Google 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

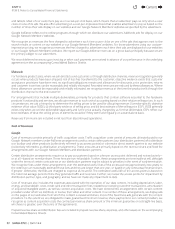

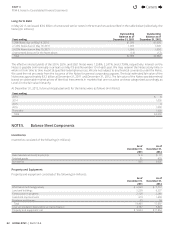

Long-Term Debt

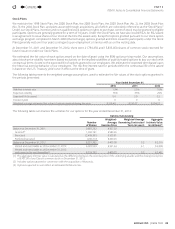

In May2011, we issued $3.0billion of unsecured senior notes in three tranches as described in the table below (collectively, the

Notes) (in millions):

Years ending

Outstanding

Balance as of

December31, 2011

Outstanding

Balance as of

December31, 2012

1.25% Notes due on May19, 2014 $1,000 $1,000

2.125% Notes due on May19, 2016 1,000 1,000

3.625% Notes due on May19, 2021 1,000 1,000

Unamortized discount for the Notes above (14) (12)

Total $2,986 $2,988

The eff ective interest yields of the 2014, 2016, and 2021 Notes were 1.258%, 2.241%, and 3.734%, respectively. Interest on the

Notes is payable semi-annually in arrears on May19 and November19 of each year. We may redeem the Notes at any time in

whole or from time to time in part at specifi ed redemption prices. We are not subject to any fi nancial covenants under the Notes.

We used the net proceeds from the issuance of the Notes for general corporate purposes. The total estimated fair value of the

Notes was approximately $3.2billion at December31, 2011 and December31, 2012. The fair value of the Notes was determined

based on observable market prices of identical instruments in markets that are not active and was categorized accordingly as

Level 2 in the fair value hierarchy.

At December31, 2012, future principal payments for the Notes were as follows (in millions):

Years ending

2013 $ 0

2014 1,000

2015 0

2016 1,000

Thereafter 1,000

Total $3,000

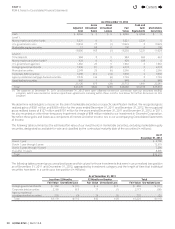

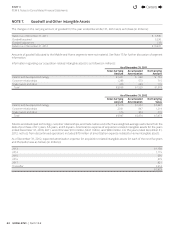

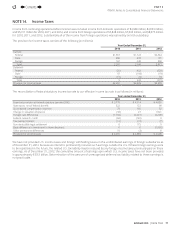

NOTE5. Balance Sheet Components

Inventories

Inventories consisted of the following (in millions):

As of

December31,

2011

As of

December31,

2012

Raw materials and work in process $0 $77

Finished goods 35 428

Inventories $35 $505

Property and Equipment

Property and equipment consisted of the following (in millions):

As of

December31,

2011

As of

December31,

2012

Information technology assets $ 6,060 $ 7,717

Land and buildings 5,228 6,257

Construction in progress 2,128 2,240

Leasehold improvements 919 1,409

Furniture and fi xtures 65 74

Total 14,400 17,697

Less: accumulated depreciation and amortization 4,797 5,843

Property and equipment, net $ 9,603 $11,854

Contents

44