, and 2012.

As of December31, 2011 and 2012, we had accrued $129million and $139million for payment of interest and penalties. Interest

and penalties included in our provision for income taxes were not material in all the periods presented.

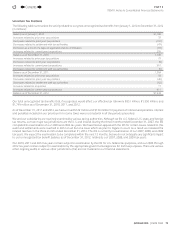

We and our subsidiaries are routinely examined by various taxing authorities. Although we fi le U.S. federal, U.S. state, and foreign

tax returns, our two major tax jurisdictions are the U.S. and Ireland. During the three months ended December31, 2007, the IRS

completed its examination of our 2003 and 2004 tax years. We have fi led an appeal with the IRS for certain issues related to this

audit and settlements were reached in 2012 on all but one issue which we plan to litigate in court. As a result we released the

related reserves in the three month ended December31, 2012. The IRS is currently in examination of our 2007, 2008, and 2009

tax years. We expect the examination to be completed within the next 12 months, but we do not anticipate any signifi cant impact

to our unrecognized tax benefi t balance as of December31, 2012, related to our 2007, 2008, and 2009 tax years.

Our 2010, 2011 and 2012 tax years remain subject to examination by the IRS for U.S. federal tax purposes, and our 2006 through

2012 tax years remain subject to examination by the appropriate governmental agencies for Irish tax purposes. There are various

other ongoing audits in various other jurisdictions that are not material to our fi nancial statements.

4

Contents

4