Google 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 GOOGLE INC. |Form10-K

PART II

ITEM7.Management’s Discussion and Analysis of Financial Condition and Results ofOperations

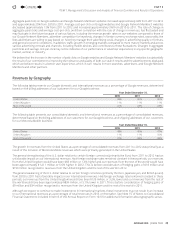

The operating margin we realize on revenues generated from ads placed on our Google Network Members’ websites through

our AdSense program is signifi cantly lower than the operating margin we realize from revenues generated from ads placed on

our websites because most of the advertiser fees from ads served on Google Network Members’ websites are shared with our

Google Network Members. For the past fi ve years, growth in advertising revenues from our websites has generally exceeded that

from our Google Network Members’ websites. This trend has had a positive impact on our operating margins, and we expect that

this will continue for the foreseeable future, although the relative rate of growth in revenues from our websites compared to the

rate of growth in revenues from our Google Network Members’ websites may vary over time. Also, the margins on advertising

revenues from mobile devices and other newer advertising formats are generally lower than those from desktop computers and

tablets. We expect this trend to continue to pressure our margins, particularly if we fail to realize the opportunities we anticipate

with the transition to a dynamic multi-screen environment.

We conduct our Motorola business in highly competitive markets, facing both new and established competitors. The markets for

many of our products are characterized by rapidly changing technologies, frequent new product introductions, changing consumer

trends, short product life cycles, consumer loyalty and evolving industry standards. Market disruptions caused by new technologies,

the entry of new competitors, consolidations among our customers and competitors, changes in regulatory requirements, changes

in economic conditions, supply chain interruptions or other factors, can introduce volatility into our businesses. Meeting all of

these challenges requires consistent operational planning and execution and investment in technology, resulting in innovative

products that meet the needs of our customers around the world.

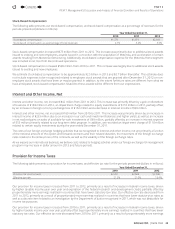

From an overall business perspective, we continue to invest aggressively in our systems, data centers, corporate facilities, information

technology infrastructure, and employees. We increased our hiring in 2012, and we may continue to do so and to provide competitive

compensation programs for our employees. Our full-time employee headcount was 32,467 at December31, 2011 and 53,861

atDecember31, 2012, which includes 16,317 headcount from Motorola. Acquisitions will also remain an important component

of our strategy and use of capital, and we expect our current pace of acquisitions to continue.We expect our cost of revenues will

increase in dollars and may increase as a percentage of revenues in future periods, primarily as a result of forecasted increases

in tra c acquisition costs, manufacturing and inventory-related costs, data center costs, content acquisition costs, credit card

and other transaction fees, and other costs. In particular, tra c acquisition costs as a percentage of advertising revenues may

increase in the future if we are unable to continue to improve the monetization or generation of revenues from tra c on our

websites and our Google Network Members’ websites.

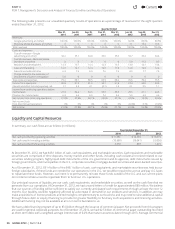

As we expand our advertising programs and other products to international markets, we continue to increase our exposure to

fl uctuations in foreign currency to U.S. dollar exchange rates. Wehave a foreign exchange risk management program that is

designed to reduce our exposure to fl uctuations in foreign currency exchange rates. However, this program will not fully off set

the eff ect of fl uctuations on our revenues and earnings.

Contents

44