Google 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 GOOGLE INC. |Form10-K

PART II

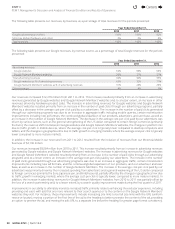

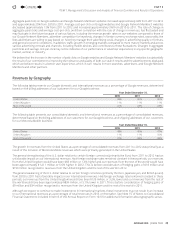

ITEM7.Management’s Discussion and Analysis of Financial Condition and Results ofOperations

realized in countries that have lower statutory tax rates, a decrease in state income taxes, and an increase in federal research and

development credits recognized in 2011, partially off set by recognition of a charge related to the resolution of an investigation

by the Department of Justice which is not deductible for tax purposes.

The federal research and development credit expired on December31,2011. On January2, 2013, the American Taxpayer Relief

Act of 2012 was signed into law. Under this act, the federal research and development credit was retroactively extended for

amounts paid or incurred after December31, 2011 and before January1, 2014. The eff ects of these changes in the tax law will

result in a tax benefi t which will be recognized in the fi rst quarter of 2013, which is the quarter in which the law was enacted.

Oureff ective tax rate could fl uctuate signifi cantly on a quarterly basis and could be adversely aff ected to the extent earnings

are lower than anticipated in countries that have lower statutory rates and higher than anticipated in countries that have higher

statutory rates. Oureff ective tax rate could also fl uctuate due to the net gains and losses recognized by legal entities on certain

hedges and related hedged intercompany and other transactions under our foreign exchange risk management program, by

changes in the valuation of our deferred tax assets or liabilities, or by changes in tax laws, regulations, or accounting principles,

as well as certain discrete items. In addition, we are subject to the continuous examination of our income tax returns by the

Internal Revenue Service (IRS) and other tax authorities. We regularly assess the likelihood of adverse outcomes resulting from

these examinations to determine the adequacy of our provision for income taxes.

See Critical Accounting Policies and Estimates below for additional information about our provision for income taxes.

A reconciliation of the federal statutory income tax rate to our eff ective tax rate is set forth in Note14 of Notes to Consolidated

Financial Statements included in Item8 of this Annual Report on Form 10-K.

Net Loss from Discontinued Operations

In December2012, we entered into an agreement with Arris and certain other persons providing for the disposition of the Motorola

Home business for total consideration of approximately $2.35billion in cash and common stock, subject to certain adjustments.

The transaction is expected to close in 2013. As a result, the following fi nancial information of Motorola Home was presented as

net loss from discontinued operations in the Consolidated Statements of Income.

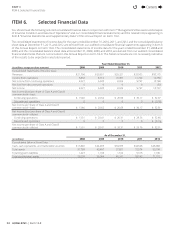

(In millions)

Year Ended

December31, 2012

Revenues $2,028

Loss from discontinued operations before income taxes (22)

Provision for income taxes (29)

Net loss from discontinued operations $ (51)

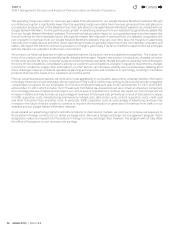

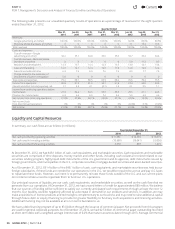

Quarterly Results of Operations

You should read the following tables presenting our quarterly results of operations in conjunction with the consolidated fi nancial

statements and related notes included in Item8 of this Annual Report on Form 10-K. We have prepared the unaudited information

on the same basis as our audited consolidated fi nancial statements. You should also keep in mind that our operating results for

any quarter are not necessarily indicative of results for any future quarters or for a full year. Pleasenote that previously reported

quarters have been adjusted to show discontinued operations for the disposition of the Motorola Home business.

The following table presents our unaudited quarterly results of operations for the eight quarters ended December31, 2012. This

table includes all adjustments, consisting only of normal recurring adjustments, that we consider necessary for fair presentation

of our consolidated fi nancial position and operating results for the quarters presented. Both seasonal fl uctuations in internet

usage and traditional retail seasonality have aff ected, and are likely to continue to aff ect, our business. Internet usage generally

slows during the summer months, and commercial queries typically increase signifi cantly in the fourth quarter of each year.

These seasonal trends have caused and will likely continue to cause, fl uctuations in our quarterly results, including fl uctuations

in sequential revenue growth rates.

Contents

44