Google 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

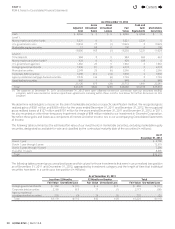

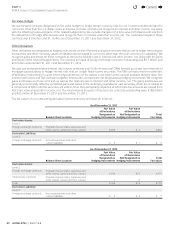

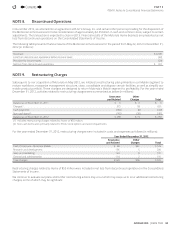

As of December31, 2012

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Cash and

Cash

Equivalents

Marketable

Securities

Cash $ 8,066 $ 0 $ 0 $ 8,066 $ 8,066 $ 0

Level 1:

Money market and other funds 5,221 0 0 5,221 5,221 0

U.S. government notes 10,853 77 (1) 10,929 0 10,929

Marketable equity securities 12 88 0 100 0 100

16,086 165 (1) 16,250 5,221 11,029

Level 2:

Time deposits 984 0 0 984 562 422

Money market and other funds(1) 929 0 0 929 929 0

U.S. government agencies 1,882 20 0 1,902 0 1,902

Foreign government bonds 1,996 81 (3) 2,074 0 2,074

Municipal securities 2,249 23 (6) 2,266 0 2,266

Corporate debt securities 7,200 414 (14) 7,600 0 7,600

Agency residential mortgage-backed securities 7,039 136 (6) 7,169 0 7,169

Asset-backed securities 847 1 0 848 0 848

23,126 675 (29) 23,772 1,491 22,281

Total $47,278 $840 $(30 ) $48,088 $14,778 $33,310

(1) The balances at December31, 2011 and December31, 2012 were cash collateral received in connection with our securities lending

program, which was invested in reverse repurchase agreements maturing within three months. See below for further discussion on this

program.

We determine realized gains or losses on the sale of marketable securities on a specifi c identifi cation method. We recognized gross

realized gains of $381million and $383million for the years ended December31, 2011 and December31, 2012. We recognized

gross realized losses of $127million and $101million for the years ended December31, 2011 and December31, 2012. In 2011,

we also recorded an other-than-temporary impairment charge of $88million related to our investment in Clearwire Corporation.

We refl ect these gains and losses as a component of interest and other income, net, in our accompanying Consolidated Statements

of Income.

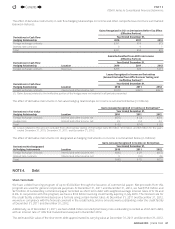

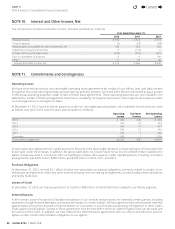

The following table summarizes the estimated fair value of our investments in marketable securities, excluding marketable equity

securities, designated as available-for-sale and classifi ed by the contractual maturity date of the securities (in millions):

As of

December31, 2012

Due in 1 year $ 4,708

Due in 1 year through 5 years 12,310

Due in 5 years through 10 years 7,296

Due after 10 years 8,896

Total $33,210

The following tables present gross unrealized losses and fair values for those investments that were in an unrealized loss position

as of December31, 2011 and December31, 2012, aggregated by investment category and the length of time that individual

securities have been in a continuous loss position (in millions):

As of December31, 2011

Less than 12 Months 12 Months or Greater Total

Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss

Foreign government bonds $ 302 $ (11) $ 6 $ 0 $ 308 $ (11)

Corporate debt securities 2,160 (97) 17 (1) 2,177 (98)

Agency residential

mortgage-backed securities 716 (3) 19 (2) 735 (5)

Total $3,178 $(111) $42 $ (3) $ 3,220 $(114 )

Contents

44