Google 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29GOOGLE INC. |Form10-K

PART II

ITEM7.Management’s Discussion and Analysis of Financial Condition and Results ofOperations

Aggregate paid clicks on Google websites and Google Network Members’ websites increased approximately 34% from 2011 to 2012

and approximately 25% from 2010 to 2011. Average cost-per-click on Google websites and Google Network Members’ websites

decreased approximately 12% from 2011 to 2012 and increased approximately 3% from 2010 to 2011. The rate of change in

aggregate paid clicks and average cost-per-click, and their correlation with the rate of change in revenues, has fl uctuated and

may fl uctuate in the future because of various factors, including the revenue growth rates on our websites compared to those of

our Google Network Members, advertiser competition for keywords, changes in foreign currency exchange rates, seasonality, the

fees advertisers are willing to pay based on how they manage their advertising costs, changes in advertising quality or formats,

and general economic conditions. In addition, tra c growth in emerging markets compared to more mature markets and across

various advertising verticals and channels, including mobile devices, also contributes to these fl uctuations. Changes in aggregate

paid clicks and average cost-per-click may not be indicative of our performance or advertiser experiences in any specifi c geographic

market, vertical, or industry.

We believe that the increase in the number of paid clicks on Google websites and Google Network Members’ websites is substantially

the result of our commitment to improving the relevance and quality of both our search results and the advertisements displayed,

which we believe results in a better user experience, which in turn results in more searches, advertisers, and Google Network

Members and other partners.

Revenues by Geography

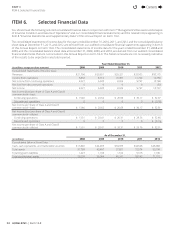

The following table presents our Google domestic and international revenues as a percentage of Google revenues, determined

based on the billing addresses of our customers for our Google business:

Year Ended December31,

2010 2011 2012

United States 48% 46% 46%

United Kingdom 11% 11% 11%

Rest of the world 41% 43% 43%

The following table presents our consolidated domestic and international revenues as a percentage of consolidated revenues,

determined based on the billing addresses of our customers for our Google business, and shipping addresses of our customers

for our Motorola Mobile business:

Year Ended December31,

2010 2011 2012

United States 48% 46% 47%

United Kingdom 11% 11% 10%

Rest of the world 41% 43% 43%

The growth in revenues from the United States as a percentage of consolidated revenues from 2011 to 2012 was primarily as a

result of the inclusion of Motorola Mobile revenues which were primarily generated in the UnitedStates.

The general strengthening of the U.S. dollar relative to certain foreign currencies (primarily the Euro) from 2011 to 2012 had an

unfavorable impact on our international revenues. Had foreign exchange rates remained constant in these periods, our revenues

from the United Kingdom would have been $68million or 1.4% higher and our revenues from the rest of the world would have

been approximately $1,211million or 5.6% higher in 2012. This is before consideration of hedging gains of $18million and

$199million recognized to revenues from the United Kingdom and the rest of the world in 2012.

The general weakening of the U.S. dollar relative to certain foreign currencies (primarily the Euro, Japanese yen, and British pound)

from 2010 to 2011 had a favorable impact on our international revenues. Had foreign exchange rates remained constant in these

periods, our revenues from the United Kingdom would have been $129million, or 3.2%, lower and our revenues from the rest of

the world would have been approximately $834million, or 5.1%, lower in 2011. This is before consideration of hedging gains of

$9million and $34million recognized to revenues from the United Kingdom and the rest of the world in 2011.

Although we expect to continue to make investments in international markets, these investments may not result in an increase

in our international revenues as a percentage of total revenues in 2013 or thereafter. See Note15 of Notes to Consolidated

Financial Statements included in Item8 of this Annual Report on Form 10-K for additional information about geographic areas.

4

Contents

4