Google 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

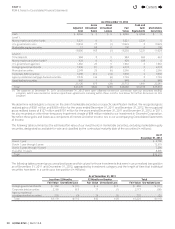

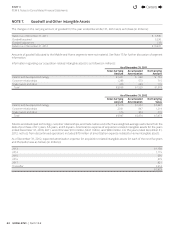

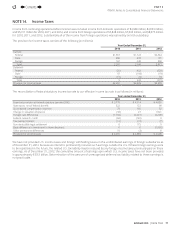

Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income were as follows (in millions):

As of

December31,

2011

As of

December31,

2012

Foreign currency translation adjustment $ (148) $ (73)

Net unrealized gains on available-for-sale investments, net of taxes 327 604

Unrealized gains on cash fl ow hedges, net of taxes 97 7

Accumulated other comprehensive income $ 276 $ 538

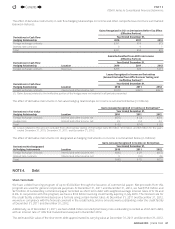

NOTE6. Acquisitions

On May22, 2012, we completed our acquisition of Motorola, a provider of innovative technologies, products and services that

enable a range of mobile and wireline digital communication, information and entertainment experiences. The acquisition is

expected to protect and advance our Android ecosystem and enhance competition in mobile computing. Under the transaction,

we acquired all outstanding common shares of Motorola for $40 per share and all vested Motorola stock options and restricted

stock units, for a total purchase price of approximately $12.4billion in cash. In addition, we assumed $401million of unvested

Motorola stock options and restricted stock units, which will be recorded as stock-based compensation expense over the remaining

service periods. Transaction costs were approximately $50million, which were recorded as general and administrative expense

as incurred.

The fair value of assets acquired and liabilities assumed was based upon a preliminary valuation and our estimates and assumptions

are subject to change within the measurement period. The primary areas of the purchase price that are not yet fi nalized are

related to certain legal matters, income taxes, and residual goodwill. Of the $12.4billion total purchase price, $2.9billion was

cash acquired, $5.5billion was attributed to patents and developed technology, $2.5billion to goodwill, $0.7billion to customer

relationships, and $0.8billion to other net assets acquired.

The goodwill of $2.5billion is primarily attributed to the synergies expected to arise after the acquisition. Goodwill is not expected

to be deductible for tax purposes.

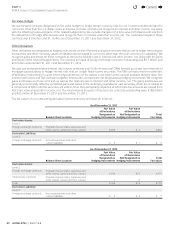

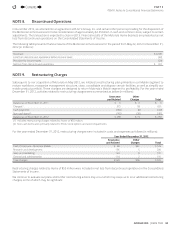

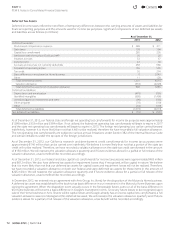

Supplemental information on an unaudited pro forma basis, as if the Motorola acquisition had been consummated on January1,

2011, is presented as follows (in millions, except per share amounts):

Year Ended December31,

2011 2012

Revenues(1) $ 47,294 $ 53,656

Net income $ 8,792 $ 10,583

Net income per share of Class A and Class B common stock—diluted $ 26.83 $ 31.82

(1) Excludes Home.

These pro forma results are based on estimates and assumptions, which we believe are reasonable. They are not necessarily

indicative of our consolidated results of operations in future periods or the results that actually would have been realized had

we been a combined company during the periods presented. The pro forma results include adjustments primarily related to

amortization of acquired intangible assets, severance and benefi t arrangements in connection with the acquisition, and stock-

based compensation expenses for assumed unvested stock options and restricted stock units.

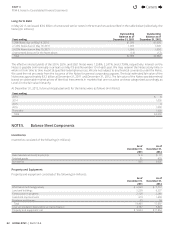

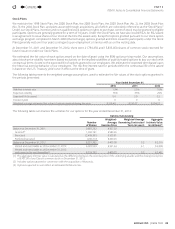

During the year ended December31, 2012, we completed 52 other acquisitions and purchases of intangible assets for a total

cash consideration of approximately $1,171million, of which $733million was attributed to goodwill, $462million to acquired

intangible assets, and $24million to net liabilities assumed. These acquisitions generally enhance the breadth and depth of our

expertise in engineering and other functional areas, our technologies, and our product off erings. The amount of goodwill expected

to be deductible for tax purposes is approximately $29million.

Pro forma results of operations for these acquisitions have not been presented because they are not material to the consolidated

results of operations, either individually or in the aggregate.

For all acquisitions completed during the year ended December31,2012, patents and developed technology have a weighted-

average useful life of 8.9 years, customer relationships have a weighted-average useful life of 7.4 years and trade names and

other have a weighted-average useful life of 9.0 years.

4

Contents

4