Google 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

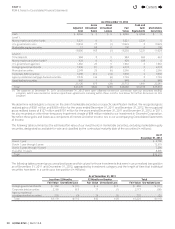

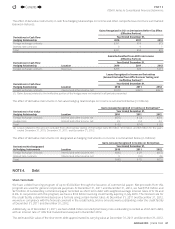

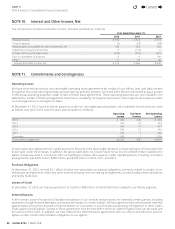

The eff ect of derivative instruments in cash fl ow hedging relationships on income and other comprehensive income is summarized

below (in millions):

Derivatives in Cash Flow

Hedging Relationship

Gains Recognized in OCI on Derivatives Before Tax Eff ect

(Eff ective Portion)

Year Ended December31,

2010 2011 2012

Foreign exchange contracts $331 $54 $73

Interest rate contracts 0 0 1

Total $331 $54 $74

Derivatives in Cash Flow

Hedging Relationship

Gains Reclassifi ed from AOCI into Income

(Eff ective Portion)

Year Ended December31,

Location 2010 2011 2012

Foreign exchange contracts Revenues $203 $43 $217

Derivatives in Cash Flow

Hedging Relationship

Losses Recognized in Income on Derivatives

(Amount Excluded from Eff ectiveness Testing and

Ineff ective Portion)(1)

Year Ended December31,

Location 2010 2011 2012

Foreign exchange contracts Interest and other income, net $(320) $(323) $(447)

(1) Gains (losses) related to the ineffective portion of the hedges were not material in all periods presented.

The eff ect of derivative instruments in fair value hedging relationships on income is summarized below (in millions):

Derivatives in Fair Value

Hedging Relationship

Gains (Losses) Recognized in Income on Derivatives(2)

Year Ended December31,

Location 2010 2011 2012

Foreign exchange contracts Interest and other income, net $(35) $ (2) $(31)

Hedged item Interest and other income, net 29 (12) 23

Total $ (6 ) $(14 ) $ (8 )

(2) Losses related to the amount excluded from effectiveness testing of the hedges were $6million, $14million, and $8million for the years

ended December31, 2010, December31, 2011, and December31, 2012.

The eff ect of derivative instruments not designated as hedging instruments on income is summarized below (in millions):

Derivatives Not Designated

As Hedging Instruments

Gains (Losses) Recognized in Income on Derivatives

Year Ended December31,

Location 2010 2011 2012

Foreign exchange contracts Interest and other income, net $(40) $ 29 $(67)

Interest rate contracts Interest and other income, net 0 (19) (6)

Total $(40 ) $ 10 $(73 )

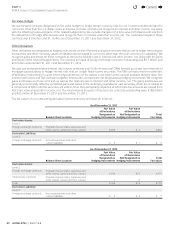

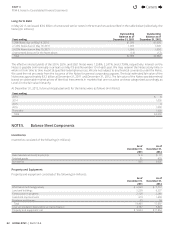

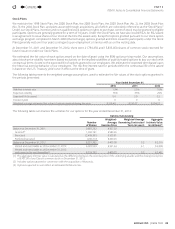

NOTE4. Debt

Short-Term Debt

We have a debt fi nancing program of up to $3.0billion through the issuance of commercial paper. Net proceeds from this

program are used for general corporate purposes. At December31, 2011 and December31, 2012, we had $750million and

$2.5billion of outstanding commercial paper recorded as short-term debt with weighted-average interest rates of 0.1% and

0.2%. In conjunction with this program, we have a $3.0billion revolving credit facility expiring in July2016. The interest rate for

the credit facility is determined based on a formula using certain market rates. At December31, 2011 and December31,2012,

we were in compliance with the fi nancial covenant in the credit facility, and no amounts were outstanding under the credit facility

at December31,2011 and December31, 2012.

Additionally, as of December31, 2011, we had a $468million secured promissory note outstanding recorded as short-term debt,

with an interest rate of 1.0% that matured and was paid in December2012.

The estimated fair value of the short-term debt approximated its carrying value at December31, 2011 and December31, 2012.

4

Contents

4