Google 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

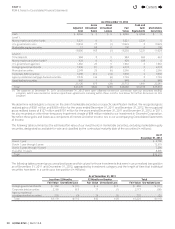

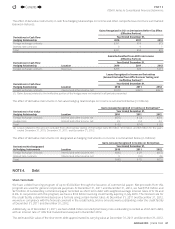

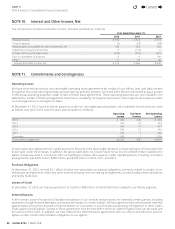

As of December31, 2012

Less than 12 Months 12 Months or Greater Total

Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss

U.S. government notes $ 842 $ (1) $ 0 $ 0 $ 842 $ (1)

Foreign government bonds 509 (2) 12 (1) 521 (3)

Municipal securities 686 (6) 9 0 695 (6)

Corporate debt securities 820 (10) 81 (4) 901 (14)

Agency residential

mortgage-backed securities 1,300 (6) 0 0 1,300 (6)

Total $4,157 $(25) $102 $(5) $ 4,259 $(30)

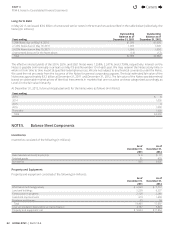

Securities Lending Program

From time to time, we enter into securities lending agreements with fi nancial institutions to enhance investment income. We loan

selected securities which are secured by collateral in the form of cash or securities. Cash collateral is invested in reverse repurchase

agreements. We classify loaned securities as cash equivalents or marketable securities on the accompanying Consolidated Balance

Sheets.We record the cash collateral as an asset with a corresponding liability. We classify reverse repurchase agreements

maturing within three months as cash equivalents and those longer than three months as receivable under reverse repurchase

agreements on the accompanying Consolidated Balance Sheets. For lending agreements collateralized by securities, we do not

record an asset or liability as we are not permitted to sell or repledge the associated collateral.

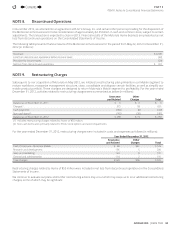

Derivative Financial Instruments

We enter into foreign currency contracts with fi nancial institutions to reduce the risk that our cash fl ows and earnings will be

adversely aff ected by foreign currency exchange rate fl uctuations. We use certain interest rate derivative contracts to hedge

interest rate exposures on our fi xed income securities and our anticipated debt issuance. Our program is not designated for

trading or speculative purposes.

We enter into master netting arrangements, which reduce credit risk by permitting net settlement of transactions with the same

company. To further reduce credit risk, we enter into collateral security arrangements that provide for collateral to be received

when the net fair value of certain fi nancial instruments fl uctuates from contractually established thresholds. We present our

derivative assets and derivative liabilities at their gross fair values. At December31, 2011 and December31, 2012, we received

cash collateral related to the derivative instruments under our collateral security arrangements of $113million and $43million,

which are recorded as accrued expenses and other current liabilities in the accompanying Consolidated Balance Sheets.

We recognize derivative instruments as either assets or liabilities on the accompanying Consolidated Balance Sheets at fair

value. We record changes in the fair value (i.e., gains or losses) of the derivatives in the accompanying Consolidated Statements

of Income as interest and other income, net, as part of revenues, or to accumulated other comprehensive income (AOCI) in the

accompanying Consolidated Balance Sheets.

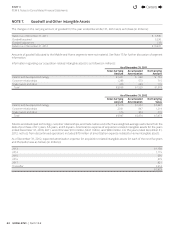

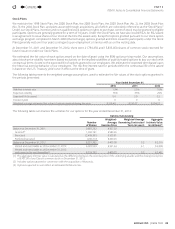

Cash Flow Hedges

We use options designated as cash fl ow hedges to hedge certain forecasted revenue transactions denominated in currencies other

than the U.S. dollar. The notional principal of these contracts was approximately $6.5billion and $9.5billion as of December31,

2011 and December31, 2012. These foreign exchange contracts have maturities of 36 months or less.

During the second quarter of 2012, we began to hedge the variability of forecasted interest payments on an anticipated debt

issuance using forward-starting interest swaps. The total notional amount of these forward-starting interest swaps was $1.0billion

as of December31, 2012 with terms calling for us to receive interest at a variable rate and to pay interest at a fi xed rate. These

forward-starting interest swaps eff ectively fi x the benchmark interest rate on an anticipated debt issuance of $1.0billion in 2014,

and they will be terminated upon issuance of the debt.

We initially report any gain or loss on the eff ective portion of a cash fl ow hedge as a component of AOCI and subsequently reclassify

to revenues or interest expense when the hedged transactions are recorded. If the hedged transactions become probable of

not occurring, the corresponding amounts in AOCI would be reclassifi ed to interest and other income, net. Further, we exclude

the change in the time value of the options from our assessment of hedge eff ectiveness. We record the premium paid or time

value of an option on the date of purchase as an asset. Thereafter, we recognize any change to this time value in interest and

other income, net.

As of December31, 2012, the eff ective portion of our cash fl ow hedges before tax eff ect was $11million, $10million of which is

expected to be reclassifi ed from AOCI to revenues within the next 12 months.

4

Contents

4