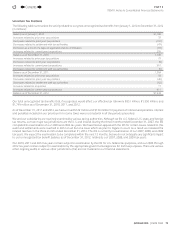

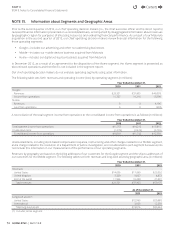

Google 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

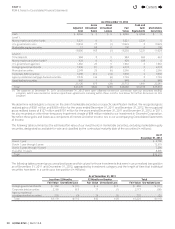

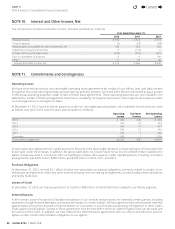

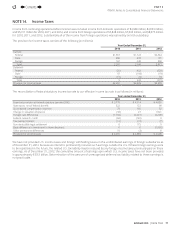

NOTE10. Interest and Other Income, Net

The components of interest and other income, net were as follows (in millions):

Year Ended December31,

2010 2011 2012

Interest income $ 579 $ 812 $ 713

Interest expense (5) (58) (84)

Realized gains on available-for-sale investments, net 185 254 282

Impairment of equity investments 0 (110) 0

Foreign currency exchange losses (355) (379) (531)

Gain on divestiture of business 0 0 188

Other 11 65 58

Interest and other income, net $ 415 $ 584 $ 626

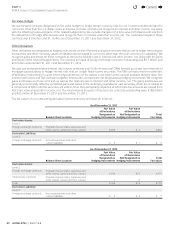

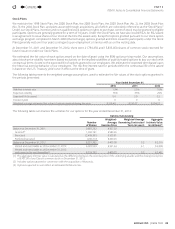

NOTE11. Commitments and Contingencies

Operating Leases

We have entered into various non-cancelable operating lease agreements for certain of our o ces, land, and data centers

throughout the world with original lease periods expiring primarily between 2013 and 2063. We are committed to pay a portion

of the actual operating expenses under certain of these lease agreements. These operating expenses are not included in the

table below. Certain of these arrangements have free or escalating rent payment provisions. We recognize rent expense under

such arrangements on a straight-line basis.

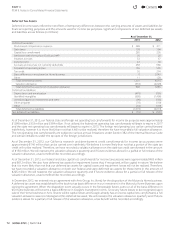

At December31, 2012, future minimum payments under non-cancelable operating leases, net of sublease income amounts, were

as follows over each of the next fi ve years and thereafter (in millions):

Operating

Leases

Sub-lease

Income

Net Operating

Leases

2013 $ 492 $ 26 $ 466

2014 475 22 453

2015 434 17 417

2016 374 12 362

2017 333 7 326

Thereafter 1,596 1 1,595

Total minimum payments $3,704 $85 $3,619

Certain leases have adjustments for market provisions. Amounts in the above table represent our best estimates of future payments

to be made under these leases. In addition, the above table does not include future rental income of $649million related to the

leases that we assumed in connection with our building purchases. Rent expense under operating leases, including co-location

arrangements, was $293million, $380million, and $448million in 2010, 2011, and 2012.

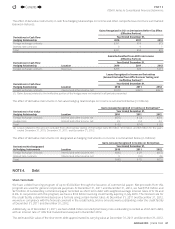

Purchase Obligations

At December31, 2012, we had $2.1billion of other non-cancelable contractual obligations, primarily related to certain of our

distribution arrangements, video and other content licensing revenue sharing arrangements, as well as data center operations

and facility build-outs.

Letters of Credit

At December31, 2012, we had unused letters of credit for $89million, of which $45million related to our Mobile segment.

Indemnifi cations

In the normal course of business to facilitate transactions in our services and products, we indemnify certain parties, including

advertisers, Google Network Members, and lessors with respect to certain matters. We have agreed to hold certain parties harmless

against losses arising from a breach of representations or covenants, or out of intellectual property infringement or other claims

made against certain parties. Several of these agreements limit the time within which an indemnifi cation claim can be made and

the amount of the claim. In addition, we have entered into indemnifi cation agreements with our o cers and directors, and our

bylaws contain similar indemnifi cation obligations to our agents.

Contents

44