Google 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

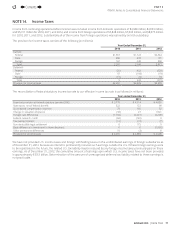

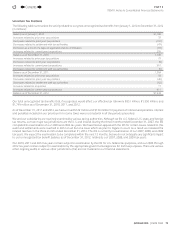

NOTE14. Income Taxes

Income from continuing operations before income taxes included income from domestic operations of $4,948million, $4,693million,

and $5,311million for 2010, 2011, and 2012, and income from foreign operations of $5,848million, $7,633million, and $8,075million

for 2010, 2011, and 2012. Substantially all of the income from foreign operations was earned by an Irish subsidiary.

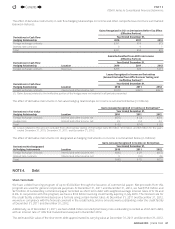

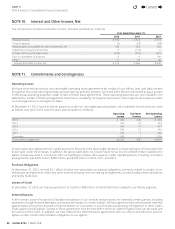

The provision for income taxes consists of the following (in millions):

Year Ended December31,

2010 2011 2012

Current:

Federal $1,657 $1,724 $2,342

State 458 274 171

Foreign 167 248 358

Total 2,282 2,246 2,871

Deferred:

Federal (25) 452 (328)

State 47 (109) (19)

Foreign (13) (0) 74

Total 9 343 (273)

Provision for income taxes $2,291 $2,589 $2,598

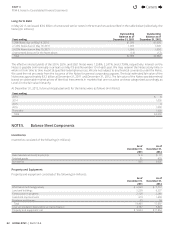

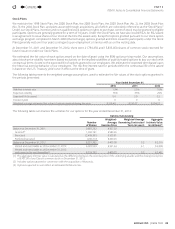

The reconciliation of federal statutory income tax rate to our eff ective income tax rate is as follows (inmillions):

Year ended December31,

2010 2011 2012

Expected provision at federal statutory tax rate (35%) $ 3,779 $ 4,314 $ 4,685

State taxes, net of federal benefi t 322 122 99

Stock-based compensation expense 79 105 52

Change in valuation allowance (34) 27 1,921

Foreign rate diff erential (1,769) (2,001) (2,200)

Federal research credit (84) (140) 0

Tax exempt interest (12) (10) (7)

Non-deductible legal settlement 0 175 0

Basis diff erence in investment in Home business 0 0 (1,960)

Other permanent diff erences 10 (3) 8

Provision for income taxes $ 2,291 $ 2,589 $ 2,598

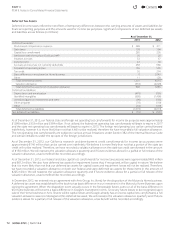

We have not provided U.S. income taxes and foreign withholding taxes on the undistributed earnings of foreign subsidiaries as

of December31,2012 because we intend to permanently reinvest such earnings outside the U.S. If these foreign earnings were

to be repatriated in the future, the related U.S. tax liability may be reduced by any foreign income taxes previously paid on these

earnings. As of December31,2012, the cumulative amount of earnings upon which U.S. income taxes have not been provided

is approximately $33.3billion. Determination of the amount of unrecognized deferred tax liability related to these earnings is

not practicable.

4

Contents

4