Google 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23GOOGLE INC. |Form10-K

PART II

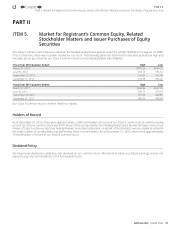

ITEM5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Results of Google’s Transferable Stock Option (TSO) Program

Under our TSO program, eligible employees are able to sell vested stock options to participating fi nancial institutions in

an online auction as an alternative to exercising options in the traditional method and then selling the underlying shares.

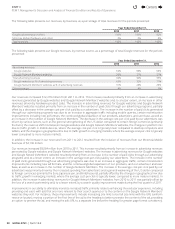

The following table provides information with respect to sales by our employees of TSOs during the three months ended

December31, 2012:

Period(1)

Aggregate Amounts Weighted-Average Per Share Amounts

Number of Shares

Underlying TSOs Sold

Sale Price

ofTSOs Sold

TSO

Premium(2)

Exercise Price

of TSOsSold

Sale Price

ofTSOs Sold

TSO

Premium(2)

(in thousands)

October1– 31 49,772 $15,307 $ 514 $381.19 $307.55 $10.34

November1 – 30 190,351 66,001 1,153 338.77 346.73 6.06

December1 – 31 0 0 0 0 0 0

Total (except weighted-average

per share amounts) 240,123 $81,308 $1,667 $347.56 $338.61 $ 6.95

(1) The TSO program is generally active during regular trading hours for the Nasdaq Global Select Market when our trading window is open.

However, we have the right to suspend the TSO program at any time for any reason, including for maintenance and other technical reasons.

(2) TSO premium is calculated as the difference between (a)the sale price of the TSO and (b)the intrinsic value of the TSO, which we define as

the excess, if any, of the price of our ClassA common stock at the time of the sale over the exercise price of the TSO.

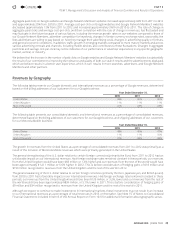

Our TSO program allows participation by executive o cers (other than Larry Page, Sergey Brin, and Eric E. Schmidt). The

following table provides information with respect to sales by our executive o cers of TSOs during the three months ended

December31, 2012:

Executive Offi cer

Aggregate Amounts

Number of Shares

Underlying TSOs Sold

Sale Price

ofTSOs Sold

TSO

Premium

(in thousands)

Nikesh Arora 2,843 $ 999 $ 3

Patrick Pichette 9,291 $2,441 $177

Total 12,134 $3,440 $180

4

Contents

4