Google 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

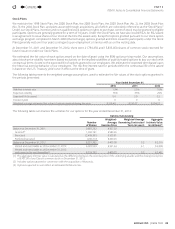

Stock Plans

We maintain the 1998 Stock Plan, the 2000 Stock Plan, the 2003 Stock Plan, the 2003 Stock Plan (No.2), the 2003 Stock Plan

(No.3), the 2004 Stock Plan, and plans assumed through acquisitions, all of which are collectively referred to as the “Stock Plans.”

Under our Stock Plans, incentive and non-qualifi ed stock options or rights to purchase common stock may be granted to eligible

participants. Options are generally granted for a term of 10 years. Under the Stock Plans, we have also issued RSUs. An RSU award

is an agreement to issue shares of our stock at the time the award vests. Except for options granted pursuant to our stock option

exchange program completed in March2009 (the Exchange), options granted and RSUs issued to participants under the Stock

Plans generally vest over four years contingent upon employment or service with us on the vesting date.

At December31, 2011 and December31, 2012, there were 21,794,492 and 15,833,050 shares of common stock reserved for

future issuance under our Stock Plans.

We estimated the fair value of each option award on the date of grant using the BSM option pricing model. Our assumptions

about stock-price volatility have been based exclusively on the implied volatilities of publicly traded options to buy our stock with

contractual terms closest to the expected life of options granted to our employees. We estimate the expected term based upon

the historical exercise behavior of our employees. The risk-free interest rate for periods within the contractual life of the award

is based on the U.S. Treasury yield curve in eff ect at the time of grant.

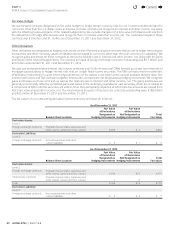

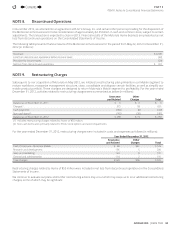

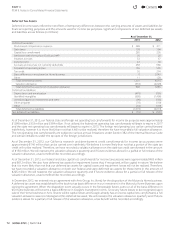

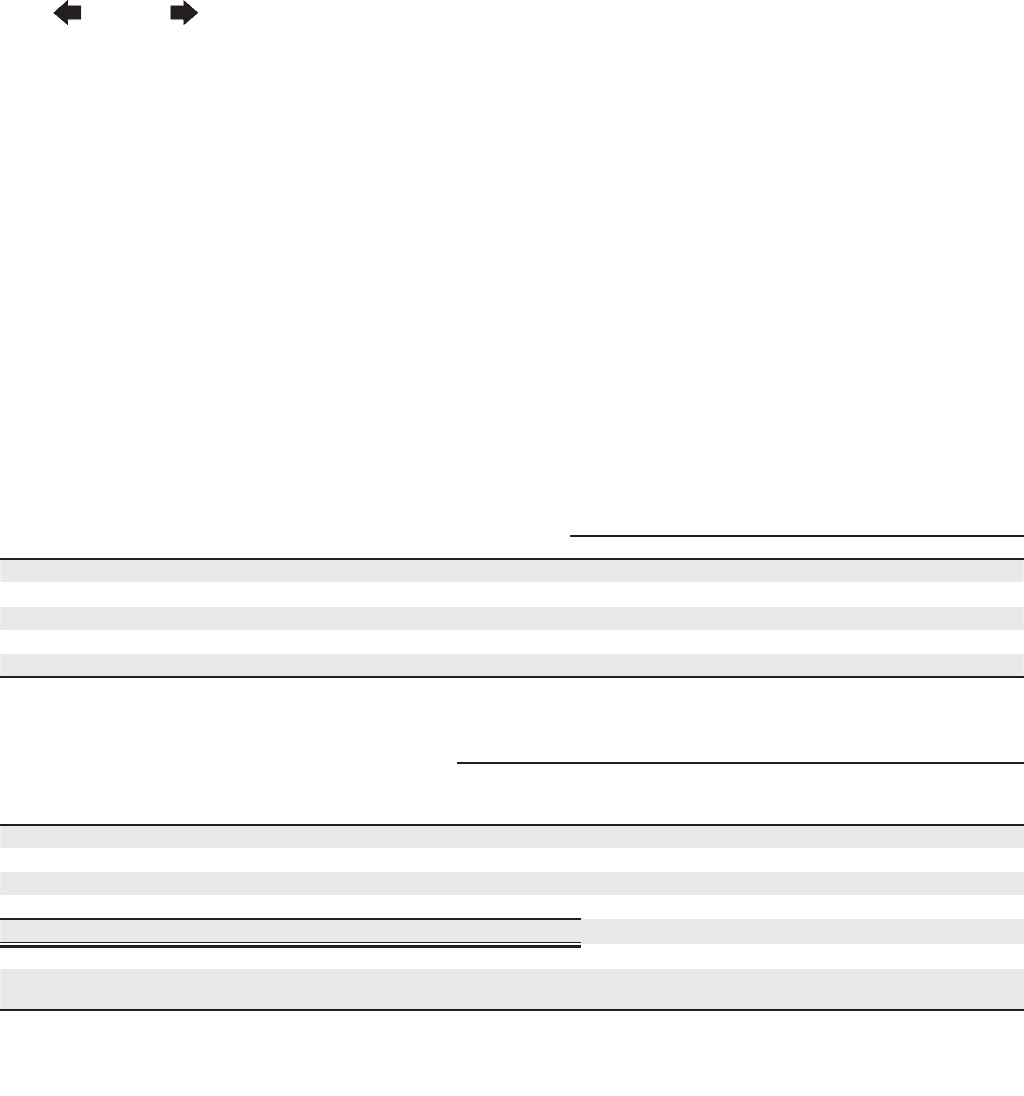

The following table presents the weighted-average assumptions used to estimate the fair values of the stock options granted in

the periods presented:

Year Ended December31,

2010 2011 2012

Risk-free interest rate 1.9% 2.3% 1.0%

Expected volatility 35% 33% 29%

Expected life (in years) 5.4 5.9 5.2

Dividend yield 0 0 0

Weighted-average estimated fair value of options granted during the year $216.43 $210.07 $194.27

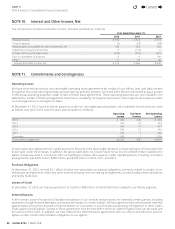

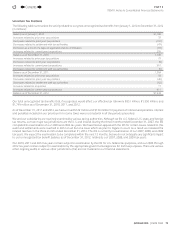

The following table summarizes the activities for our options for the year ended December31, 2012:

Options Outstanding

Number

of Shares

Weighted-

Average

Exercise Price

Weighted-Average

Remaining Contractual

Term (in years)

Aggregate

Intrinsic Value

(in millions)(1)

Balance at December31, 2011 9,807,252 $357.92

Granted(2) 1,392,191 $580.45

Exercised (2,409,331) $305.81

Forfeited/canceled (238,717) $460.45

Balance at December31, 2012 8,551,395 $405.98 5.2 $2,516

Vested and exercisable as of December31, 2012 6,023,559 $351.44 4.1 $2,099

Vested and exercisable as of December31, 2012

andexpected to vest thereafter(3) 8,218,732 $400.72 5.2 $2,461

(1) The aggregate intrinsic value is calculated as the difference between the exercise price of the underlying awards and the closing stock price

of $707.38 of our ClassA common stock on December31, 2012.

(2) Includes options granted in connection with the acquisition of Motorola.

(3) Options expected to vest reflect an estimated forfeiture rate.

4

Contents

4