Google 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39GOOGLE INC. |Form10-K

PART II

ITEM7.Management’s Discussion and Analysis of Financial Condition and Results ofOperations

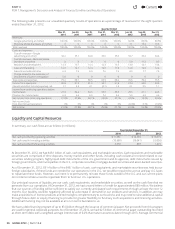

Operating Leases

We have entered into various non-cancelable operating lease agreements for certain of our o ces, land, and data centers

throughout the world with original lease periods expiring primarily between 2013 and 2063. We are committed to pay a portion

of the related operating expenses under certain of these lease agreements. These operating expenses are not included in the

above table. Certain of these leases have free or escalating rent payment provisions. We recognize rent expense under such

leases on a straight-line basis over the term of the lease. Certain leases have adjustments for market provisions.

Purchase Obligations

Purchase obligations represent non-cancelable contractual obligations at December31, 2012. These contracts are primarily

related to distribution arrangements, video and other content licensing revenue sharing arrangements, data center operations

and facility build-outs, as well as purchase of inventory.

Long-term Debt Obligations

Long-term debt obligations represent principal and interest payments to be made over the life of our unsecured senior notes

issued in May2011. Please see Note4 of the Notes to Consolidated Financial Statements included in Item8 of this Annual Report

on Form 10-K for further details.

Other Long-Term Liabilities

Other long-term liabilities consist of cash obligations, primarily the legal settlement with the Authors Guild and the Association

of American Publishers (AAP), asset retirement obligations, and milestone and royalty payments owed in connection with certain

acquisitions and licensing agreements.

In addition to the amounts above, we had long-term taxes payable of $2.1billion as of December31, 2012 related to tax positions

for which the timing of the ultimate resolution is uncertain. At this time, we are unable to make a reasonably reliable estimate of

the timing of payments in individual years beyond 12 months due to uncertainties in the timing of tax audit outcomes. As a result,

this amount is not included in the above table.

Off -Balance Sheet Entities

At December31, 2012, we did not have any off -balance sheet arrangements, as defi ned in Item303(a)(4)(ii) of Regulation S-K

promulgated by the SEC, that have or are reasonably likely to have a current or future eff ect on our fi nancial condition, changes

in our fi nancial condition, revenues, or expenses, results of operations, liquidity, capital expenditures, or capital resources that

is material to investors.

Critical Accounting Policies and Estimates

We prepare our consolidated fi nancial statements in accordance with accounting principles generally accepted in the U.S. (U.S.

GAAP). In doing so, we have to make estimates and assumptions that aff ect our reported amounts of assets, liabilities, revenues,

and expenses, as well as related disclosure of contingent assets and liabilities. In some cases, we could reasonably have used

diff erent accounting policies and estimates. In some cases, changes in the accounting estimates are reasonably likely to occur

from period to period. Accordingly, actual results could diff er materially from our estimates. To the extent that there are material

diff erences between these estimates and actual results, our fi nancial condition or results of operations will be aff ected. We

base our estimates on past experience and other assumptions that we believe are reasonable under the circumstances, and

we evaluate these estimates on an ongoing basis. We refer to accounting estimates of this type as critical accounting policies

and estimates, which we discuss further below. We have reviewed our critical accounting policies and estimates with the audit

committee of our board of directors.

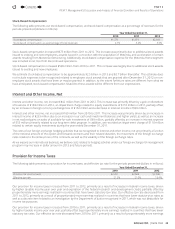

Income Taxes

We are subject to income taxes in the U.S. and numerous foreign jurisdictions. Signifi cant judgment is required in evaluating our

uncertain tax positions and determining our provision for income taxes.

Although we believe we have adequately reserved for our uncertain tax positions, no assurance can be given that the fi nal tax

outcome of these matters will not be diff erent. We adjust these reserves in light of changing facts and circumstances, such as the

closing of a tax audit or the refi nement of an estimate. To the extent that the fi nal tax outcome of these matters is diff erent than

4

Contents

4