Google 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 GOOGLE INC. |Form10-K

PART II

ITEM7.Management’s Discussion and Analysis of Financial Condition and Results ofOperations

Cash Used In Investing Activities

Cash used in investing activities in 2012 of $13,056million was primarily attributable to cash used in acquisitions and other

investments of $11,264million, including $9,518million net cash paid in connection with the acquisition of Motorola, and capital

expenditures of $3,273million related primarily to our facilities, data centers, and related equipment. These decreases were

partially off set by net maturities and sales of marketable securities of $1,770million. Also, in connection with our securities lending

program, we returned cash collateral of $334million. See Note3 of Notes to Consolidated Financial Statements included in Item8

of this Annual Report on Form 10-K for further information about our securities lending program.

Cash used in investing activities in 2011 of $19,041million was primarily attributable to net purchases of marketable securities of

$12,926million, capital expenditures of $3,438million related principally to our facilities, data centers, and related equipment, and

cash used in acquisitions and other investments of $2,328million, including $676million paid in connection with the acquisition

of ITA Software, Inc. Also, in connection with our securities lending program, we returned $354million of cash collateral.

Cash used in investing activities in 2010 of $10,680million was primarily attributable to net purchases of marketable securities

of $6,886million, capital expenditures of $4,018million of which $1.8billion was for the purchase of an o ce building in New

York City in December2010, and remaining amounts related principally to our data centers and related equipment, and cash

consideration used in acquisitions and other investments of $1,067million. Also, in connection with our securities lending program,

we received $2,361million of cash collateral which was invested in reverse repurchase agreements.

In order to manage expected increases in internet tra c, advertising transactions, and new products and services, and to support

our overall global business expansion, we expect to make signifi cant investments in our systems, data centers, corporate facilities,

information technology infrastructure, and employees in 2013 and thereafter. However, the amount of our capital expenditures

has fl uctuated and may continue to fl uctuate on a quarterly basis.

In addition, we expect to spend a signifi cant amount of cash on acquisitions and other investments from time to time. These

acquisitions generally enhance the breadth and depth of our expertise in engineering and other functional areas, our technologies,

and our product off erings.

In December2012, we signed an agreement for the disposition of Motorola Home business for total consideration of approximately

$2.35billion in cash and stock subject to certain adjustments. We expect the transaction to close in 2013.

Cash Provided by Financing Activities

Cash provided by fi nancing activities in 2012 of $1,229million was primarily driven by net proceeds of $1,328million from short-

term debt issued under our commercial paper program and excess tax benefi ts from stock-based award activities of $188million.

This was partially off set by net payments for stock-based award activities of $287million.

Cash provided by fi nancing activities in 2011 of $807million was primarily driven by net proceeds of $726million of debt issued

and excess tax benefi ts from stock-based award activities of $86million.

Cash provided by fi nancing activities in 2010 of $3,050million was primarily driven by $3,463million of net cash proceeds from the

issuance of commercial paper and a promissory note. This was partially off set by $801million in stock repurchases in connection

with our acquisitions of AdMob, Inc. and On2 Technologies, Inc., as well as net proceeds from stock-based award activities of

$294million, and excess tax benefi ts from stock-based award activities of $94million.

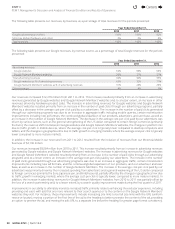

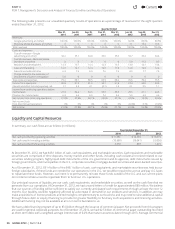

Contractual Obligations as of December31, 2012

(in millions)

Payments due by period

Total

Less than

1year 1-3 years 3-5 years

More than

5years

Operating lease obligations, net of sublease income amounts $3,619 $ 466 $ 870 $ 688 $1,595

Purchase obligations 2,123 942 943 119 119

Long-term debt obligations 3,401 70 1,121 1,083 1,127

Other long-term liabilities refl ected on our balance sheet 236 41 119 40 36

Total contractual obligations $9,379 $1,519 $3,053 $1,930 $2,877

The above table does not include future rental income of $649million related to the leases that we assumed in connection with

our building purchases.

Contents

44